https://archive.is/0p7wA#selection-2393.4-2393.73

by Ambrose Evans-Pritchard

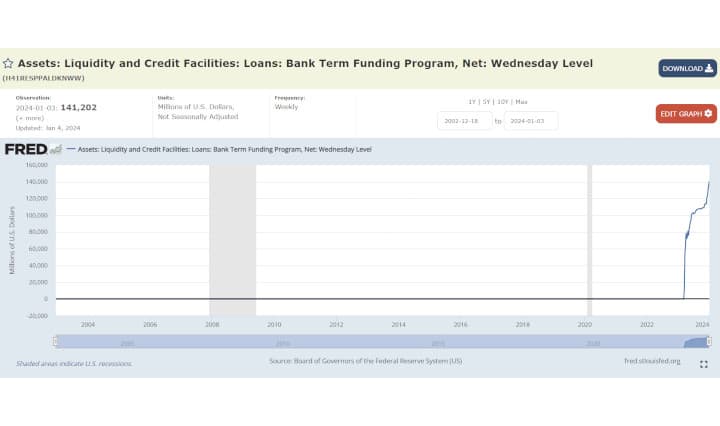

“Temporary measures have calmed the market but half of all US banks are running short of deposits with assets worth less than their liabilities, and we are talking about $9 trillion,” he said. “They are bleeding capital and could not survive if something triggers a sudden loss of confidence. It is a very fragile situation and the Federal Reserve is watching it closely”.

h/t mark000

Views: 233