As I noted yesterday, the great debt crisis of out lifetimes is approaching.

The U.S. is now adding debt at an exponential rate. The U.S. racked up its first $10 trillion in debt over the course of 232 years. Following the Great Financial Crisis, it added another $10 trillion in just nine years. The next $10 trillion took only four years.

And by the look of things, the next $10 trillion will take even less than that. The U.S. has added $2 trillion in debt in the last four months. We’re now adding $1.2 billion in debt per hour.

How will this play out?

Well there are three ways to deal with a major debt problem.

1) Pay it back.

2) Inflate it away.

Guess which one policymakers have opted for?

Why did they spend $8 TRILLION in the span of just 24 months from 2020

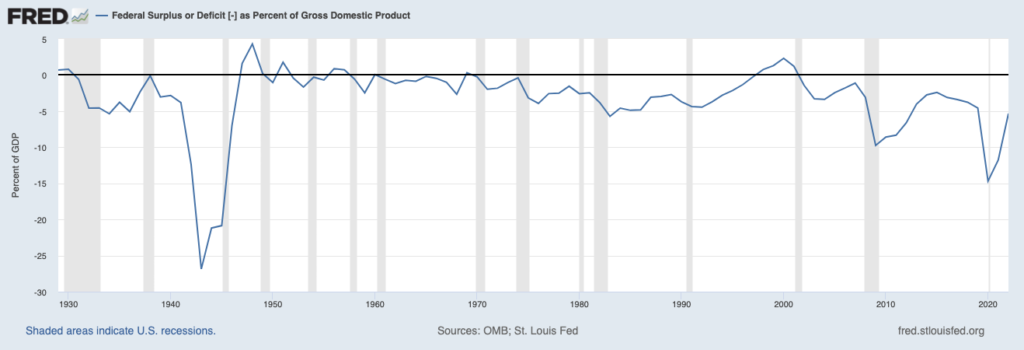

Why else is the U.S. running its largest fiscal deficit as a percentage of GDP outside of WWII… despite the fact the economy is still growing!?!

Why else is the Fed providing over $1 TRILLION in reverse repo liquidity schemes to the financial system every single night… despite the fact the financial system isn’t in a crisis?!?