https://www.marketwatch.com/investing/index/vix?mod=home-page

https://www.marketwatch.com/investing/fund/uvxy?mod=mw_quote_recentlyviewed

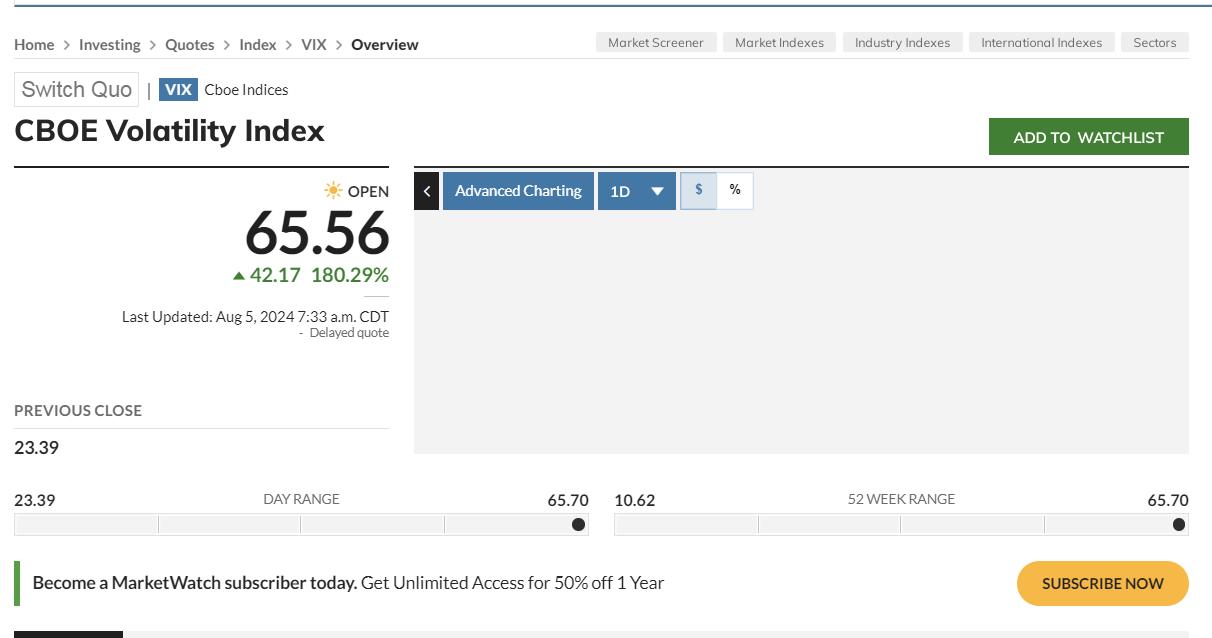

BREAKING: The volatility index, $VIX, is now trading above 65, a level only seen 2 previous times in history.

The only 2 times the $VIX has traded above 65 were the 2020 Pandemic and 2008 Financial Crisis.

This puts the $VIX up a whopping 550% from its July 2024 lows.

As a… pic.twitter.com/qH6oVJDXzz

— The Kobeissi Letter (@KobeissiLetter) August 5, 2024

BREAKING: It has now been 1.5 hours since the market opened and users at Schwab, Vanguard, Fidelity, Ameritrade, and E-Trade are still unable to access their accounts.

The volatility index, $VIX, just hit its third highest level in history.

Yet, retail traders are unable to buy… pic.twitter.com/ixkpq1KOO0

— The Kobeissi Letter (@KobeissiLetter) August 5, 2024

Wow. The only times the VIX was higher: peak 2008 crash and Covid crash. pic.twitter.com/CMMM71WM57

— Charles Edwards (@caprioleio) August 5, 2024

The marker was running the exact same risk last year, they defused it but in doing so they made the problem even worse down the road and we are seeing it in all its beauty today. Nevertheless, I was wrong, but that thought me a lesson to stop believing in free markets. https://t.co/f29dYyuaZh

— JustDario 🏊♂️ (@DarioCpx) August 5, 2024

https://twitter.com/RJRCapital/status/1820439026094027248

Earlier this year, I joined @TheStalwart and @tracyalloway to discuss how the short volatility trade had become the largest it has ever been. At Ambrus, our thesis was that this concentration was driven by a few key factors that elevated the Vega notional to massive levels. We… https://t.co/YdVZw3XU2X

— Kris Sidial🇺🇸 (@Ksidiii) August 5, 2024

Remember all those disclaimers from the CBOE that 0dte options were not draining liquidity from VIX-tenor options?

Yeah, those can be put to rest now… pic.twitter.com/fD08Gsovhc

— Michael Green (@profplum99) August 5, 2024

The VIX, or Volatility Index, is a real-time market index that represents the market’s expectations for volatility over the coming 30 days. Often referred to as the “fear gauge,” the VIX is derived from the price inputs of the S&P 500 index options. High VIX values indicate increased market volatility and uncertainty, while low values suggest more stable market conditions. It is commonly used by traders and investors to gauge market sentiment and potential risk.