As I noted a few weeks ago, inflation likely bottomed in July.

By quick way of review, the official inflation metric, the Consumer Price Index or CPI, is measured on a year over year basis. So, when the CPI is 5.5%, for instance, what it’s saying is that prices are 5.5% higher than they were during the same month the year before.

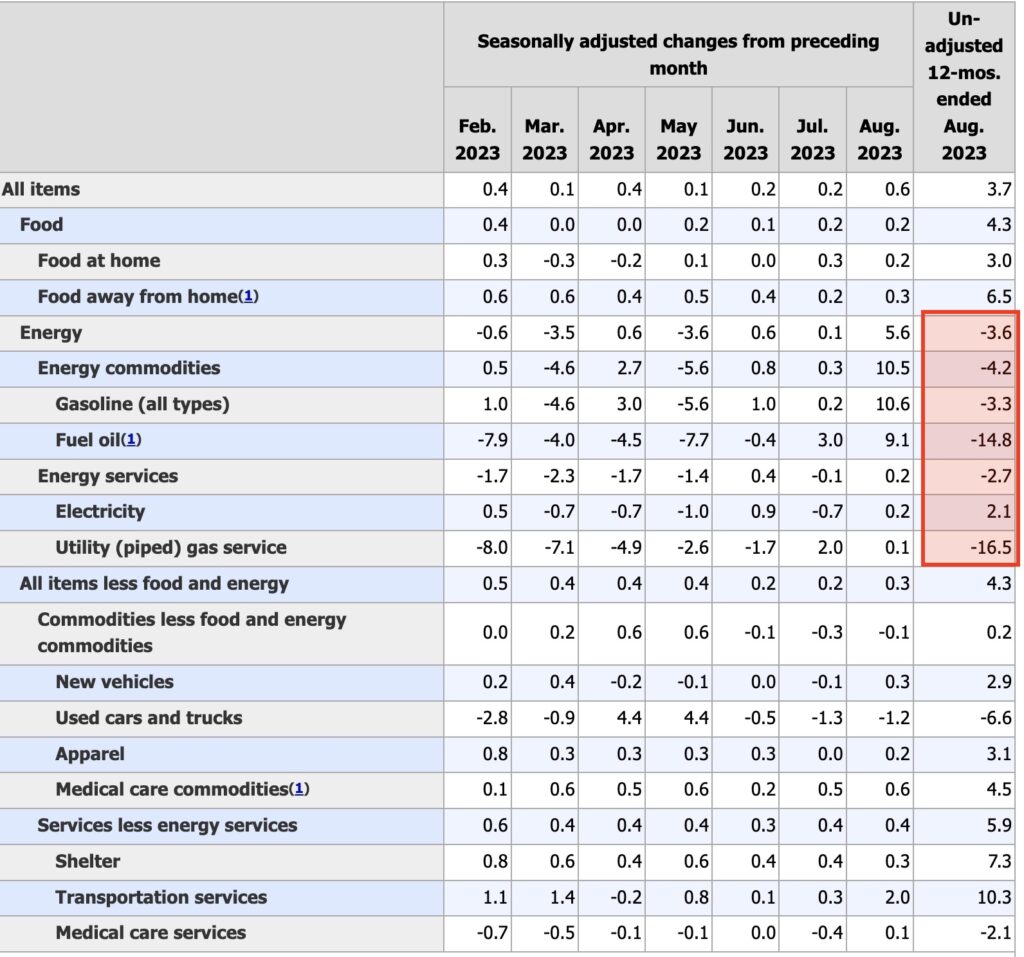

As many pundits have noted, CPI has been declining. What they are failing to recognize however is that the only part of the CPI data that has been declining in 2023 is energy prices. And the reasons for this are:

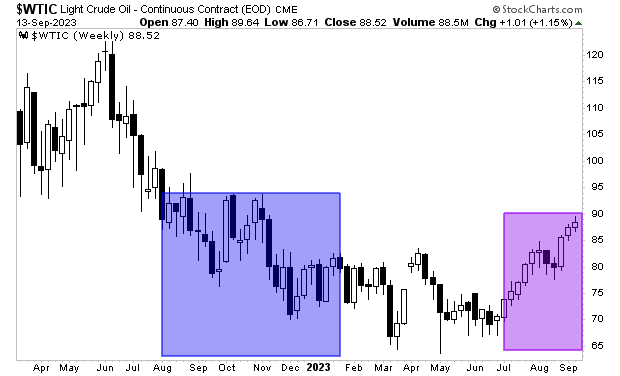

1) Oil prices collapsed for most of the last 12 months after spiking higher during Russia’s invasion of Ukraine in 1Q22.

2) The Biden administration has dumped ~292 million barrels of oil from the Strategic Petroleum Reserve (SPR) forcing oil prices lower.

You can see this for yourself in the table below. Again, the ONLY parts of the CPI that has dropped significantly are energy prices (well that and used cars and medical devices).

However, this period is now ending. On a year over year basis, energy prices will no longer be down much if at all because we are comparing prices in the purple rectangle to prices in the blue rectangle on a year over year basis. This should result in CPI moving higher.

Indeed, CPI for August clocked in at 3.7% year over year. That sounds decent until you realize that CPI was 3.0% in June. That’s quite a rebound in just two months. And bear in mind, core inflation is still well over 4%!

So again, inflation has bottomed. Some investors will profit beautifully from this. Others will get taken to the cleaners.

243 views