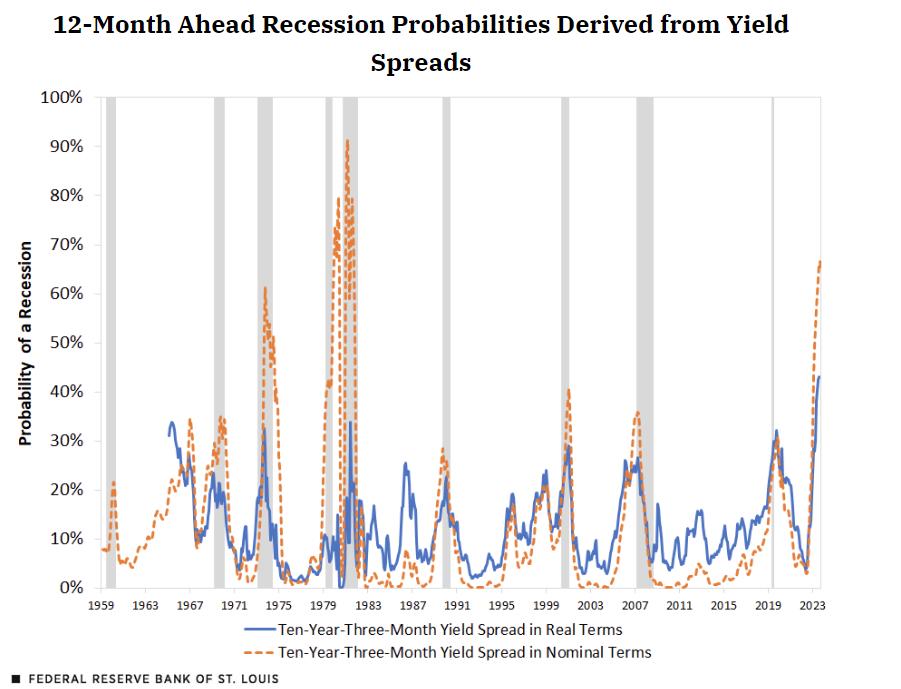

Since the 10 – 2-year yield curve recently normalized I was curious if the same were true of the near-term forward spread (10-year – 3-month), which the Federal Reserve previously announced as the most accurate predictor of recession available. It is still inverted as I write this, but what I found more interesting is while looking the values up I happened upon this article at the St. Louis Fed.

They discussed the odds of a recession occurring in a year. The article was written in September of 2023, so they happened to be making predictions for the present day.

“The nominal yield spread is currently negative—quite low by historical standards—and predicts a 65% probability of recession in 12 months. This recession probability would be unprecedentedly high for a false positive. The near-term forward spread from the Board of Governors currently implies a 50% chance of recession 12 months from now.”

Just found this interesting since we do, in fact, seem to be entering recession now. I wonder if that contributed to the unanimous decision to lower interest rates by 50 basis points.