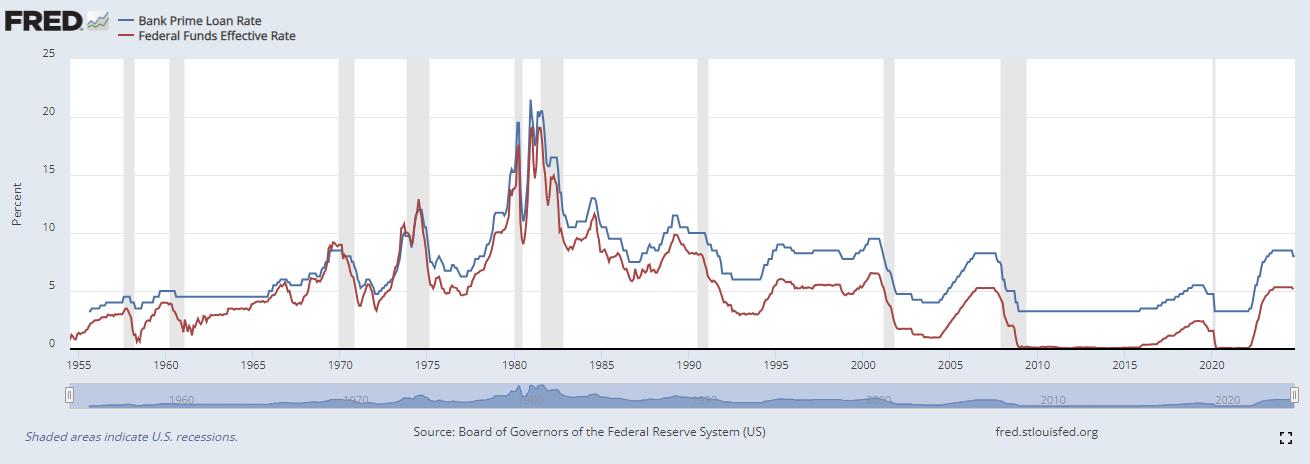

US: Bank prime loans & NFIB short-term loan rates

Soon to fall? 🤔 pic.twitter.com/SLE8afYmoM

— Win Smart, CFA (@WinfieldSmart) October 9, 2024

“The most recent surveys by the NFIB show that business conditions are deteriorating quickly for smaller companies that create about 65% of the jobs in the US.

I could show you a dozen graphs, but I’m limited to three for this post. But in all areas – sales, hiring, etc.- small businesses are feeling crushed. One of the biggest killers is that they are paying extraordinarily high interest rates on their small business loans – chart 3. As we are observing in earlier posts this week, they don’t have any relief in sight on those interest rates because rates are going in the opposite direction of the Fed’s cut.

Now, contrast that with the Atlanta Fed’s current estimate of our GDP, which they claim is at +3% (chart 4).

In an economy as large as ours, 3% GDP indicates a roaring, booming economy. 3% GDP would be “normal healthy” in a developing nation, but in the developed world 3% is an extraordinarily strong economy.

Two things about this:

1) As I’ve said over and over, when you survey private industry, you are getting a completely different take on the situation at hand than when you get data from a government source. The government data is being manipulated ahead of the election. There’s no other way I can justify the disconnect, and it’s been that way since 2021.

2) Let’s assume that the Fed’s estimate is right for a moment. If that’s true, then inflation is roaring back up. You can’t have GDP that strong without inflationary pressure.

What I actually believe we are having is something called a K-shaped economy. The very wealthiest are doing very well because of inflation moving up the price of their assets. The vast majority of us, like the bottom 80-90%, are going through hell.

So on a chart, you would see two trajectories for the economy, forming the letter K.

Where this kind of thing ends is in a hard landing because 70% of our GDP is still personal consumption. There frankly aren’t enough rich people to keep the economy afloat with their spending, and they’re not going to spend down assets that are swelling in value due to inflation.

It’s like when the government says they’re going to “tax the rich“. They never intend to do that because there aren’t enough rich people. “Tax the rich“ always means, “tax the middle class“.

So how does this end? In a recession, first in income, then in dropping asset prices. As the middle and lower income people finally curtail their discretionary spending (it’s happening already), the upper bar on the K-economy will quickly drop to meet the bottom.”

The most recent surveys by the NFIB show that business conditions are deteriorating quickly for smaller companies that create about 65% of the jobs in the US.

I could show you a dozen graphs, but I’m limited to three for this post. But in all areas – sales, hiring, etc.- small… pic.twitter.com/ZW4e3x2RN9

— Uncle Milty’s Ghost (@his_eminence_j) October 9, 2024

“Employers are now so overwhelmed with graduate applications, they don’t look at academic achievements," per FT.

— unusual_whales (@unusual_whales) October 9, 2024

UNCERTAINTY INDEX

Sum of "Don't Know" & "Uncertain" Answers on 6 Questions pic.twitter.com/73dNPuq8hp

— Win Smart, CFA (@WinfieldSmart) October 9, 2024

fred.stlouisfed.org/series/MPRIME

fred.stlouisfed.org/graph/?g=ZrPR

fred.stlouisfed.org/series/DPRIME