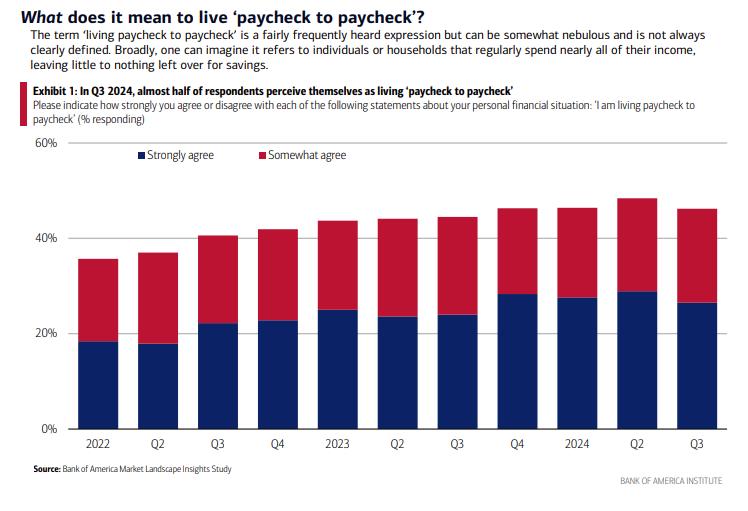

A growing 26% of U.S. households are living paycheck to paycheck, where their spending on necessities is nearly equivalent to their entire income. This trend has been rising across all income levels since 2019.

Lower-income households, earning less than $50,000 annually, are hit hardest, with 35% struggling to make ends meet. Even higher-income households, earning over $150,000, are feeling the squeeze, with 20% spending nearly all their income on essentials.

The historic inflation spike, driven by the pandemic, has amplified financial strain, particularly through rising housing costs. The Bank of America Institute highlights that middle-income families are increasingly feeling the pinch, with many now living paycheck to paycheck. As a result, discussions have intensified about potential public policies to subsidize housing costs for middle-income renters.

Sources:

- USA Today: Living paycheck to paycheck is more common, even when the paycheck is higher

- Fox Business: More Americans living paycheck-to-paycheck than 5 years ago, Bank of America data shows

- CNBC: Inflation is cooling, yet many Americans are still living paycheck to paycheck

- Bank of America Institute: Paycheck to paycheck: what, who, where, why?

Views: 110