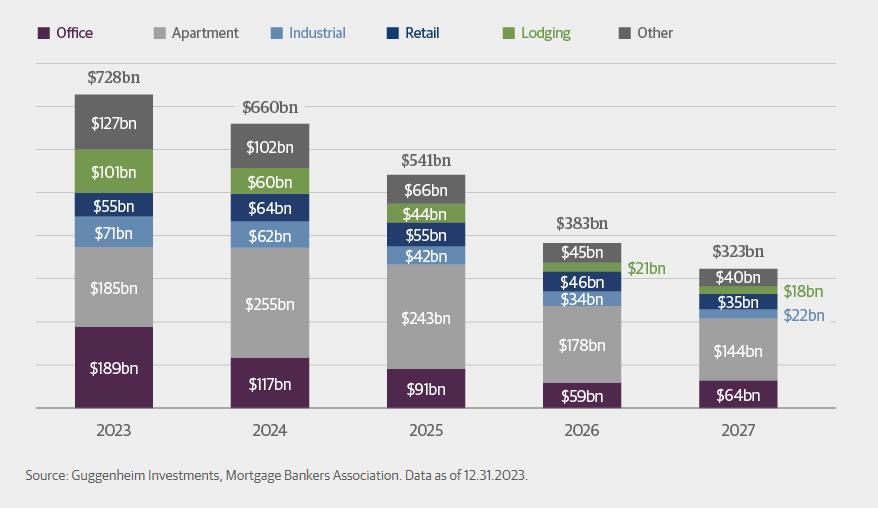

Approximately $929 billion of the $4.7 trillion outstanding commercial mortgages held by U.S. lenders and investors are set to mature in 2024, marking a 28% increase from the $729 billion that matured in 20231. Additionally, regulators have identified the near $6 trillion pile of outstanding commercial real estate loans as a top threat to the financial system in 20242. As property values fluctuate and interest rates rise, landlords may face challenges with maturing debt. It’s a critical time to monitor how much equity borrowers still have in their properties

Mortgage Bankers Association (MBA): Their 2023 Commercial Real Estate Survey indicates a total of $1.2 trillion maturing across 2024 and 2025, without a specific breakdown for 2025.

Trepp: They project $533.2 billion in total commercial mortgage loans maturing in 2025 [2].expand_more

Moss Adams: They mention $570 billion in loans reaching maturity in 2025.

Fun fact for the ‘no recession’ crowd: $2.2T of commercial mortgages will mature in next 30 months. Unrecognized losses at banks are already +$500B. How do you pretend when the loan is due?

— Porter Stansberry (@porterstansb) June 4, 2024

Did they really just ask for another government bailout for #banks? 🥶https://t.co/ykdxjkctRE pic.twitter.com/bUy60R8OO4

— Invariant Perspective (@InvariantPersp1) June 5, 2024

‘We’re in for a rough ride’: Mark Meckler sounds the alarm on the impending banking crisis

Convention of States President Mark Meckler says unpaid loans taken out during the COVID pandemic have left over 60 banks on the brink of insolvency. “What effects commercial banking affects the rest of the economy. I think we’re in for a rough ride,” he says.

🚨 Just in:

FDIC just reported that 63 banks are on the brink of insolvent collapse pic.twitter.com/NsOidVq3Cq

— Michael Burry Stock Tracker ♟ (@burrytracker) June 4, 2024

Regional bank run in 3..2 https://t.co/w2WddHffor pic.twitter.com/wxs9bOrddF

— The Great Martis (@great_martis) June 4, 2024