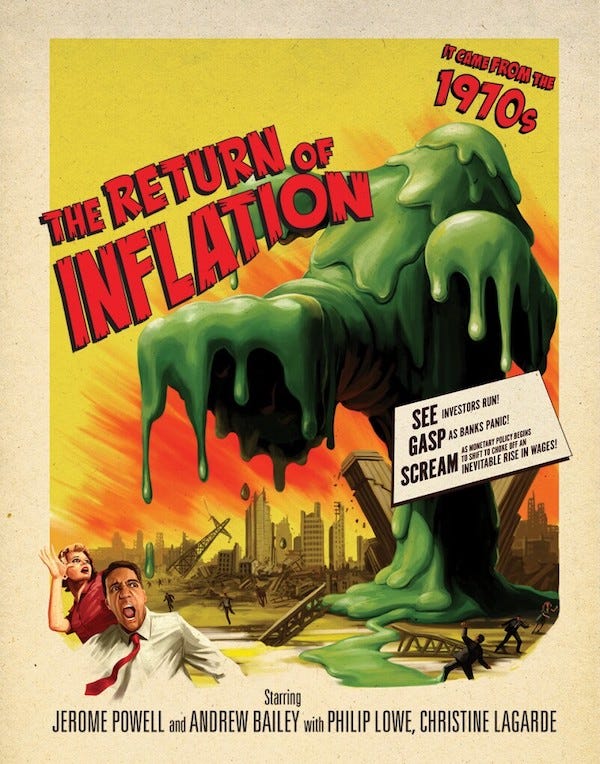

The old inflation monster is returning, and it looks “transitorily” familiar:

The supply chain pressures that caused the ‘transitory’ part of inflation in 2022 may be about to return if the problems in the Red Sea and Indian Ocean continue,” said Larry Lindsey, chief executive of global economic advisory firm the Lindsey Group. “Neither the Fed nor the ECB can do anything about them and will likely ‘look through’ the inflation they cause, potentially leading to rate cuts despite somewhat heightened inflation pressures.

In other words, Lindsey thinks the Fed will be dumb enough to see those as “transitory”causes of inflation, just as it did last time when all of this got started, so it will go to more lax monetary policy again anyway because it will believe this inflation will go away on its own. If the Fed does see it that way, we already know how badly that turns out. It will also mean we’ve learned absolutely nothing. While I’d be a little disinclined to believe the Fed will repeat the exact same stupidity twice in a row, lest it make itself look incredibly dumb, it is never safe to bet against Fed stupidity.

On top of that, this is happening in an already recessionary environment:

In the meantime, about 20% of vessel capacity isn’t being used due to a massive drop in manufacturing orders, according to industry experts. Instead, ocean carriers continue to cut their sailings while tight capacity and longer travel times are fueling rate increases….

“Given the sudden upward movement of ocean freight pricing, we should expect to see these higher costs trickle down the supply chain and impact consumers as we move through the first quarter,” said Alan Baer, CEO of shipping firm OL-USA. Companies, reflecting lessons they learned during the supply chain chaos of 2021-22, will adjust prices sooner rather than later, he added….

This is a big deal as it’s been mostly the fall in goods prices that have eased the inflation strain,” Peter Boockvar, investment chief at Bleakly Financial Group, told CNBC. “And while the battles going on in the Red Sea could end at any moment if the war in Gaza ends, it’s a reminder to the Fed that they can’t get complacent with their inflation fight if they don’t want to repeat the 1970s.”

It’s reminiscent of what freight companies experienced during Covid’s earlier days.

Now, of course, this could all go away quickly if the Houthis are rapidly defeated. Maybe they’ll be defeated as quickly and easily as Al Qaeda was in Afghanistan. Ten years, and we’ll be almost done with this.

For now, however, we are seeing the Red Sea deliver exactly the problems I described here: “They say “the end of inflation” is on the horizon, but I see red as far as the eye can see.” and here: “The Market Runs Red, So Does the Sea, So Do Bank Repo Loans!” From my point of view, therefore, this is going exactly as expected. Read those articles, and you’ll see how I laid out why this would go exactly like those Covid supply-line problems that delivered this inflation to us when they came on top of the Fed’s money printing. Now the Fed is sucking money out of the financial system, but it still has a long way to go to get to where we were with money supply before Covid money printing.

The article goes on to describe multiple factors in shipping that are as blocked up now as they were during the Covid lockdowns. Of course, the problems are made worse by the restrictions now in place through the Panama Canal due to drought, too, which is more in demand due to port blockages related to the Red Sea that are causing some Asian shippers to aim westward for the US East Coast via Panama, rather than eastward through the Suez Canal:

“Coming out of the holiday break we are seeing significant volumes being routed from Asia to the U.S. West Coast and via the Panama Canal to the U.S. East Coast to avoid the Suez Canal.”

If drought continues, the Panama Canal could tighten up even more.

As a result of the shutdown of the Suez Canal, oil prices rose more than 3% today, and the drop in oil prices was the biggest thing that was bringing overall CPI down. The Fed, of course, ignores oil.

Other news came out about job openings lining up to match better with available workers, but claimed that is likely to put upward pressure on inflation:

Today’s report is good news for American workers and the economy, but it also suggests to me that the Fed is unlikely to cut rates as aggressively in 2024, as markets currently indicate, given the risk of reigniting inflationary pressures.

Even bond traders and delirious stock investors rethought their dreamy-eyed positions on Fed rate cuts today. They learned today from Fed minutes that the Fed was not quite as dovish as they had thought. Go figure! Yields dropped and stocks plunged.

The ISM manufacturing report remains in recessionary territory, so this continues to look like a stagflationary recession. Meanwhile the US debt that seems be packing on almost a trillion dollars per quarter now, just cruised past another trillion-dollar mile marker, rising above $34-Trillion. Nothing to worry about there folks. Congress has this under control.