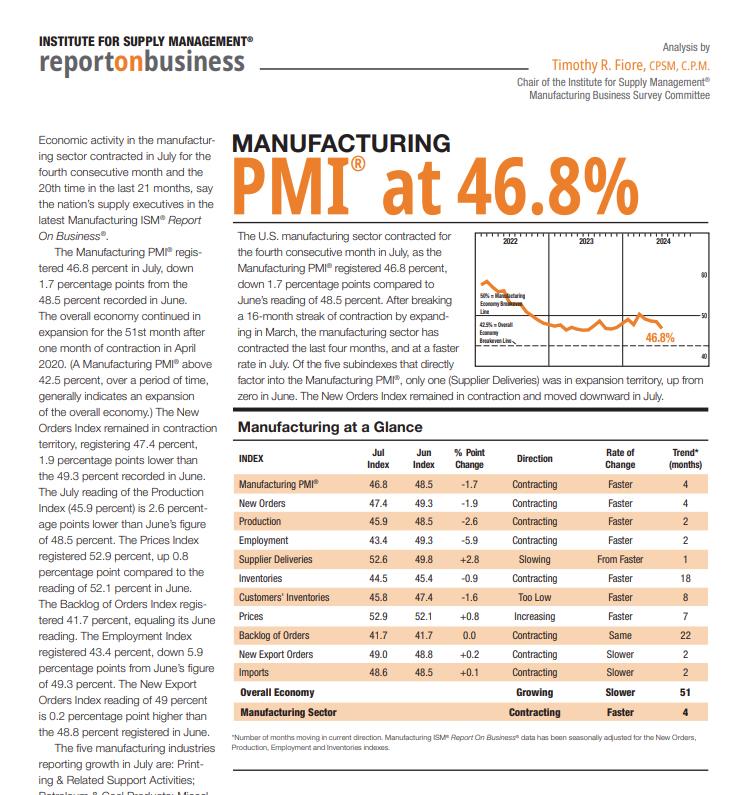

Weak demand, declining output, and cautious employment trends characterize the sector. The Prices Index shows some inflationary pressures, but overall, challenges persist.

Details:

- Manufacturing PMI®: The Manufacturing PMI® registered 46.8 percent in July, down 1.7 percentage points from the 48.5 percent recorded in June. This marks the fourth consecutive month of contraction for the manufacturing sector.

- New Orders Index: The New Orders Index remained in contraction territory, registering 47.4 percent, which is 1.9 percentage points lower than June’s reading of 49.3 percent.

- Production Index: The July reading of the Production Index stands at 45.9 percent, 2.6 percentage points lower than June’s figure of 48.5 percent.

- Prices Index: The Prices Index increased slightly to 52.9 percent, up 0.8 percentage point compared to June’s reading of 52.1 percent.

- Backlog of Orders Index: The Backlog of Orders Index remained at 41.7 percent, equaling its June reading. This index reflects strong contraction in order backlogs.

- Employment Index: The Employment Index registered 43.4 percent, down 5.9 percentage points from June’s figure of 49.3 percent. This indicates a decline in employment within the manufacturing sector.

- Supplier Deliveries Index: Supplier deliveries slowed, registering 52.6 percent, which is 2.8 percentage points higher than the 49.8 percent recorded in June. (Note: Supplier Deliveries is inversed; a reading above 50 percent indicates slower deliveries as the economy improves and customer demand increases.).

- Inventories Index: The Inventories Index stood at 44.5 percent, down 0.9 percentage point compared to June’s reading of 45.4 percent.

- Export and Import Orders: The New Export Orders Index increased slightly to 49 percent, while the Imports Index remained in contraction territory at 48.6 percent.

Sources:

https://finance.yahoo.com/news/manufacturing-pmi-46-8-july-140000448.html

https://www.ismworld.org/globalassets/pub/research-and-surveys/rob/pmi/rob202407pmi.pdf