by Euro347

Bank of Japan has been saying they are keeping an eye on the Yen. And the yen keeps getting weaker, currently at 154 to the Dollar and going higher by the day.

Bank of Japan is the single biggest holder of US treasuries. About a Trillion+ Dollars worth.

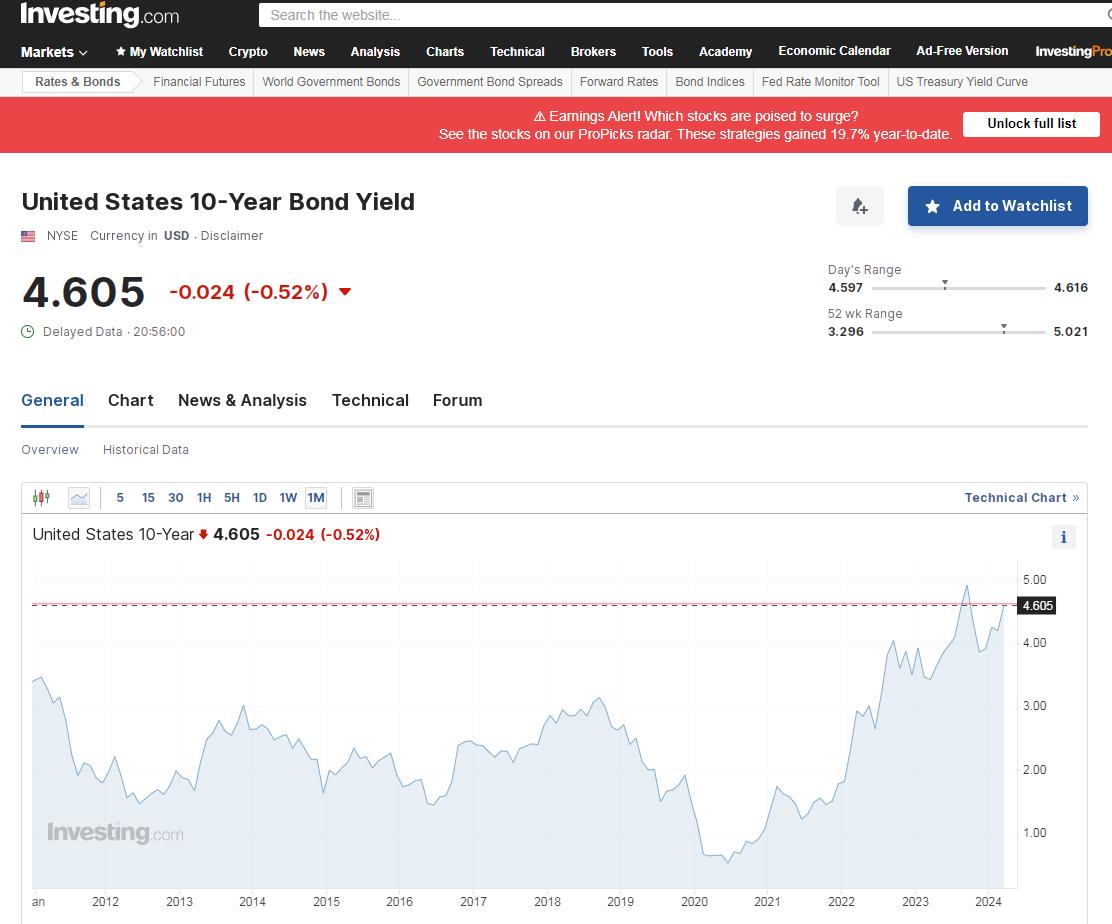

If they want to save the Yen they may need to sell US dollars/Treasuries.

This will cause a sell off and yields will rise making financing US debt much more expensive as the Treasury department issues new debt.

I think hedge funds will push to weaken the yen and short treasuries making ALOT of money.

Plus the middle east isnt helping.

Views:

120