US GDP rose at an upwardly revised 3.4% annualized pace in 4Q of 2023.

"The government’s other main gauge of economic activity — gross domestic income (GDI) — rose 4.8%, the most in two years."

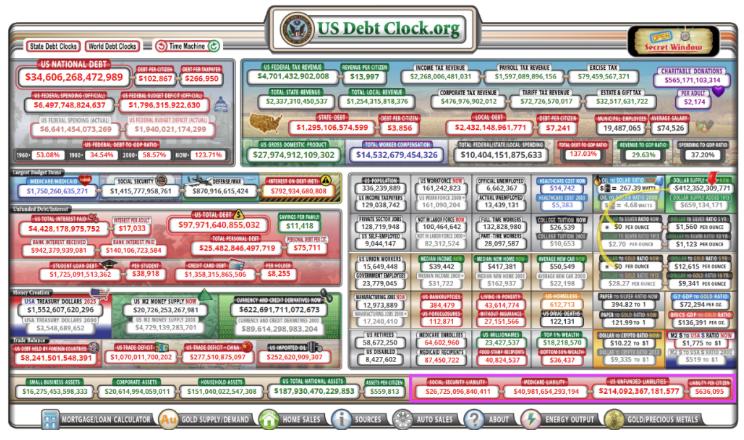

$2 trillion budget deficits work as intendedhttps://t.co/qvcavuZGDs pic.twitter.com/1CJbfcT15y

— Global Markets Investor (@GlobalMktObserv) March 28, 2024

In recent economic news, the US GDP surged in the last quarter of 2023, with gross domestic income hitting a two-year high. While this may seem like good news, the reality is more complex. The government’s massive budget deficits are driving this growth, but at what cost? With a staggering $2 trillion deficit, the US government is playing a dangerous game, risking higher interest rates and inflation.

As if that weren’t enough, 38% of the federal debt needs refinancing within the next three years, adding further strain to an already precarious situation. While the top 1% revel in record wealth, the broader population faces the harsh reality of mounting debt and unfunded entitlements. This unsustainable path raises serious concerns about the future of the economy and the well-being of its citizens.

To put it in perspective, each US citizen is on the hook for a staggering $636,000 in unfunded entitlements alone. This burden, combined with the escalating national debt, paints a grim picture of the nation’s financial future.

The government’s reliance on deficit spending to fuel economic growth and inflation is not sustainable and poses significant risks to the nation’s financial stability.

Sources:

🇺🇸 Higher interest rates for longer? The US federal government can’t afford that.

38% of the federal debt needs to be refinanced within the next three years.

H/t: @jsblokland pic.twitter.com/eHz9dmoxJR

— Alex Joosten (@joosteninvestor) March 28, 2024

The inflation reading was virtually unchanged in this morning's final GDP estimate, so the trajectory for real (inflation-adjusted) interest payments on the debt likewise remains the same, and it's not good: pic.twitter.com/EA8b5uS0jA

— E.J. Antoni, Ph.D. (@RealEJAntoni) March 28, 2024

New record wealth for the top 1%.

Data as of Q4 2023. Q1 2024 will show further acceleration.

Powell: there will be some pain

Narrator: Not for the top 1% pic.twitter.com/GGIGt8XXP1— Sven Henrich (@NorthmanTrader) March 25, 2024