After all, the banks will be running.

While I ruminated yesterday about how hard it is to keep your balance when nearly all the mainstream financial writers in the world disagree with you and when no one questions the seemingly false data that you question as you explain why you believe you were right in spite of the data that are being reported, today comes along and demonstrates the one thing I said I use most to gauge whether I’m wrong in my predictions or the government data are wrong.

There were two things really: The first was whether other equally important data contradicts the data that disagrees with my predictions (such as how gross domestic income is running diametrically opposite of gross-domestic product, which typically only happens when GDP is wrong). The second is whether the overall major trends are continuing to march in the direction I’ve indicated, despite some contrary data.

That is where today’s news comes along and says those predictions appear to be on track. Once again unemployment comes in reported almost inexplicably down, in spite of today’s report of 32,000 high-tech job cuts and plenty of other cuts in the recent path. While the mainstream media explains what even it says is a nearly-impossible-to-explain labor market as being a case of a strong economy placing great demands on labor. I have some stats that I said I’d report in this coming weekend’s Deeper Dive that will show that does not appear to be the case. This one is not so much a case of which data are right as which explanation of the data is right based on more data of other kinds.

Anyway, jobless claims came in way low today, holding the unemployment rate in the basement, which fits one of the trends I said was the most important trend prediction to watch all of last year and now into this year — how the labor market was never going to cut Powell any slack from his inflation fight until he tightens us into a deep recession (because the labor market is broken and doesn’t function as a gauge right now). The mainstream media is befuddled by how “strong” labor continues to be. The Deeper Dive will give a metric I haven’t come across before that shows that sustained low unemployment has very little do with a strong economy and much to do with broken labor.

Along these same lines, I keep saying we are going to see another round of major bank failures, in spite of the fact that our smiling gramma secretary of the treasury keeps telling us banks are fundamentally sound … until she finally admitted otherwise this week. (More grist for the mill this weekend in the Deeper Dive issue.) Today, as Yellen gets praised and softballed and then praised some more in congress, which is supposed to oversee her regulatory committee that fails to regulate (yet gets praised for the outstanding job of regulation it has done), we see more headlines about those rising bank failures that she is supposed to regulate. So, job well done, Yellen.

New York Community Bancorp (NYCB) just got its THIRD credit-rating downgrade in less than that many weeks, and now word on the street is that its troubles are spreading to Europe and Asia … so no big deal then. I guess it is becoming more apparent that my guess as to why the Fed’s FOMC had removed the phrase about “strong and resilient” banks from its official meeting statement was right: they suddenly saw big banking problems about to break out with the timing of their meeting. (It could, of course, just be that they thought the assurance was no longer needed, but that is increasingly hard to believe as word of NYCBs crashing stocks and contagion troubles continues to develop.) The bank’s stock has now fallen 60% in just one week!

Nothing to see there folks. Ignore the contagion to Asian and European bank stocks. Yellen’s regulatory oversight committee would not be getting such praise today (in the video linked below) from the congressional oversight committee that oversees her oversight if there were a problem here blowing up under her oversight. I’m sure this unfolding bank event will be as boring as watching paint dry, though it is one of those trends that keeps steamrolling along in the direction I’ve said it would, in spite of all that charming GDP and CPI data and the huge cheering section that said data has in the mainstream financial media.

“Liquidity appears sufficient, but given the bank failures last spring, we remain cautious given that the adverse headline risk, including a significant decline in NYCB’s stock price, could eventually spook customer and depositor confidence,” Morningstar DBRS said.

Hmm. Ya think?

NYCB’s newly appointed executive chairman Alessandro DiNello on Wednesday said the bank will consider the sale of loans in its CRE portfolio or allow them to run off the balance sheet naturally.

So, they’ve solved the problem with a quickly appointed replacement CEO and a fire sale of their CRE portfolio. Isn’t that the area where I said way back early last summer the next banking blowout was certain to come from? But surely Powell will reverse his tightening in March so that this all ends soon due to lowering interest rates as Yellen assured us is about to happen when she declared about two weeks ago that the Fed’s mission was accomplished … until the Fed subsequently said, “Not quite.”

