by MyRealLifeHD

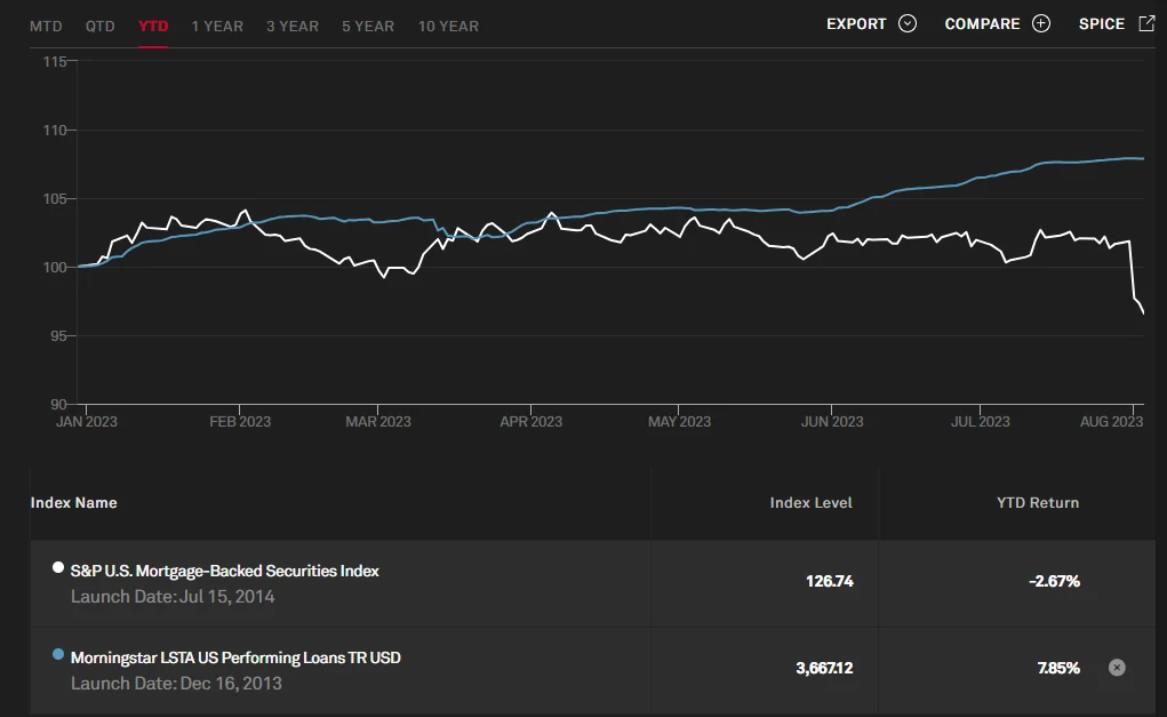

The S&P U.S. Mortgage-Backed Securities Index is a measure of the performance of mortgage-backed securities. A decline in the index could have a number of implications for the stock market.

- Lower mortgage rates: Mortgage-backed securities are typically priced inversely to interest rates. This means that when interest rates fall, the prices of mortgage-backed securities rise. A decline in the index could signal that interest rates are expected to fall, which could boost the stock market.

- Weaker housing market: Mortgage-backed securities are also a proxy for the housing market. A decline in the index could indicate that the housing market is weakening, which could weigh on the stock market.

- Risk aversion: A decline in the index could also be seen as a sign of risk aversion among investors. This could lead to a sell-off in stocks, as investors move to safer assets.

The impact of the decline in the S&P U.S. Mortgage-Backed Securities Index on the stock market will depend on a number of factors, including the overall health of the economy and the housing market. However, the decline could be a sign of trouble ahead for the stock market, and investors should be prepared for volatility.