by bitkogan

In a classic case of “bad news is good news” sentiment, the stock market seems to be embracing the notion that a cooling labor market could trigger interest rate cuts.

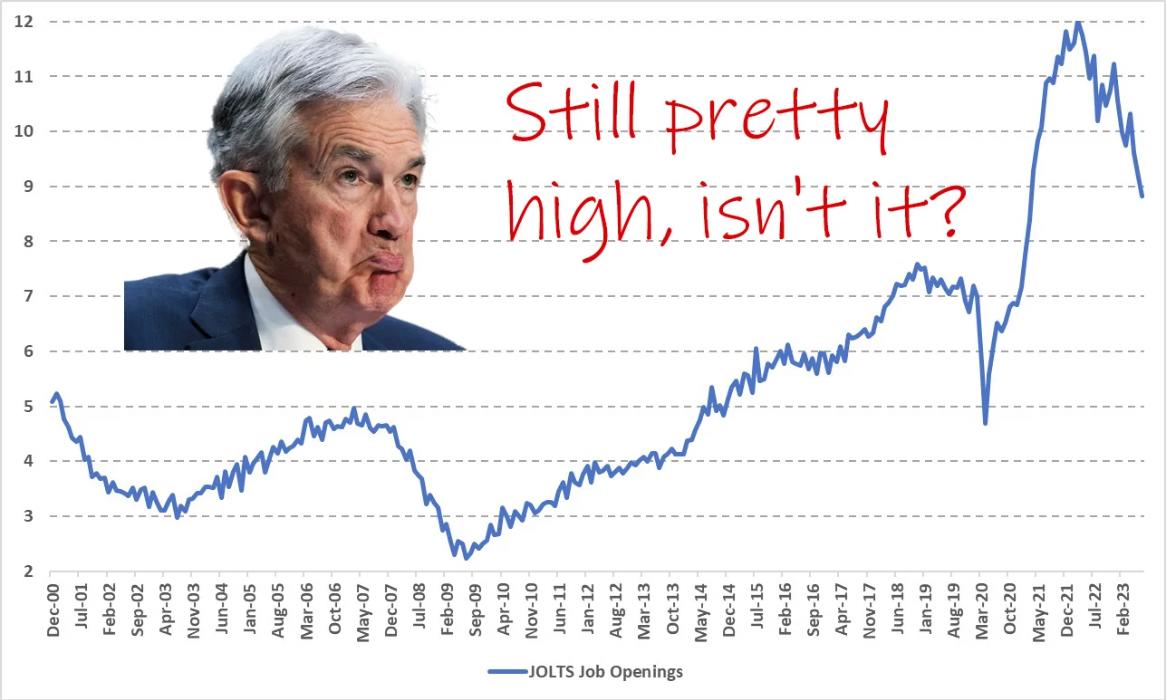

However, the Federal Reserve has made it clear they’re data-dependent. As such, the Fed has not committed to implementing rate cuts that are based solely on a tepid labor market. Despite the drop in U.S. job openings to 8.83 million, that market is still far from frigid.

Given the numbers, the Fed will require more compelling evidence before it takes action. If that data doesn’t materialize by Friday, the market could be in for a rude awakening.