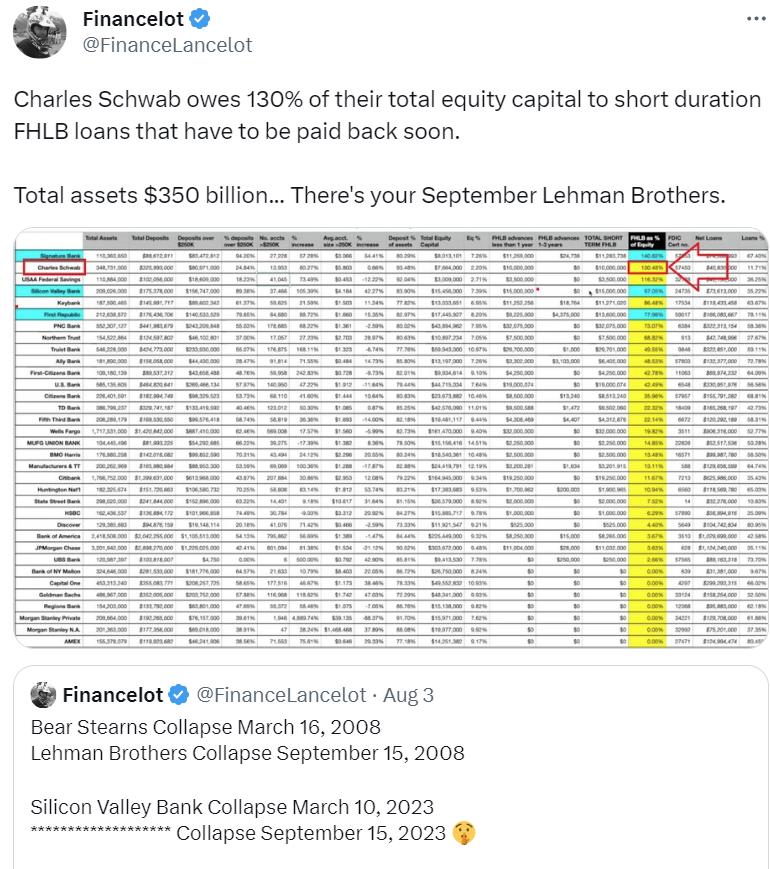

“Charles Schwab owes 130% of their total equity capital to short duration FHLB loans that have to be paid back soon.

Total assets $350 billion… There’s your September Lehman Brothers.”

Charles Schwab 📉

Probably nothing…pic.twitter.com/Bgn5i8uUHC https://t.co/S94qKp1SJV

— Financelot (@FinanceLancelot) August 21, 2023

BREAKING: Charles Schwab to cut jobs, close and downsize some corporate offices, with expected costs of $400m-$500m…

Perfect timing 😂 https://t.co/S94qKp1SJV

— Financelot (@FinanceLancelot) August 21, 2023

Goldman Sachs mulls sale of investment advisory unit $GS

Nothing to see here just Citi and Goldman dumping their biz units

— Don Johnson (@DonMiami3) August 21, 2023

You will never find a clearer example of a banking crisis unfolding than FHLB advances skyrocketing above $1 trillion dollars in Q1 2023.

This represents $1 trillion in panic borrowing by the banks & we have no idea what's happening right now in Q3. https://t.co/2RhyVZh9fE pic.twitter.com/khNOgPLpry

— Financelot (@FinanceLancelot) August 21, 2023

JUST IN: Charles Schwab to cut jobs and close and downsize some corporate offices, with expected costs of $400m-$500m.

More announcements like this to come.

— Genevieve Roch-Decter, CFA (@GRDecter) August 21, 2023