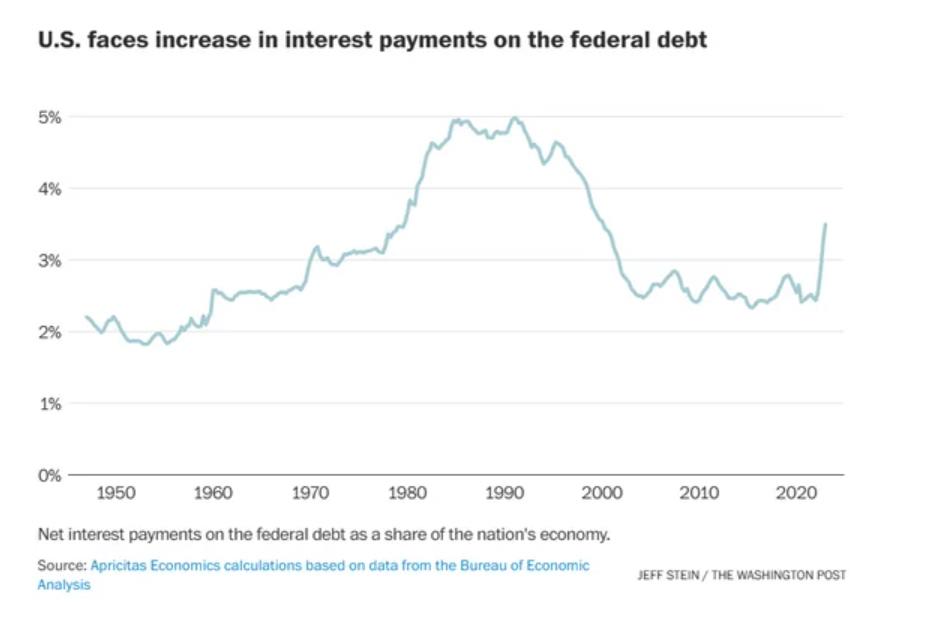

The data in this graph is alarming. It shows that the US government’s interest payments on the federal debt are increasing as a share of the nation’s economy. This is unsustainable and will eventually lead to a fiscal crisis.

