via Zerohedge:

Total money-market fund assets plunged by $112BN in the last week as Tax-Day demands took the total assets below $6 Trillion for the first time sine January (to $5.97 Trillion)…

Source: Bloomberg

Corporate taxes collected from April 11 through April 17 totaled $100.7 billion, Treasury data show.

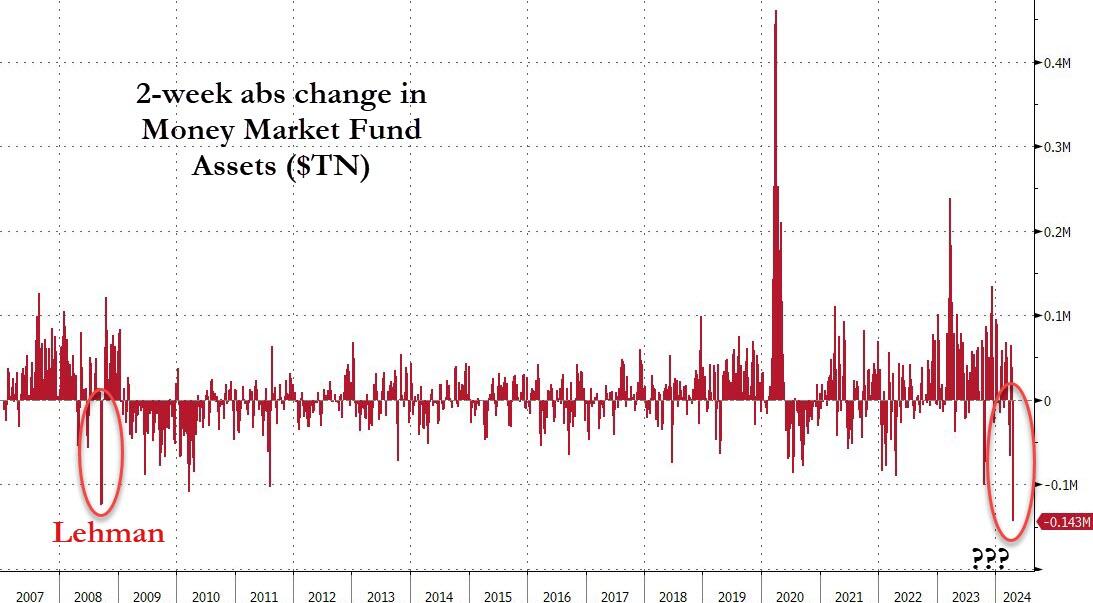

While Tax-Day’s impact matters obviously, we note that this is the largest weekly drop in money-market fund assets since Lehman (Sept 2008) and the biggest two-week drop (-$143BN) on record…

Source: Bloomberg

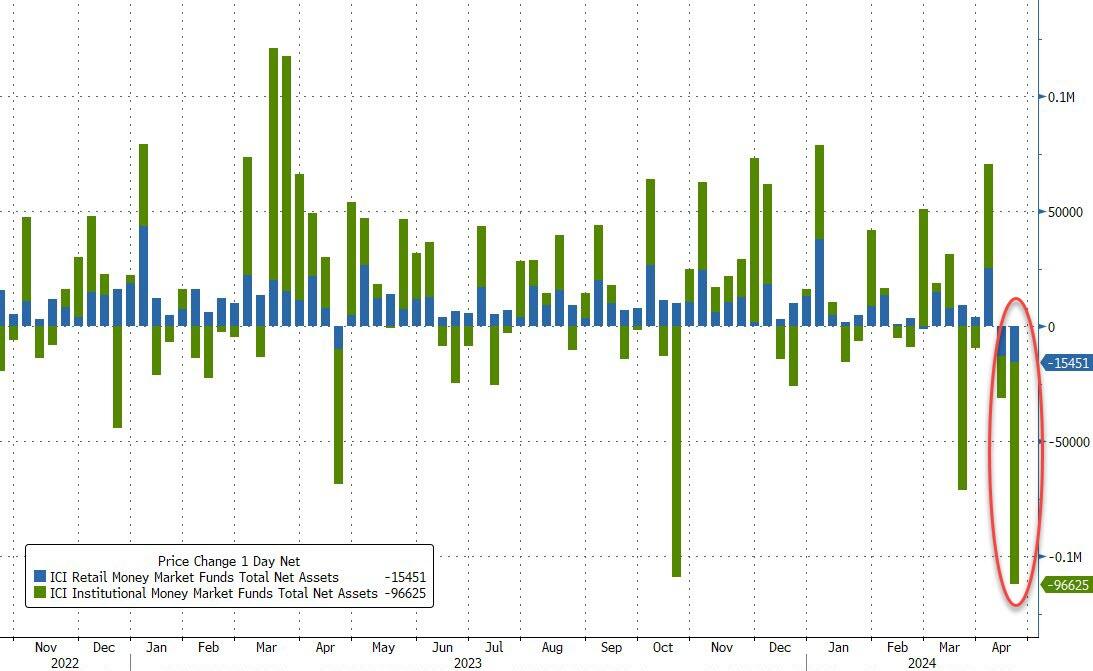

Much of the decline in money-market fund assets was led by institutional outflows that totaled $96.6BN in the week ended April 17 – the largest drawdown since an extended tax-filing deadline in mid-October. Retail investors pulled about $15.5 billion out of money-market funds../.

Source: Bloomberg

In a breakdown for the week to April 17, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets fall to $4.8 trillion, a $99 billion decline.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets fall to $1.01 trillion, a $12 billion decline.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold – and this week has seen rate-cut expectations tumble further…

Source: Bloomberg

The Fed’s balance sheet shrank to its smallest since February 2021…

Source: Bloomberg