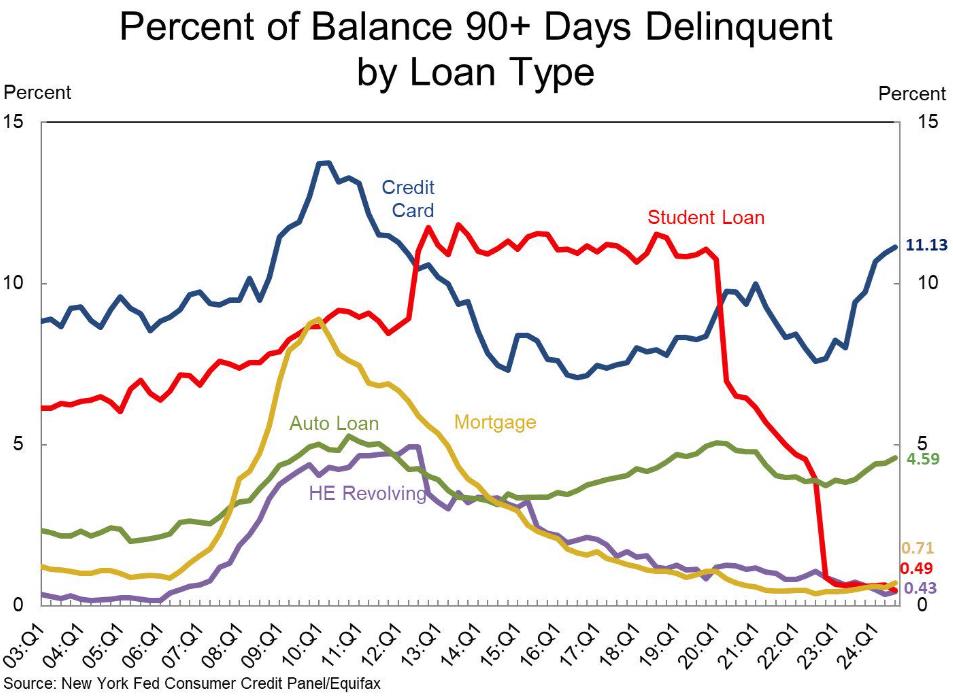

The financial strain on American consumers is unmistakable. Credit applications for mortgages, auto loans, and credit cards are being rejected at their highest rate since 2013. At the same time, over 11% of credit card balances are now 90+ days delinquent—the worst delinquency rate in over a decade.

The Federal Reserve Bank of New York’s Credit Access Survey reports a staggering 21% rejection rate for credit applications in 2024, a jump from 20.1% in 2023 and 18% in 2022. Mortgage refinancing saw a particularly sharp rejection rate of 25.6%, while auto loan rejections hit 11.4%, both record highs since the survey began.

BREAKING 🚨: U.S. Consumers

U.S. credit applications for mortgages and auto loans are being rejected at the highest rate in more than a decade pic.twitter.com/xb6A1i8POb

— Barchart (@Barchart) November 19, 2024

These numbers reflect a tightening credit market, where borrowing has become increasingly challenging for consumers. Delinquency on credit cards, with over 11% of balances overdue by three months or more, underscores the growing financial distress among households. This figure marks the highest since 2012, signaling rising defaults amidst economic uncertainty.

The combination of stricter lending standards and rising debt is a red flag for the broader economy. As rejection rates climb and delinquencies rise, the ripple effects could weigh heavily on consumer spending—the backbone of the U.S. economy.

Sources: