In a stark revelation, it’s emphasized that approximately half of the US office spaces remain unoccupied, signaling a significant and potentially troublesome issue. The simplicity of the statement underlines the gravity of the situation, prompting a second reading for emphasis.

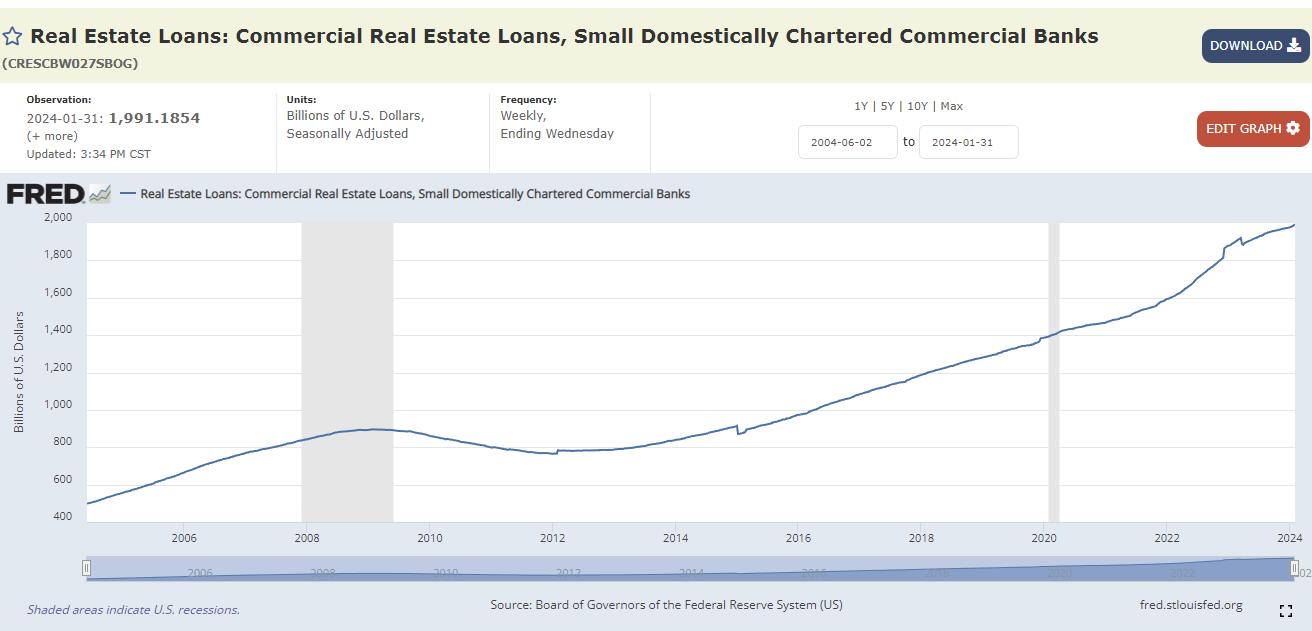

The narrative pivots to a broader concern, pointing out that, concurrently, Commercial Real Estate Loans in Small Domestically Chartered Commercial Banks have reached another all-time high on January 24, now standing at nearly $2 trillion of exposure. This staggering figure amplifies the magnitude of the problem, indicating potential risks in the financial landscape.

The dire scenario is further accentuated by the ongoing decline in commercial construction starts. The sequential enumeration of these examples paints a narrative of interconnected challenges, with vacant office spaces being just one facet of a larger economic concern.

Sources:

US offices remain about half vacant.

Read that again,

Half vacant.This is a massive problem. @DiMartinoBooth is doing some great work on this subject.

— Gold Telegraph ⚡ (@GoldTelegraph_) February 9, 2024

https://fred.stlouisfed.org/series/CRESCBW027SBOG

Commercial construction starts continues to decline. pic.twitter.com/rS86qLPN75

— Piker Capital (@PikerCapital) February 9, 2024

Moron leveraged into CRE…..lost

The biggest idiots were made to look like the smartest in the room pic.twitter.com/KxxNE4S5FG

— Darth Powell 🦈🇺🇲🇺🇦🇵🇱🇫🇮 (@GRomePow) February 9, 2024