The Debt Problem in America Is Only Getting Bigger

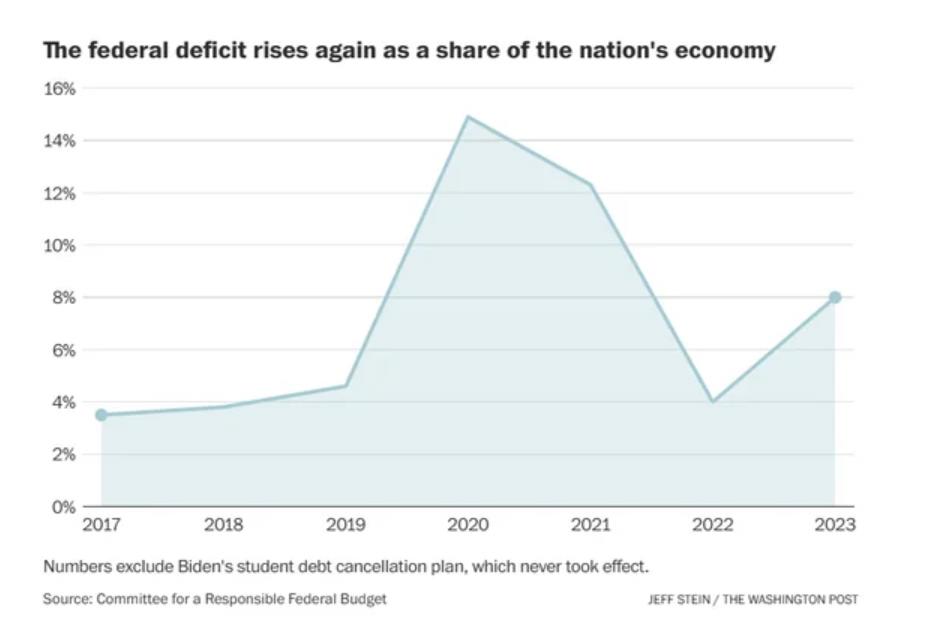

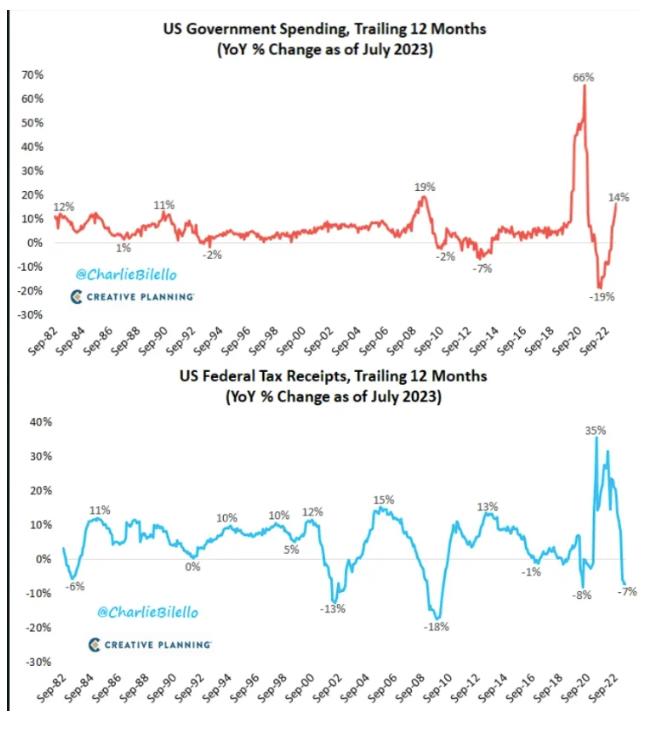

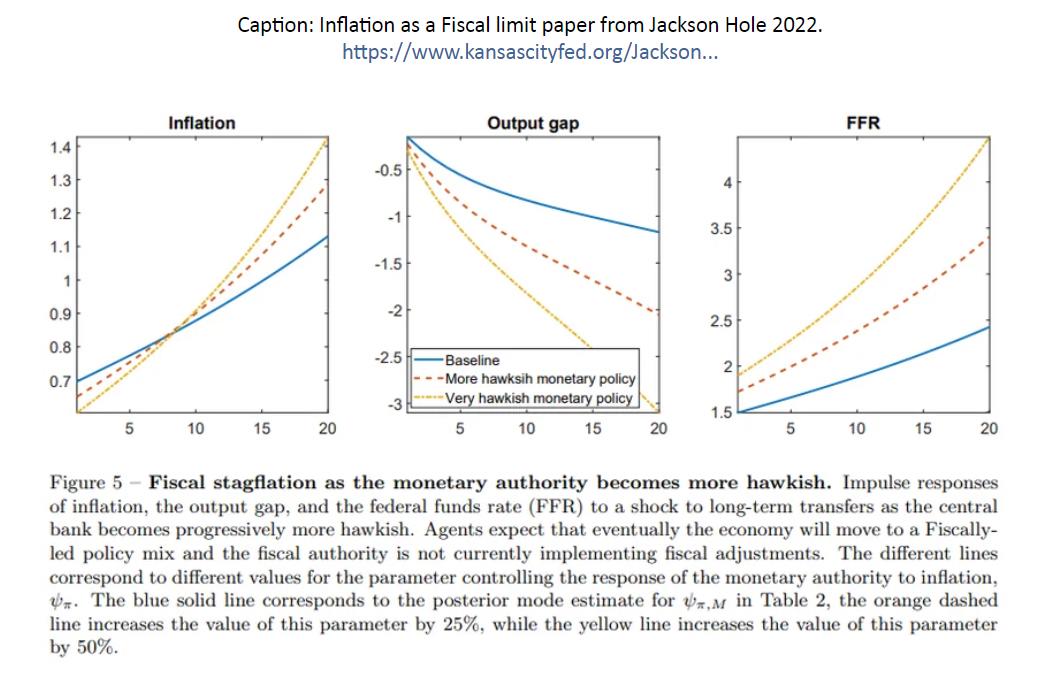

The US is facing a grave debt problem with its gross national debt nearing $33 trillion, equivalent to 122% of its GDP. The speed at which the debt is accumulating is alarming, resulting in soaring interest payments. The Congressional Budget Office (CBO) warns that interest costs could reach around $71 trillion over the next 30 years, consuming 35% of federal revenues by 2053. The CBO projects interest costs to become the largest “program” in the coming decades, a bleak scenario exacerbated by potential higher inflation and interest rate hikes.

118 views