Steven and Katherine Wolf missed out on the ultra-low mortgage rates of the pandemic. By the time the couple secured solid jobs and could buy a home, borrowing costs more than doubled.

Rather than wait, the former renters jumped into home ownership in fall 2022. They also stretched, buying a Bakersfield home that carried an uncomfortable monthly payment.

Steven Wolf figured the pain would be fleeting. Within a year rates would drop enough to allow them to refinance and put hundreds of dollars back into their pockets.

That hasn’t happened and isn’t expected to soon. In fact, rates are higher.

“We did this with the expectation that we would only have to weather this high payment for a chunk of time,” the 37-year old English teacher said. “Now that chunk of time is looking like it might actually be permanent.”

Across the country, many buyers employed similar strategies since rates surged in 2022 — at times encouraged by real estate agents and mortgage brokers who earn a commission on each deal. The tactic could still work, but as interest rates stay higher for longer, some Americans express varying degrees of regret as their finances buckle.

A woman in Twinsburg, Ohio, said she’s taken a second job. A man in Oregon said putting money away for retirement is a “distant thought.”

Some said they’re now selling their home or will need to soon. Chelsea Bolinger purchased a house in Highland Ranch, Colo. The 35-year-old tech worker called the experience “horrible.”

“I only bought it because the loan company really pushed that interest rates were going to go down,” Bolinger said.

In Wolf’s case, he said his family’s monthly housing costs jumped nearly $1,500 when they ditched their second-floor apartment and bought a Bakersfield house for $421,000, in part because he and his wife wanted a yard for their two children.

Unable to knock down his monthly payment through refinancing, the family is making little progress paying off other debts and Wolf is working an extra period.

His wife, a speech language pathologist, has picked up weekend shifts she wouldn’t have if rates had dropped.

“That would have been more Saturdays together with the kids,” Wolf said.

In theory, the strategy Wolf and others employed is supposed to work like this.

Buy now — when rates are high and demand low — and you’ll easier snag a home than waiting until rates drop and reignite extreme bidding wars.

By acting now, a home’s purchase price will be lower. The monthly payment will be high, but that will go down once rates decline and you refinance.

As some say: Marry the house. Date the rate.

Personal finance, of course, is complicated.

When refinancing, you pay loan fees and other closing costs, which can surpass several thousands of dollars. Consumers must weigh those upfront costs against any savings on the monthly payment.

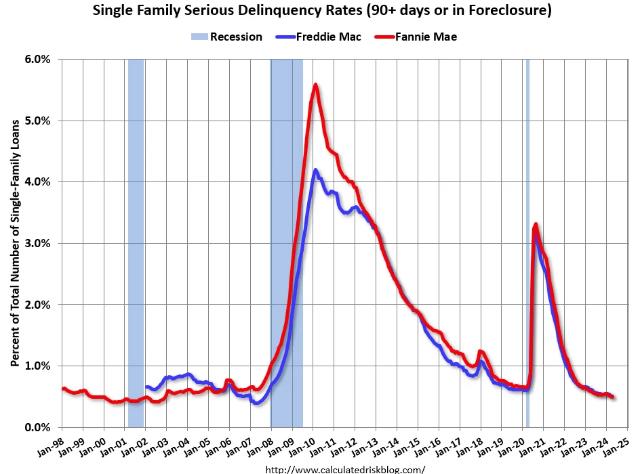

Single Family Serious Delinquency Rate Decreased Again. Now below even pre-pandemic lows.

The data makes sense! Because homeowners who are on the edge of delinquency can sell their homes quickly, and for higher prices than what they owe. The delinquency rate will always be low in a strong seller’s market.

h/t Moonlightwolf2020

575 views