Since early 2023, numerous pundits and gurus have been calling for a recession. And despite numerous indicators flashing that one is coming… the recession has yet to arrive.

Why?

This:

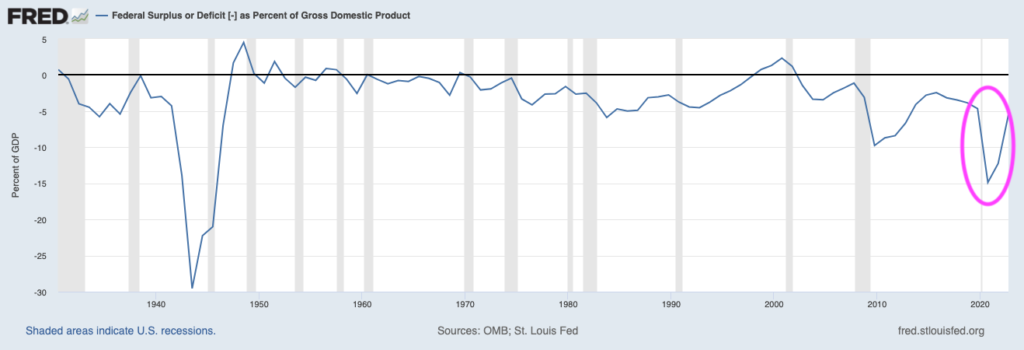

The U.S. is running a GARGANTUAN deficit equal to 5.5% of GDP.

To put this into perspective, it’s larger than the deficit the U.S. ran during EVERY recession in the last 100 years except for the Great Financial Crisis and when the economy was shutdown in 2020.

Put simply, the U.S. is running the kind of spending that we usually see during periods in which the private sector is in a total free-fall… at a time when the private sector is weak, but not yet collapsing.

This has managed to keep the economy positive. But it’s a short-term fix.

Ultimately, the U.S. cannot stay out of recession forever as no amount of government spending can replace the economic impact of the private sector (we learned this during the shutdowns when the Fed and Uncle Sam spent $8 trillion in 12 months but the economy still collapsed).

Moreover… this situation presents us with a MAJOR problem down the road: if the U.S. is already spending at a pace usually associated with recessions while the economy is still growing, what is going to happen when the economy finally does roll over into recession? How much spending will it be doing then? 8% of GDOP? 10% of GDP? More?

And bear in mind, this spending is being funded by debt (it is a deficit after all). What happens to the bond market if the U.S. cranks up its spending to 8% or more of GDP when the actual recession hits?

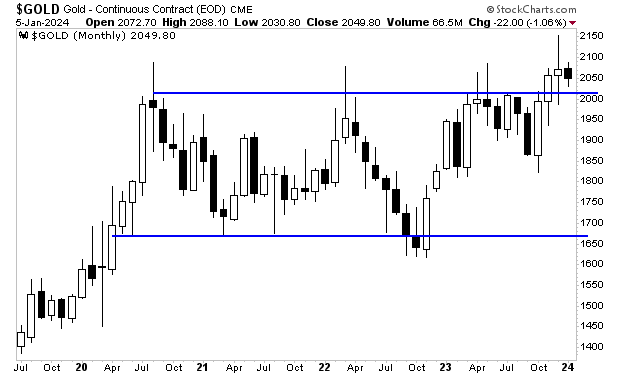

Gold has started to figure it out. Other assets will figure it out soon.