By Graham Summers, MBA | Chief Market Strategist

The stock market has finally woken up to what I’ve been warning about for weeks… namely that inflation is rebounding.

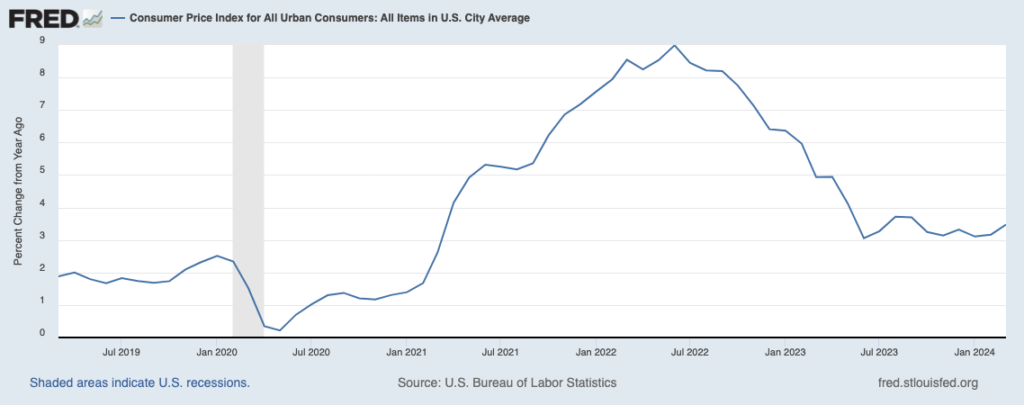

By quick way of review, the Fed stopped raising interest rates in July 2023. It then started talking about cutting interest rates in November. And it did this despite the clear evidence that Energy prices were the only part of the inflation data that had turned negative. Put another way, every other segment of the inflation data was still rising… albeit at a slower pace.

Fast forward to today, and the official inflation measure, the Consumer Price Index or CPI for short has bottomed and is beginning to rebound.

With inflation doing this, there is NO WAY the Fed can cut rates three times this year. The bond market has realized this and is now discounting maybe one rate cut of 0.25% this year.

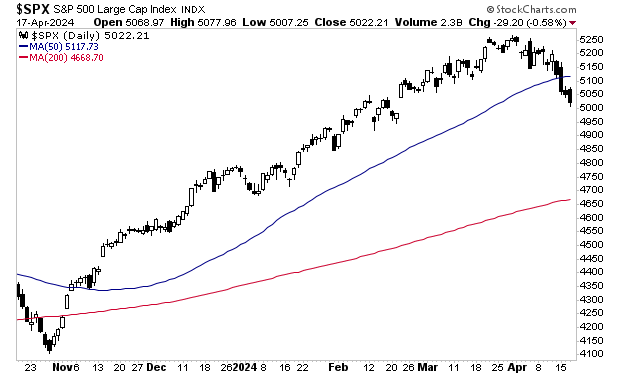

Stocks didn’t like that. The S&P 500 has now dropped 4% and is below its 50-day moving average (DMA) for the first time since November 2023.