by dkrich

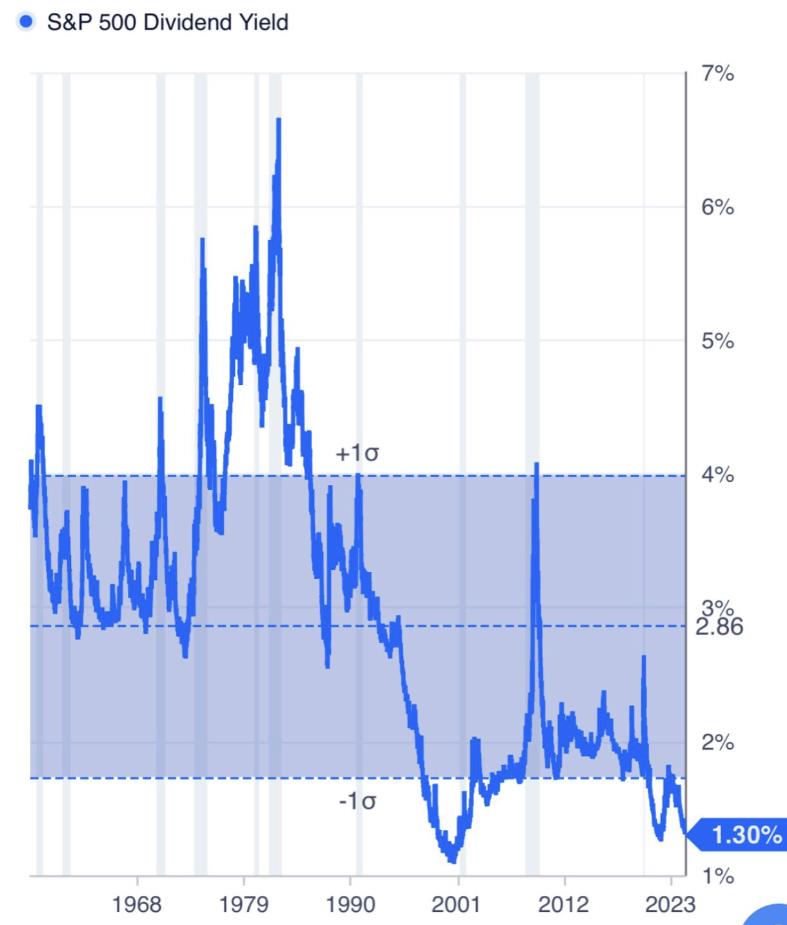

People will explain this away in various ways but the reality is that throughout history when the yield on the S&P 500 gets to relative extreme lows, forward returns are very poor. The bottom line is that the market is very expensive right now.

The yield can (and probably will) go a bit lower but there are professional analysts like Gene Munster and Dan Ives calling this a “1995 moment” and I’d like to say those analysts are highly regarded.

Those times the yield was low before the crash as the market was at ATHs. Same as before the 87 crash and 73-4 bear market. It’s a very reliable indicator of markets relative valuation. It doesn’t necessarily mean there will be an immediate bear market but it does mean the risk reward for equities is very low and risks are elevated