Is the current economic situation indicating that we’re experiencing a recession at this moment?

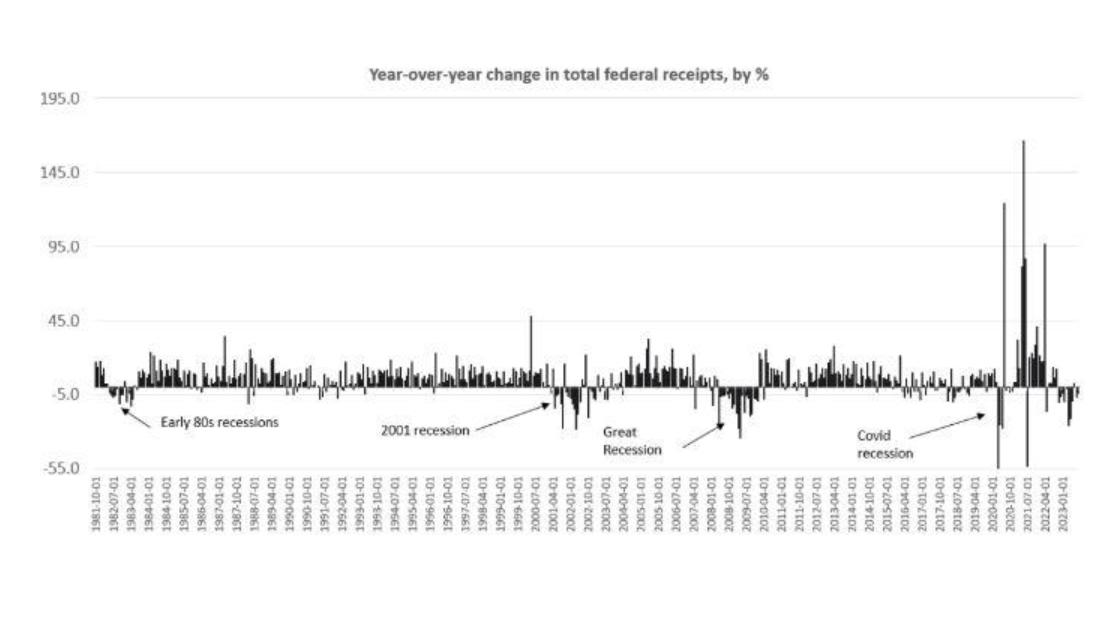

The harrowing sequence of consecutive declines in the Conference Board Leading Economic Indicators stands at an alarming 18, suggesting an ominous trajectory for the economy. Disturbingly, nearly half of recent homeowners reveal struggles in meeting mortgage obligations, attributing this challenge to soaring interest rates. Concurrently, the predictive yield curves ominously forecast another impending recession. This bleak forecast is echoed in the dwindling tax revenue, demonstrating a concerning decrease of around 5% in federal receipts since the early 1980s. These multiple, interwoven indicators signal a looming economic crisis.

🇺🇸 US number of consecutive monthly declines in Conference Board Leading Economic Indicators 18.

Deeper in #recession territory!

H/t: @JeffWeniger pic.twitter.com/hKuxRQBaIH

— Alex Joosten (@joosteninvestor) November 11, 2023

Retail turns tail pic.twitter.com/HDuZQE0Zc9

— Win Smart, CFA (@WinfieldSmart) November 13, 2023

Of the homeowners who bought a property in the past year, 46% indicate that they are struggling to manage their monthly mortgage payments due to high interest rates, per USA Today.

— unusual_whales (@unusual_whales) November 13, 2023

A homebuyer must earn $114,627 to afford the median-priced U.S. home, up 15% ($15,285) from a year ago and up more than 50% since the start of the pandemic.

That’s the highest annual income necessary to afford a home on record, per Redfin: pic.twitter.com/cNLouJLkSB

— unusual_whales (@unusual_whales) November 13, 2023

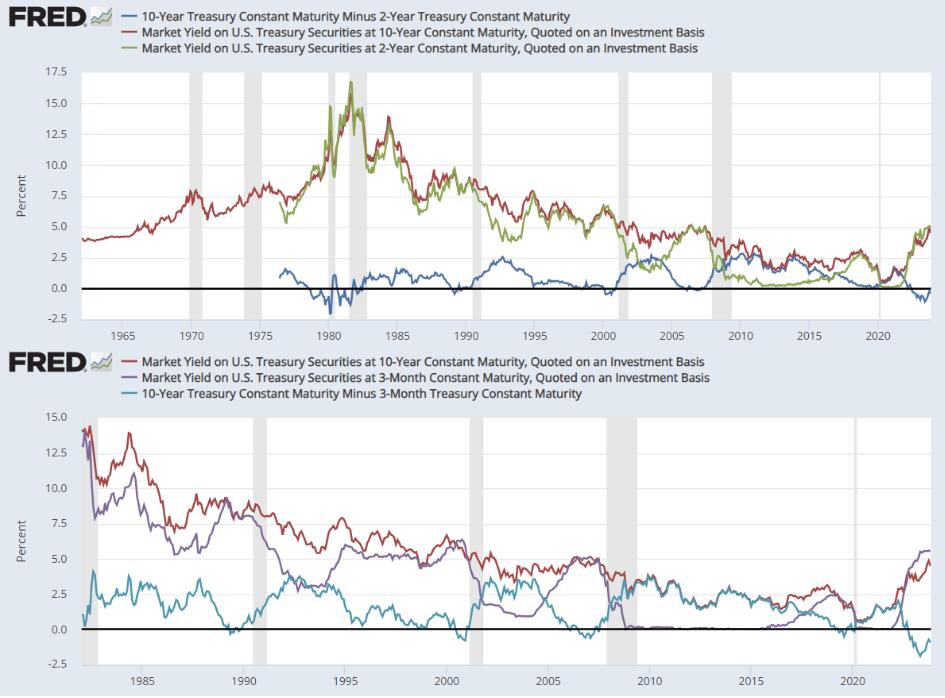

The yield curves are predicting recession again

Shaded bars = recession. Recession occurs after the yield curve un-inverts. What will the next recession be like?

Tax revenue declines flashing recession.

h/t SpontaneousDisorder

Views: 119