So, tightening continues as big banks fail … again on her watch and Powell’s … but there is no recession in site, in spite of the obvious manufacturing recession because “earnings are strong,” in spite of the fact that earnings expectations got what may have been their biggest downgrades in history before corporate reports started coming in “above expectations. Yet, all you hear are “earnings are strong, driving up stock prices.”

The week-long sell-off in NYCB shares has soured sentiment on banks both in the U.S. and abroad while stirring worries over global contagion from CRE exposure.

But Yellen just told us a week or two ago that CRE was not like to be a problem with any prospects of contagion. It would be limited to just a few banks that took unnecessary risks. (Banks that maybe her regulators and the Fed’s should have stopped from taking such risks?)

Germany’s Deutsche Pfandbriefbank (PBB), whose 15% of total loans is tied to the CRE sector, termed the situation as “the greatest real estate crisis since the financial crisis.”

Well, clearly there is nothing to be concerned about there then! Just like Yellen said. (Note: Any bank that starts with the word “Deutsche” in its name has me concerned at this point.)

The lender said it has enough funds to cope with a downturn in the real estate segment, even as its shares and bonds fell again.

Did I just hear an echo of the president of Silicon Valley Bank?

U.S. Treasury Secretary Janet Yellen said Thursday she expects additional stress on banks and some financial losses from weakness in the U.S. commercial real estate market, but banking regulators are working with banks to address these risks.

Oh, well, thank goodness for that. With her regulators on the job, the bank should be put into insolvency and sold in a firesafe to JPMorgan by the end of this weekend! When I hear Yellen say banks are “strong and resilient,” I ask “what’s wrong?” When I hear her actually say there will be some trouble, which I possibly have never heard her say, I say it’s time to slit the bottom of the mattress and start filling it with cash because this is just about to reach the red zone that she calls “as boring as watching paint dry” before it goes completely over the edge of “I think we’ll never see another financial crisis in my lifetime.” (Said no doubt right after she got her first diagnosis of fully metastasized brain cancer, creating an adjustment in her anticipated lifetime. Fortunately for us, they must have found a cure so she’s back on the job of stabilizing American banks! Though all I hear is a giant flushing sound.)

The S&P 5000

The S&P this week has been magnetized toward the 5,000 line, as I said we could expect, and it is banging its head along the bottom of that as strong resistance, as I said we could also expect. The big question is whether it will jack-hammer through and continue to rise or attempt a breakthrough, see that fail to hold, and then crash. And, no, I’m not about to predict when the market’s irrational behavior will end. I’m just commenting on the irrationality of the stock mania as banks crash and the Houthi crisis on the Red Sea worsens, causing oil to break above the $80 mark again today. Maersk has announced that the Red Sea dangers are now worse than they’ve ever been, and all news is now showing the inflationary pressure I said we could expect from this crisis showing up in producer prices. (All stories of the day that you’ll find below the paywall.)

Of course, I also have to admit where I am wrong … at least for now. The Treasury market is having zero trouble digesting all those massively more massive Treasury issuances that Yellen and her boss keep gushing upward. Yesterday and today both saw stellar Treasury auctions, showing clear signs that the US Treasury is having no problem at all finding new buyers to replace Russia, China and others who have fled the US Treasury market.

