The maniacs got their heads chopped off this week.

Ah for yesteryear when the Fed and Treasury were both certain inflation was merely “transitory.” Today, what became more transitory was the fantasy that the Fed is about to pivot on high interest because its fight with inflation is nearly over.

One reason the Fed pivot fantasy matters so much is because markets that rise on pure fantasy, eventually fall on reality. Reality always wins. It’s stronger. Today we got to see reality pound its message into the fogged brains of pivot fanatics. The jobs data came in hot with wages rising and unemployment going nowhere (at 3.7%), giving the Fed no latitude from its second mandate (maintaining strong jobs) to back off on its first mandate (stabilizing the value of the dollar).

While I won’t pretend for a minute that the jobs report wasn’t a pile of lies from the Bureau of Lying Statistics, it is the report the Fed will be going by as it sets “data-based” policy, and the data therein cut the Fed no slack. The report is, or course, lies because the incumbent president wants the government to push the employment numbers as high and hard as it can get away with to help secure his election.

We know that because the numbers always come out way hotter than the truth and then get revised down next month when no one is looking at them. Thus, today’s hotter-than-expected numbers will get revised down next month just like last month’s low jobs number got revised even lower today. Just like every reported number last year got revised down once no on was paying any attention to it because it had become old news. That’s just the way the BLS works to earn the monicker I’ve given it.

Of course, whether employment really jumped up or crashed down depends on which part of the report you pay attention to, as the more-than-a-year-long disconnect between the “Establishment Survey” and the “Household Survey” grew wider, with the household survey showing a major drop in employment while the “Establishment Survey” kept climbing apace with its past trend. (Guess which one is harder for the government to manipulate):

Other baloney in the report becomes apparent when you open the hood and look inside. The total size of the US labor force plunged in size (down 845,000 due to historic data revisions).

Without going too deep in the weeds on this report, the critical part that guides the Fed didn’t do what the Fed wants to see. The critical number in the report is that wages are still on the rise (up 0.4% v the 0.3% expected). That is the number the Fed most wants to tamp down in order to curb inflation. It didn’t cooperate this December.

But the biggest shocker, and one you won’t hear about anywhere else, is that the number of full-time jobs actually plunged by 1.5 million in December to the lowest since Feb 2023, while part-time jobs exploded higher by 762K to the highest on record. And there was another record: in the number of multiple jobholders.

So, yeah, it looks like as many people are employed. It’s just that, on the balance, they are employed at worse jobs. That’s not really a report that shows the economy is popping along nicely; but it is one that gives the Fed none of what it wants to see in terms of stopping wage inflation. As I’ve long been saying, the Fed’s broken labor gauge is going to hold the Fed to tightening deep into a recession. So, tighten on we go.

The press is covering it as follows:

The U.S. labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported Friday.

As you can see, nothing here to show the kind of economic destruction the Fed wants to see in order to know it is making progress bringing down the pressures of inflation that it created on your behalf so that you can suffer the inflation and then suffer the correction:

And with that kind of coverage, the stock market completed a strong down strike for the first week of the year, even though the major indices ended a trickle higher for the day. Bond yields broke strongly above 4% on the 10YR and held, unwinding some of the fantasy pivot trade of the last two months.

At this rate, the Fed is not scoring a soft landing. It’s scoring no landing. The Fed is still flying around looking for the airport!

So, Zero Hedge admitted,

Stocks, Bonds, & Bullion Dump As Rate-Cut Hopes Plunge Post-Payrolls

A hotter than expected payrolls print and re-acceleration in wage growth are not the recipe for a dovish Fed that so many had banked on in the last two months of 2023.

And so, the rate-cut hype is eviscerated.

And there went the pivot fantasy.

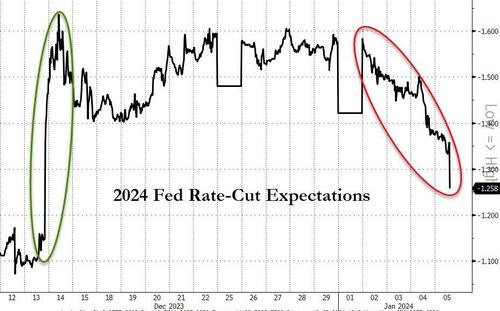

2024 rate-cut odds fell all week long to end up ALMOST back where they were before Powell’s dopey-eyed December press conference lit the fanatics on fire:

That’s called adjusting back down to reality.

The EU’s rate-cut odds also tumbled as EU inflation re-accelerated in December.

Seeing red

Off the jobs scene, the pressures for rising inflation also continued to build where I have expected we would see that happening. Part of why I called 2024 “The Year of Chaos,” as if everything since Covid hasn’t been chaos, is that the new war that has begun is going to be less contained than Putin’s War. There are a lot of angry people who have hated Israel all their lives and who hate the US for all its wars as well as its support of Israel, and they are all going to pile into this conflict as opportunity seekers. This they see as they’re one big shot.

It is no surprise, then, to read that the Houthis completely ignored the warning of the US and its many allies and launched bolder forms of attack. As a result, Maersk the Danish shipping giant, announced a longterm revisions of all of its Suez Canal routes to go around the southern tip if African “for the foreseeable future.” To keep from jostling customers along on anticipated schedules, they won’t be attempting any runs through the Suez Canal anymore until they are certain this mess is fully cleaned up. They decided it is better their customers just KNOW the schedule is going to be slow and predictable, rather than keep bumping around their hopes with attempted but failed runs through the canal.

ISIS just jumped in by attacking Iran this week—a move the US would be glad to see, except that there is no way to know it will stay contained to hurting Iran. The whole thing is growing more complicated. This has the makings of becoming a catch-all war for the Middle East. Everyone wants a piece of the action.

As one article states,

ISIS plotting to exploit Middle East chaos to make blood-soaked comeback after killing 100 in Iran bomb attack

ISIS terrorists could be looking to use concerns over a possible escalation of war to “carve out space for themselves” to operate again.

I guess they were feeling a little sidelined in the action lately, so this is new opportunity for them.

Welcome to 2024. Let the wild rumpus begin!