Many banks are kept afloat by borrowing from a special short term rescue fund at the Fed. To date over $ 100 billion has been borrowed to keep the banks solvent. The banks are sitting on a keg of financial dynamite with over $ 650 billion in unrealized losses on Treasury securities in addition to dealing with their silent bank run problem. The Banks are having a bunch of massive problems related to their lending business as well.

Fed’s Bank Bailout Fund Explodes To Record High As Massive Money-Market Fund Inflows Continue

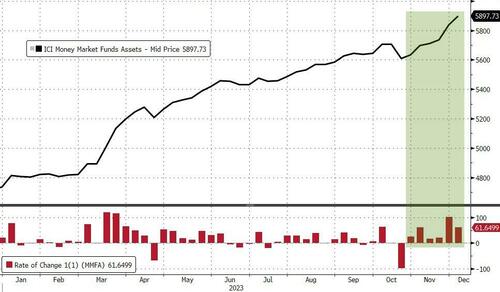

THURSDAY, DEC 07, 2023Money-market funds saw another large ($61.5BN) inflow last week. That is the sixth straight week of inflows, adding $290BN in that time to a new record high of $5.9TN…

Source: Bloomberg

In a breakdown for the week to Dec. 6, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.829TN, a $56.1BN increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets climb to $946BN, a $6.1BN increase

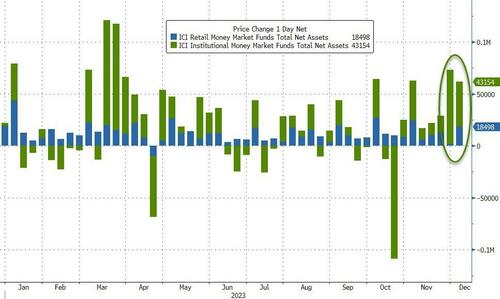

Institutional funds saw the bulk of the inflows once again (+$43BN) while the unbroken trend of inflow into Retail funds continues (+$18.5BN)…

We’ve had more bank failures this year than in the banking crisis in 2008. And the banks are hanging on by using a Fed lifeline….

Why Treasury Auctions Have Wall Street on Edge

Scrutiny of Treasury auctions—whereby the government funds operations by selling the world’s safest bonds to big banks and dealers—has grown alongside their size. For years, many in Washington and on Wall Street assumed that… pic.twitter.com/H62FuwlsRJ

— Win Smart, CFA (@WinfieldSmart) December 11, 2023