Thanks to Bidenomics, code for massive Federal spending on green energy initiatives and payoffs fo large donors, we have agonizing inflation and consumers are borrowing more and more to cope with inflation. And with the increased use of debt comes …. drumroll … delinquenices!

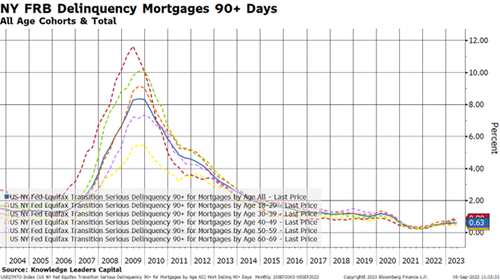

Let’s start with mortgage loans, the overall delinquency rate is 63bps, near record lows, likely due to the huge home appreciation of the last few years which padded the equity cushion for most homeowners. Even the youngest cohort (18-29 years old) has a delinquency rate only 30bps higher than the aggregate. Unlike the 2007-2011 period, the credit cycle is not playing out in the real estate market.

The US conforming mortgage rate is UP 158% under Bidenomics.

Let’s move on to some forms of consumer loans, where the story is a little more daunting.

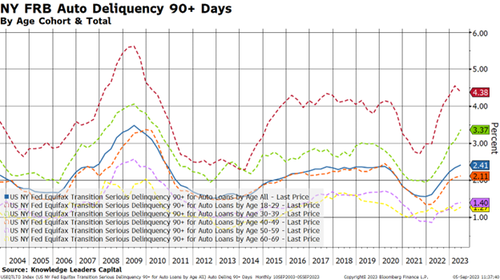

Auto loans are definitely the epicenter of the credit cycle. While the overall average is a still somewhat tame 2.41%, younger borrowers are not keeping up. Younger borrowers have delinquency rates that are 1-2% higher than the average while the inverse is true for older borrowers. Eighteen-to-thirty-nine year-old borrowers have the highest delinquency rate in 13 years.

Somehow, I sense that used car lots are going to start filling up again as these vehicles get repossessed. This should put downward pressure on used car prices, bringing that element of inflation down. This is one of the channels through which monetary policy works.

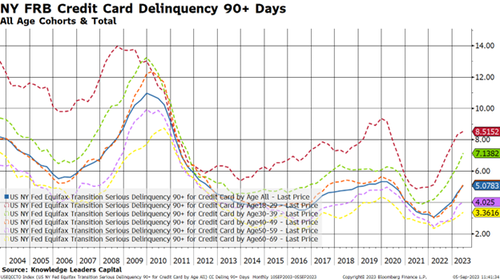

Lastly, I’ll take a look at credit card delinquencies.

Here is where we can really see the stresses building.

- First, the overall delinquency rate has about doubled from 2.5% to 5% over the last couple years.

- Second, older borrowers have seen a tick up in delinquency rates, a feature we don’t really see in other credit products.

- Third, one in 12 younger 18-29 year-old borrowers are 90+ days late making their credit card payments.

Credit Card Delinquency Rate across all commercial banks hit 2.77% in the 2nd quarter, the highest level in more than a decade.

In conclusion, we are in the early days of a consumer credit cycle. Younger borrowers are the weakest link in this analysis, and this makes me wonder where rates go when student debt payments turn back on at the end of the month.

68 views