via Mike Shedlock:

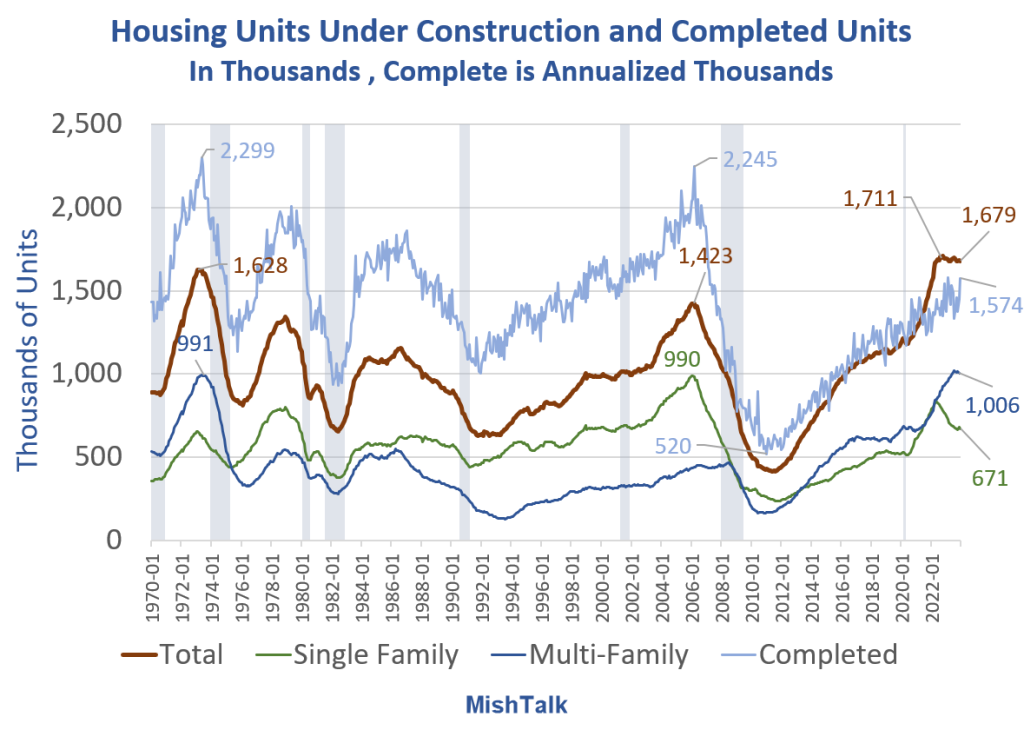

There’s a recurring claim that the price of rent will decline as soon as the near-record number of housing units under construction are completed. Let’s investigate the claim.

The price of rent has gone up 28 consecutive months by at least 0.4 percent. Two themes are repeated over and over.

- New leases suggest rent is falling or soon will.

- As soon as the record number of housing units under construction are completed, the price of rent will drop.

Housing Units Under Construction

Housing Starts Drop 6.6 Percent

For discussion of the December New Residential Construction report on which that chart is based, please see Housing Starts Drop 6.6 Percent on Top of Negative Revisions

The point of this post is the line in red, total units under construction, and light blue, completed units.

Random Correlation

The first chart shows random correlation between completed units and the price of rent. Instead, the price of rents tend to drop in recessions.

This makes sense. People are out of work, get evicted, and move back in with parents or take on roommates to cut expenses.

Rents also stabilize or drop in cities that are overbuilt. Otherwise the price of rent tend to rise.

Hotter Than Expected CPI Led by Rent, Up Another 0.4 Percent

For well over two years, economists and analysts said rent was declining or soon would be. But for the 28th consecutive month rent and OER were up at least 0.4 percent.

On January 11, I commented Hotter Than Expected CPI Led by Rent, Up Another 0.4 Percent

Yet Another Groundhog Day for Rent

I repeat my core key theme for over two years now. People keep telling me rents are falling, I keep saying they aren’t. I thought this may finally be the month the rent trend breaks but it wasn’t.

Rent of primary residence, the cost that best equates to the rent people pay, jumped another 0.5 percent in December. Rent of primary residence has gone up at least 0.4 percent for 28 consecutive months! [Note: somewhere along the way I got off by a month. Last month I said 28 months but it is 28 months this month].

The “rents are falling” (or soon will) projections have been based on the price of new leases. But existing leases, more important, keep rising.

Only 8 to 9 percent of renters move each year. It’s been a huge mistake thinking new leases and finished construction would drive rent prices.

Moreover, some of the alleged declines failed to take in seasonal adjustments. Most people move between May and September. It’s harder to fill a lease in December pressuring rents in the winter.

Why Predictions of When the Price of Rent Will Fall Have Been Wrong

For further discussion of the rent setup, please see my January 1, 2024 post Why Predictions of When the Price of Rent Will Fall Have Been Wrong

I address seasonality, five different measures of rent, and how the BLS smooths things out.

Why Are Americans in Such a Rotten Mood?

Those who do rent, most likely the lower economic groups, have been royally screwed by Fed policy.

This addresses the question Why Are Americans in Such a Rotten Mood? Biden Blames the Media

People can cut back on some things but rent and food are not in that list.

For the 36 percent of the nation that rents, Bidenomics has been a complete disaster.

Is the BLS Is Overstating Rent and Exaggerating Inflation?

On December 7, I investigated A Curious Claim that the BLS Is Overstating Rent and Exaggerating Inflation

I provide solid evidence that the BLS has been doing no such thing.

Nonetheless, assume inflation slows along with rent. At some point it’s bound to happen.

The key question then becomes: Was inflation transitory or is it the easing that’s transitory?

The extra money home owners have in their pockets thanks to the Fed and refinancing at 3 percent, coupled with Biden’s regulations, the end of just-in-time manufacturing, and totally inane energy policy all suggest it’s the current easing of inflation that is transitory, not the initial spike.

At some point rent will stop rising so much, or even stabilize or for a while. Perhaps next month.

But I suspect people will read too much into that, unless it’s due to the hard reality of another recession.

Biden’s Claim on Inflation

In case you missed it, please see Is Inflation Down? That’s What President Biden Says

Ask anyone who rents, buys groceries, is in college, buys their own health insurance, or even the average Joe on the street what they think of Biden’s claim.