by alcatpone

Throughout this year, the prevailing narrative has been one of a robust economy, with assurances of widespread prosperity: low unemployment, rising wages, and increased earnings for the populace. However, from my perspective, this portrayal doesn’t resonate with reality

The US economy is officially in stagflation, possibly worse, and I believe it’s in a recession but no-one will admit it.

- Despite indicators, official media outlets are hesitant to acknowledge economic downturn.

- Recent comments by the Fed Chief during the latest FOMC conference dismissed stagflation and inflation concerns despite all of the data saying otherwise.

- GDP growth was just 1.6% in the latest quarter, the slowest since before the 08 crash, effectively zero when adjusted for inflation.

- Job market growth fell far below estimates with only 175,000 jobs created compared to the expected 3,100,000.

- The Fed is struggling to meet its 2% inflation target, despite insisting it’s achievable.

- Rising everyday prices are evident, impacting everyday expenses like fast food and coffee (see starbucks, fast food chain sales declines). Consumers are stretched thin.

- Credit card defaults are surging across the US, reminiscent of the early stages of the 2008 financial crisis.

- Capital One, the fourth largest credit card issuer in the US, reported a staggering 5.9% charge-off rate (basically defaults), the highest since the 2008 financial crash.

- This charge-off rate has risen by over 230% in the past two years, indicating a significant increase in accounts being shut down due to non-payment.

- The surge in credit card defaults is a major concern for the US economy, suggesting that consumers are struggling to cope with inflation and excessive spending. These defaults may serve as a leading indicator of economic trouble ahead

- Lower-income US consumers are bearing the brunt of loan stress, as noted by Fed Goolsbee,

- Biden downplayed inflation concerns…suggesting people have extra money to spend lmao

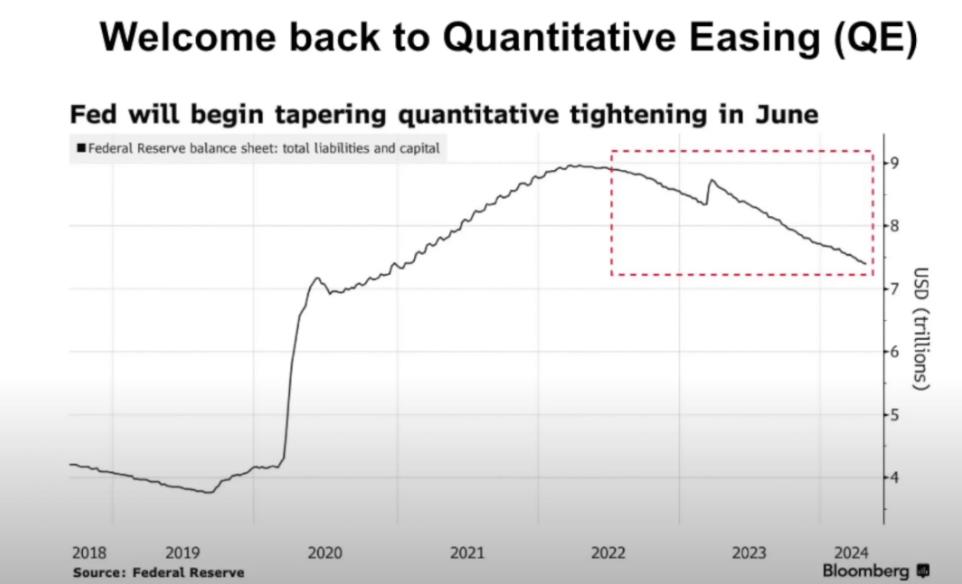

- The Fed’s approach to fighting inflation seems ineffective, as they’ve begun the process of quantitative easing (big one)

- The Fed’s actions suggest a pivot from fighting inflation to easing monetary conditions (again lying about the 2% goal)

- Despite holding interest rates steady, the Fed is making bank lending conditions looser, favoring investors over ordinary people.

- If the Fed wanted to curb inflation, they would need to address rising asset prices, particularly in housing (but we’ve seen massive drops in first home buyer interest and increase in time houses are on market).

- The latest job market report marks a turning point, with job creation slowing by 30% and a rise in long-term unemployment (companies especailly in states like CA are no longer hiring – first sign of future lay offs).

- Most new jobs created are part-time, indicating a shift in employment patterns.

- The number of people working part-time due to inability to find full-time work has increased from 800,000 to 1.1 million year over year.

See also Denzel Washington has become a minister. Says you can't talk about religion in the industry