I am no forune teller, but this doesn’t look to good for old Joe (Biden).

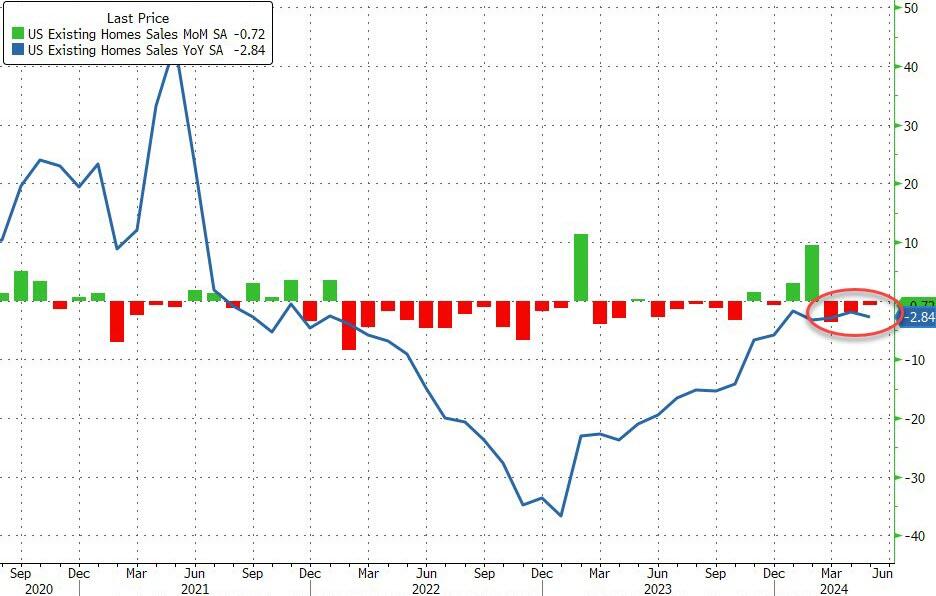

Existing home sales fell -2.8% YoY in May.

US existing home sales fell for the third straight month in May (-0.7% MoM vs -1.0% exp). This left home sales down 2.8% YoY (YoY sales have not increased since July 2021)…

Source: Bloomberg

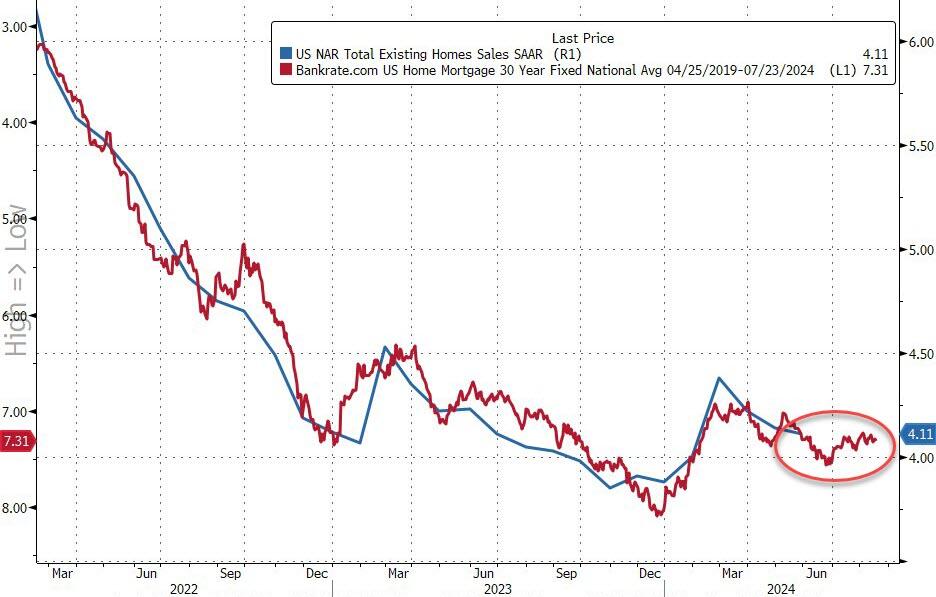

The total home sales SAAR is push back towards COVID lockdown lows once again at 4.1mm, but prices accelerated to a new record high…

Source: Bloomberg

“Home prices reaching new highs are creating a wider divide between those owning properties and those who wish to be first-time buyers,” NAR Chief Economist Lawrence Yun said in a statement.

“Eventually, more inventory will help boost home sales and tame home price gains in the upcoming months.”

And given that mortgage rates remain stubbornly above 7%, existing home sales show no signs of improving anytime soon…

Source: Bloomberg

The supply of homes on the market increased 18.5% from the same month last year to 1.28 million, but it’s still well below the level seen before the pandemic when mortgage rates were much lower.

Source: Bloomberg

About 67% of the homes sold were on the market for less than a month in May, roughly flat from the prior month, while 30% sold above the list price. Properties remained on the market for 24 days on average in May, compared with 26 days in April, NAR’s report said.

The Conference Board Leading Economic Index® (LEI) for the U.S. decreased by 0.5 percent in May 2024 to 101.2 (2016=100), following a 0.6 percent decline in April. Over the six-month period between November 2023 and May 2024, the LEI fell by 2.0 percent—a smaller decrease than its 3.4 percent contraction over the previous six months.