What recession bulls say.

The deficit is worse than 6 out of 8 recessions since 1960.

Borrowing 6% of GDP to grow 1%.

Hyper moronic. pic.twitter.com/AtYikK5CX4

— Mac10 (@SuburbanDrone) June 6, 2023

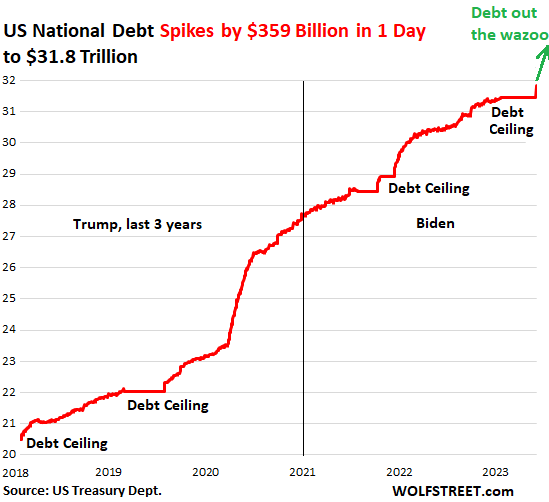

The Debt Ceiling Charade ended over the weekend when President Biden signed the “Fiscal Responsibility Act of 2023,” that suspends the debt ceiling through early 2025. A US default was “averted.” The ending of the charade is always known in advance: Congress will agree on a deal at the last minute, and the President will sign it, as it has been done for the 80th times since 1960. But the process of getting there can make you nervous. Then, after the Debt Ceiling Charade is over, we get a huge spike in the debt.

So the U.S. national debt spiked by $359 billion in one single day, the first working day after the debt ceiling was suspended, to $31.83 trillion, as of yesterday evening, reported this evening by the Treasury Department.

And that was just the beginning, there will be more hair-raising single-day spikes of the debt over the next few days:

The total national debt comes in two types of Treasury securities, nonmarketable (cannot be traded in the bond market) and marketable (can be traded in the bond market).

Savers’ favorite “I bonds” are nonmarketable Treasury securities. The Treasuries securities held by government pension funds, the Social Security Trust Fund, etc. are nonmarketable. Nonmarketable Treasury securities jumped by $28 billion yesterday, reported today, to $6.79 trillion.

From the @WSJ article on "Treasury’s $1 Trillion Debt Deluge Threatens Market Calm: U.S. government could face borrowing at rates near 6%, up from 0.1% less than two years ago."

The amount and likely cost of issuance are well known.

Less clear, and there's a range of possible… pic.twitter.com/x46vSr36wL— Mohamed A. El-Erian (@elerianm) June 7, 2023