The Warren Buffett Indicator has surged to an all-time high of 202%, surpassing previous market peaks, including the Dot Com Bubble, the Global Financial Crisis, and the 2022 Bear Market. This surge signals a dangerously overvalued U.S. stock market compared to the economy’s size.

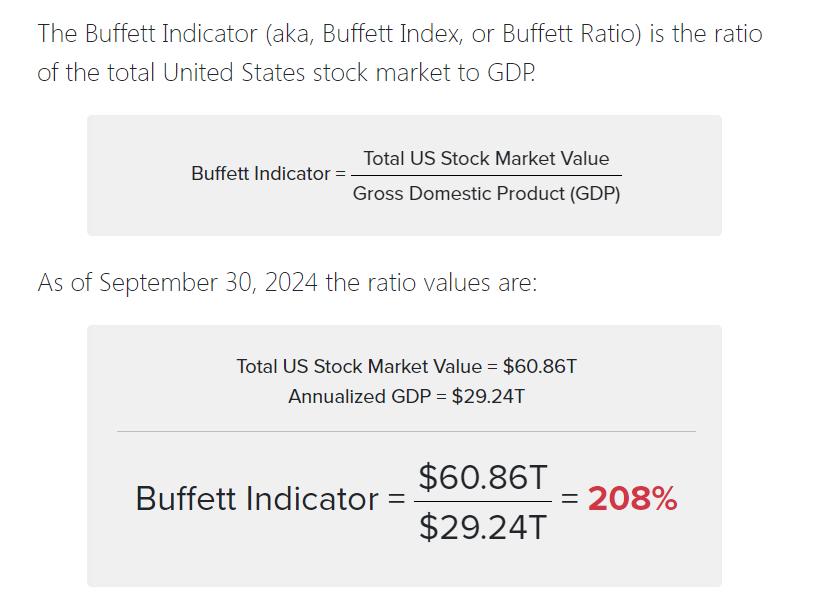

The indicator measures the ratio of total U.S. stock market value to GDP. As of September 30, 2024, it hit 208%, reinforcing fears of market instability. This trend suggests the stock market is significantly detached from economic reality.

Meanwhile, the yield curve inversion—where short-term interest rates exceed long-term rates—has been in effect since mid-2022, historically a reliable recession predictor. The inversion reflects investor expectations of slowing economic growth.

Yield curve inversion has already set the stage for a recession

This had also happened in 1928, 1972, and 2000

All of them ended in a recession

Buckle up 🧵 pic.twitter.com/pyux2sB3oU

— Bravos Research (@bravosresearch) November 18, 2024

The Federal Reserve Bank of New York estimates a 61% chance of a recession by January 2025, and history shows a pattern: similar yield curve inversions in 1928, 1972, and 2000 were followed by major recessions, including the Great Depression and Dot Com Bubble burst.

With both the Buffett Indicator at unprecedented levels and the yield curve inversion firmly in place, the signs point to a significant economic downturn on the horizon.

Sources:

https://currentmarketvaluation.com/models/buffett-indicator.php

https://behindthemarkets.com/the-buffett-indicator-explained-and-what-its-telling-us-now/

https://financer.com/financial-indicators/buffett-indicator/

https://money.usnews.com/investing/articles/inverted-yield-curve-is-it-still-a-recession-indicator

https://www.marketplace.org/2024/09/12/inverted-yield-curve-recession-predictor-indicator/

https://www.fool.com/investing/2024/08/11/the-long-inverted-yield-curve-just-uninverted-but/

https://www.statista.com/statistics/1087216/time-gap-between-yield-curve-inversion-and-recession/

https://globalfinancialdata.com/the-inverted-yield-curve-in-historical-perspective