As the nation grapples with economic turbulence, a chilling revelation shakes the very foundation of financial stability: US credit card delinquency rates soar to unprecedented heights, signaling a looming crisis of unprecedented proportions.

According to the Philadelphia Fed, the fourth quarter of 2023 bears witness to a grim milestone: more credit card balances are delinquent by 30+ and 60+ days than at any point in history. A staggering ~3.5% of credit card balances languish in arrears, a harbinger of economic distress on an unparalleled scale.

Yet, the grim tableau doesn’t end there. Total credit card debt skyrockets to a record $1.3 trillion, amplifying the strain on households already teetering on the brink of financial ruin. With the average credit card interest rate reaching an eye-watering 28%, the burden of debt becomes an unbearable weight on the shoulders of millions of Americans.

In the midst of this economic maelstrom, a stark reality emerges: credit card debt is not the panacea for inflationary pressures. As net savings of Americans plummet to negative territory—a phenomenon witnessed only twice before, during the Great Financial Crisis and the COVID-19 pandemic—the specter of impending doom looms large.

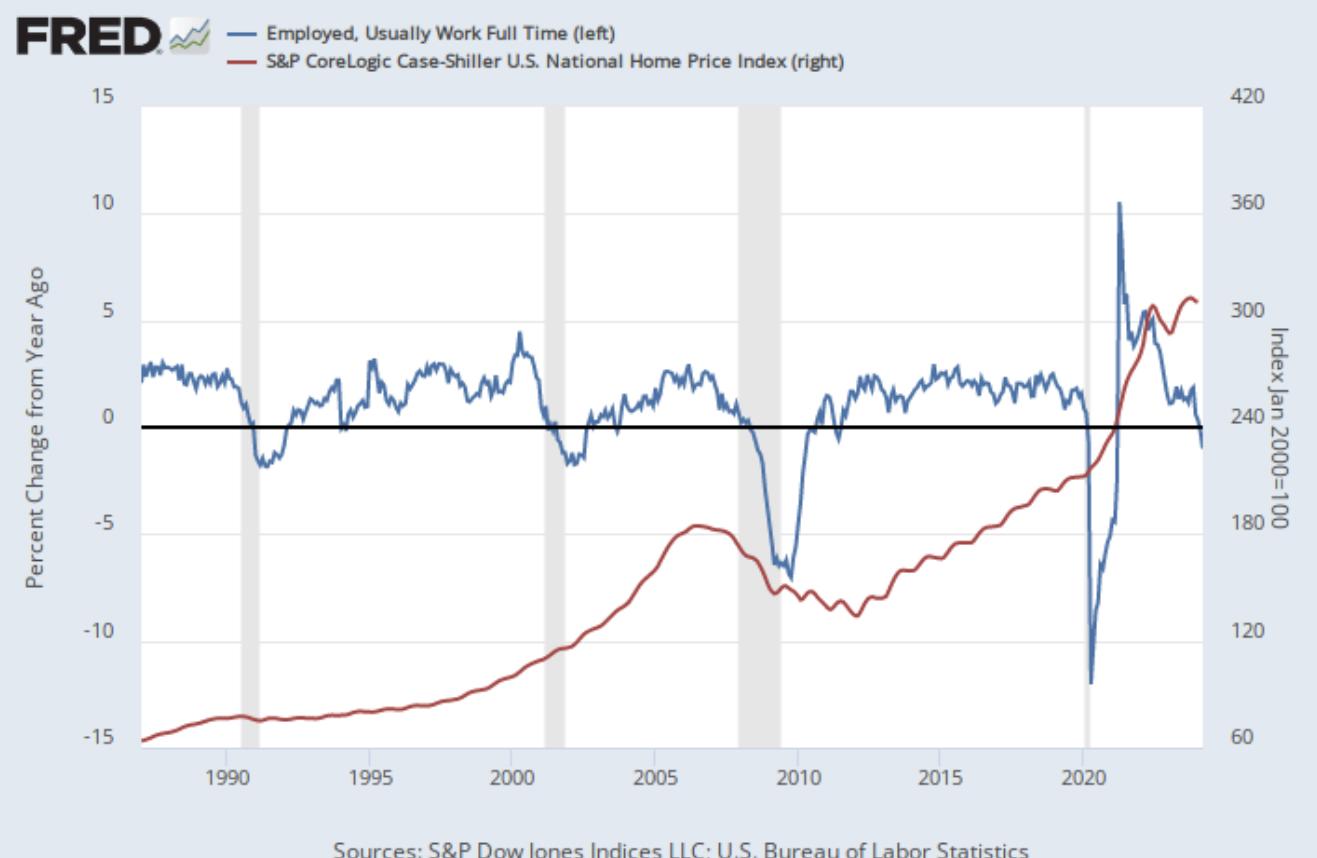

The warning signs are unmistakable. With full-time employment waning and the housing market poised on the precipice of collapse, the nation hurtles towards an abyss of financial catastrophe. The echoes of past crises reverberate ominously, serving as a chilling reminder of the fragility of economic stability.

Sources:

JUST IN: US credit card delinquency rates are now at their highest on record, according to the Philadelphia Fed.

In Q4 2023, more credit card balances were 30+ and 60+ days past due compared to any other period in history.

The percentage of credit card balances at least 30 days… pic.twitter.com/siPFmGM7bT

— The Kobeissi Letter (@KobeissiLetter) April 14, 2024

https://globalmarketsinvestor.substack.com/p/are-us-consumers-finances-seriously