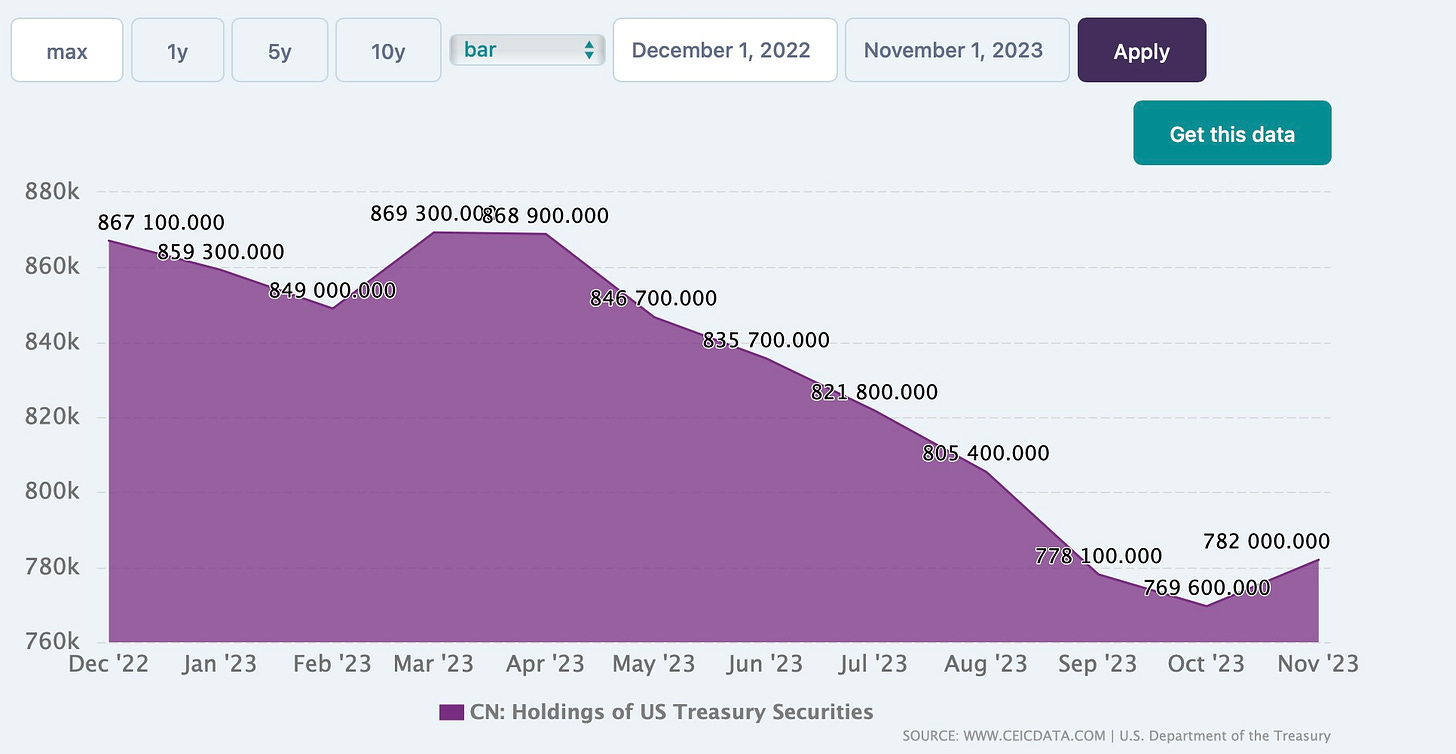

Of course, China hasn’t run very far:

That may look like a deep belly until you realize that the bottom of the graph is only down an eighth of the way to the true bottom from the top position, so China is down by less than an eighth of its total holdings back in Dec 22., and those holdings are now rising again. I have resisted the idea that China is going to divest and destroy the dollar, but I did think the US would be having problems with its Treasure auctions at long last finding enough buyers for its Treasuries due to historically massive and runaway deficit spending. It looks more like China is stepping back up to the plate.

China is, however down by about half from its all-time maximum in November of 2013 of $1.3M, but that leaves fifty-percent of the journey still to go if divesting and killing the dollar is really China’s goal.

More on all of this bankster fun in the next Deeper Dive.

Now, words said at the start of every major banking crisis that should make anyone run:

“While we cannot rule out more concerns emerging over individual names, we do not think that there is a systemic crisis in the making,”

—Mohit Kumar, chief economist, Europe, for Jefferies.