Will The Fed keep on printing??

The answer is “not!”

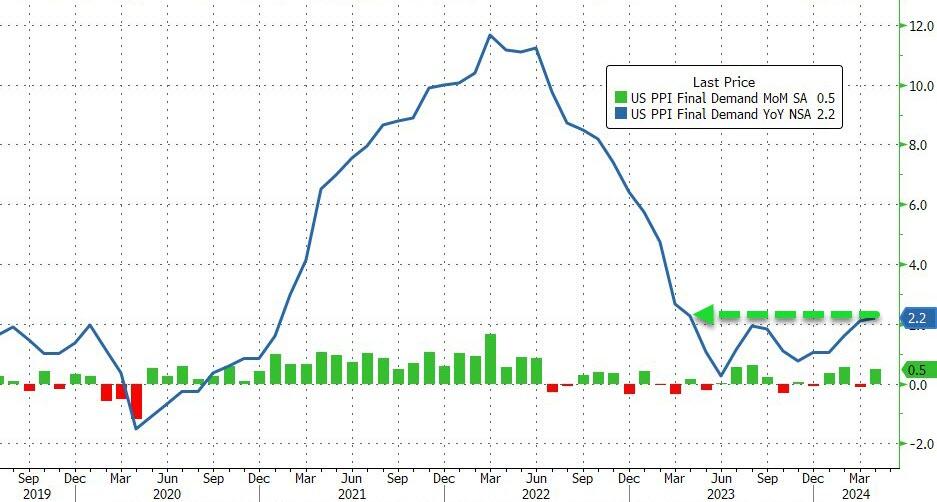

April Producer Prices rose 0.5% MoM (vs +0.3% exp), with March’s +0.2% MoM revised down to -0.1% MoM. The downward revision did not stop the YoY read rising to 2.2% (from +2.1% in March)…

Source: Bloomberg

This is the highest YoY read since April 2023 and is the fourth hotter than expected headline PPI print…

Source: Bloomberg

Producer Prices have been aggressively downwardly revised for 4 of the last 7 months…

Source: Bloomberg

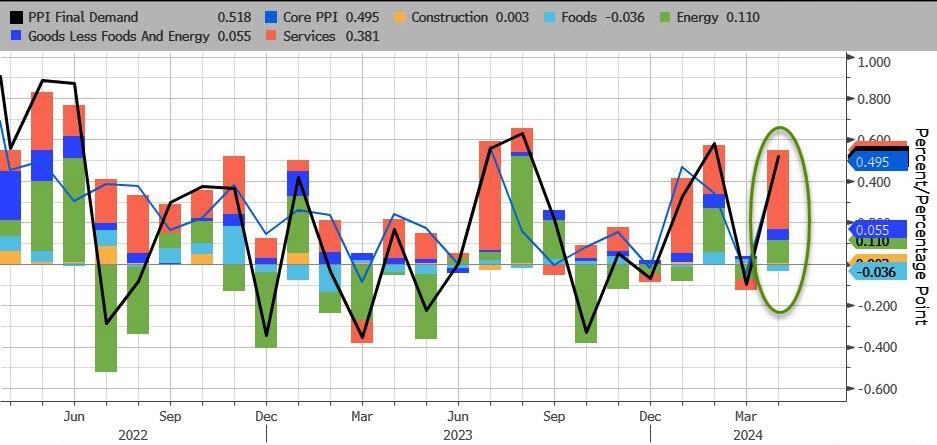

Services costs soared, dominating April’s PPI gains with Energy the second most important factor. Food prices actually declined on a MoM basis.

