https://finance.yahoo.com/quote/%5EVIX/

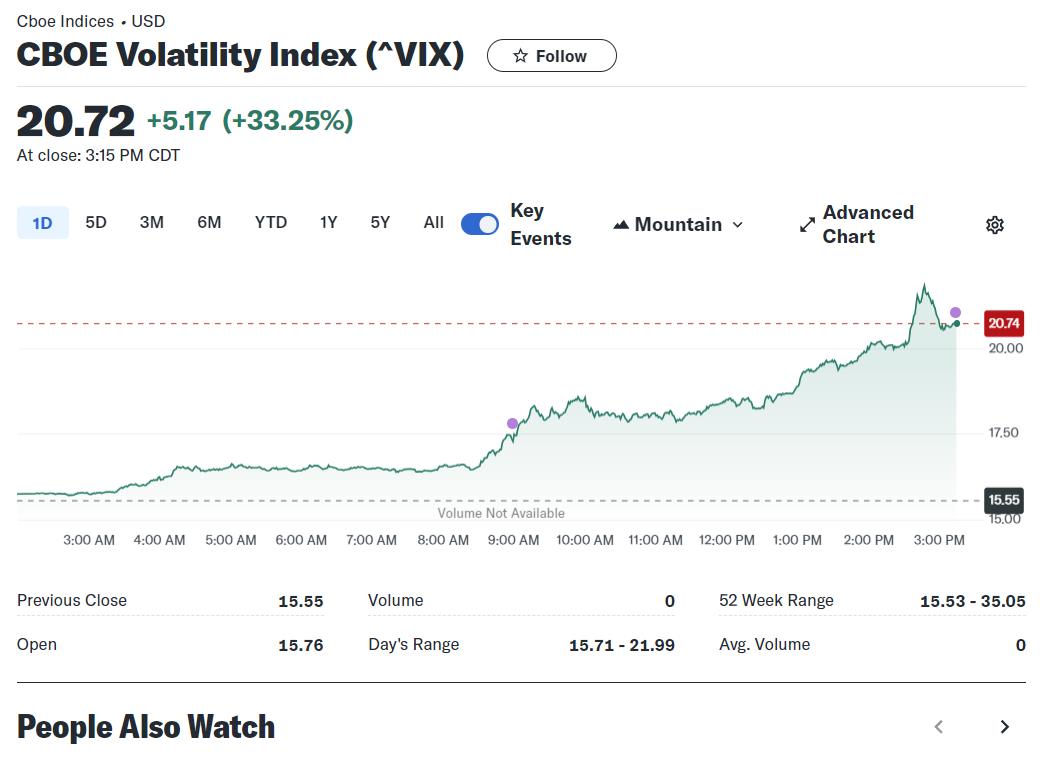

A few weeks ago, VIX briefly soared 400% following a 22% overnight drop in the Bank of Japan’s stock price. Adding to the unease, the M2 yield inverted last week, signaling potential trouble ahead. These developments hint at a looming market crash.

For those who don’t know, that’s the Volatility Index. The higher it goes the worse it gets. If it gets too bad investors start fleeing the market.

The VIX, or Volatility Index, is a measure of market expectations for volatility in the S&P 500 Index over the next 30 days. Often referred to as the “fear gauge,” the VIX reflects investor sentiment, particularly during periods of market uncertainty or turbulence. When the VIX rises, it generally indicates that traders expect significant price swings in the stock market, usually due to heightened anxiety about future events. Conversely, a low VIX suggests that the market expects stable conditions with minimal fluctuations.

AC