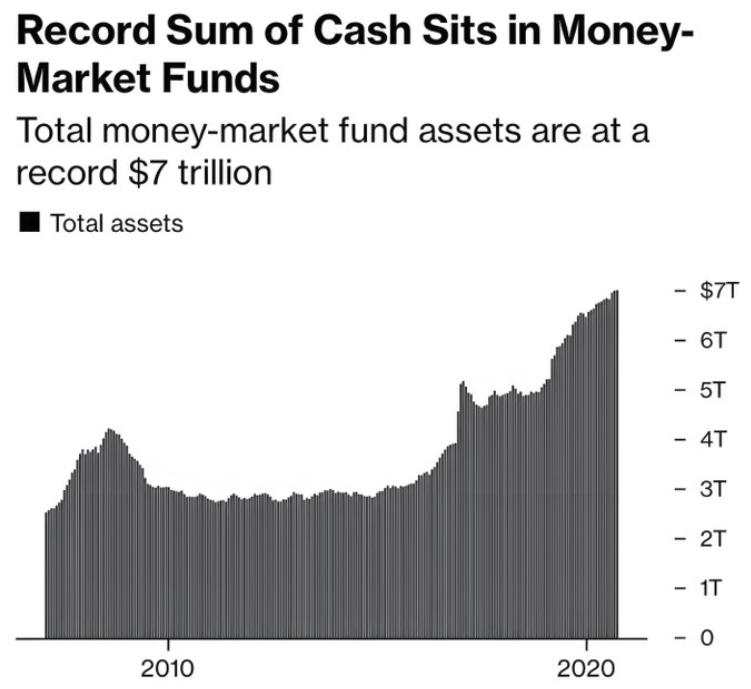

$7 trillion is now sitting in U.S. money market funds, a record high.

This happens because the fed overnight rate is close to 5% at this time, so it makes no sense for banks to park money there ONLY for them to have to pay customers the same rate. There’s no room for any profit in doing that. Banks know they can charge more than what the fed would pay them to park it, especially with mortgages rates at 7%, us prime at 7.75% plus margin, HE loans and Helocs around 9%.

And considering those rates, it’s more lucrative for banks to pay customers’ 4.78% to rent their money rather than borrow it from the fed at 5%. That means banks need customers funds. This increased demand means they offer generous APR for customers money.

The wealthy will save & lend, earning interest on the poor (who borrow & spend).

Sources

- Investment Company Institute

- Federal Reserve Bank of St. Louis

- CBS News

- Federal Reserve

- MSN

- Bankrate

- InflationData

h/t canned_spaghetti85