Source: Bloomberg

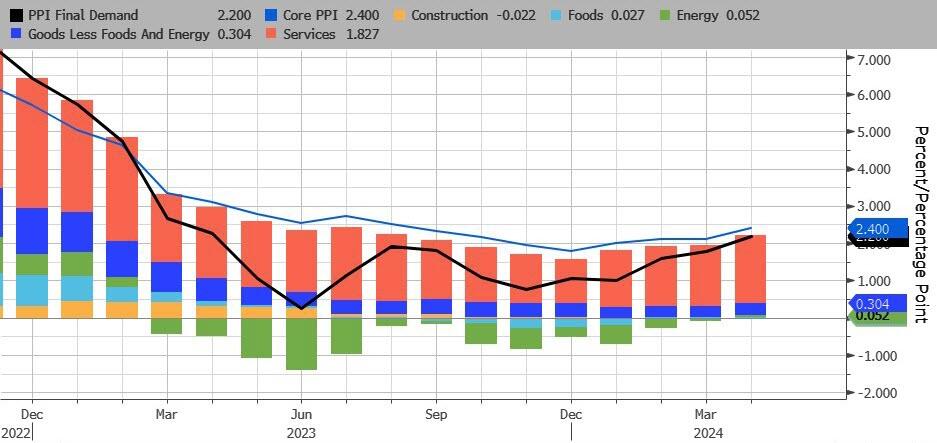

On a YoY basis, headline PPI’s rise was dominated by Services (rising at their hottest since July 2023). For the first time since Feb 2023, none of the underlying factors were negative on a YoY basis…

Source: Bloomberg

After last month’s farcical ‘seasonally adjusted’ gasoline price, April saw the PPI Gasoline index rise (with actual prices at the pump) but still has a long way to go…

Source: Bloomberg

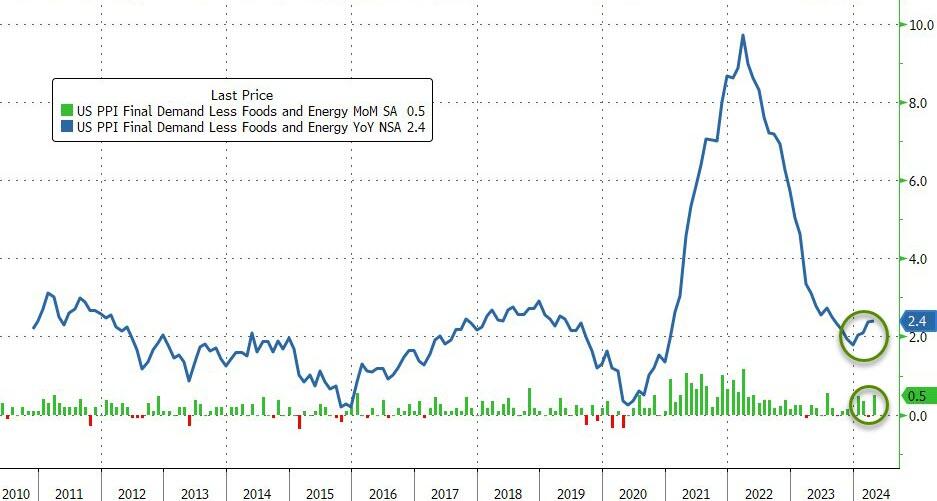

Core PPI was worse – rising 0.5% MoM (more than double the +0.2% MoM expected) – which pushed the Core PPI YoY up to +2.4%…

Source: Bloomberg

And finally US PPI Final Demand Less Foods Energy and Trade Services rose by 0.4% MoM and 3.1% YoY (the highest in 12 months).

Worse still the pipeline for primary PPI is not good as intermediate demand is starting to accelerate…

Source: Bloomberg

Over the past month, ‘higher prices’ have dominated ‘lower prices’ in recent survey data…

Higher producer prices:

- New York Empire manufacturing price paid advanced to 33.7 from 28.7.

- Philadelphia Fed manufacturing reported prices paid gained to 23.0 from 3.7 in March.

- Philadelphia Fed non-manufacturing prices paid rose to 31.0 from 26.6 in the prior month.

- Richmond Fed services prices paid rose to 6.11 from 5.43 in March.

- Kansas City Fed manufacturing prices paid advanced to 18 from 17.

- Kansas City Fed services input price growth continued to outpace selling prices.

- S&P Global manufacturing input cost inflation quickened to hint at sustained near-term upward pressure on selling prices.

- ISM Manufacturing prices paid gained to 60.9, the highest since June 2022, from 55.8 in March.

- ISM Services prices paid notched up to 59.2, the highest since January, from 53.4 in March.

Lower producer prices:

- New York Fed Services prices paid fell to 53.4 from 55.1 in March.

- Richmond Fed manufacturing growth rates of prices paid dipped to 2.79 from 3.22 in March

- Dallas Fed Manufacturing outlook reported prices paid for raw materials dropped to 11.2 from 21.1 in the prior month.

- Dallas service sector input prices index nudged down to 28.8 from 30.4 in the prior month.

- S&P Global Service saw input costs slowed from six-month highs in March.

Do you see the ‘flation’ now, Jay?

So, no, The Fed does not have inflation under control.

Tomorrow’s CPI report should be interesting.