Macro was ugly – really ugly – today: Personal Consumption ugly (Q1 downgraded on 3rd look), continuing jobless claims ugly (highest since Nov 2021), core capital goods new orders and shipments ugly (not a great signals for Q2 GDP), pending home sales ugly (puke to record lows SAAR), and finally, Kansas City Fed manufacturing ugly (21st month in a row without expansion)…

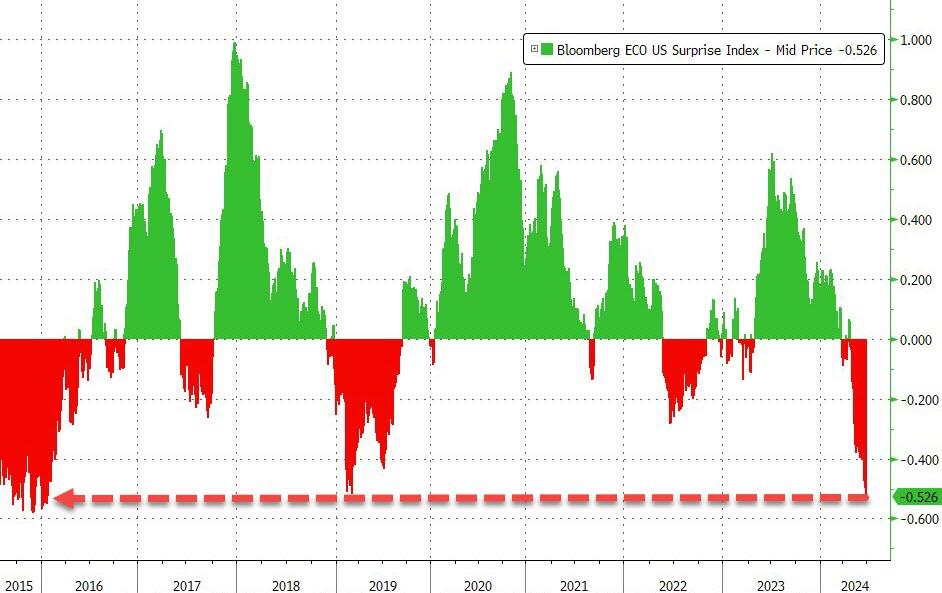

This smashed the US Macro Surprise Index to its weakest since January 2016 (and we have May’s PCE tomorrow)…

Source: Bloomberg

Micro was not pretty: Micron spooked the AI trade (NVDA lower too)…

READ MORE:

https://www.zerohedge.com/markets/bonds-bullion-bitcoin-big-tech-ex-nvda-bid-despite-macro-meltdown