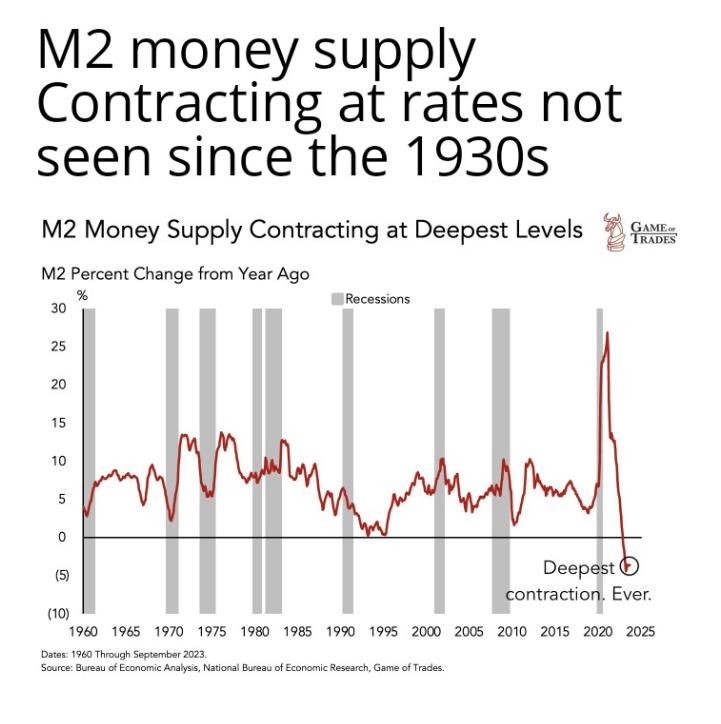

Contraction of the money supply leads to an imminent recession. That’s what happened in the Great Depression. The gov’t f**ked around with required bank deposit percentages for normal accounts and time deposits which caused banks to pull back. Since they couldn’t create money via loans, that sparked the recession. The speculation in agriculture and rural economies laid the foundation for this which together with the contracting money supply caused the crash. See Murray Rothbard for more details. He has some excellent books.

M2 money supply Contracting at rates not seen since the 1930s

h/t Apprehensive_Ask_364

469 views