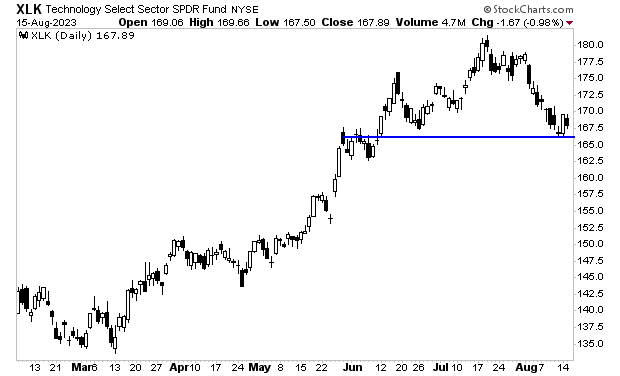

Tech looks due for a bounce.

The Tech ETF (XLK) is at major support at $166. Even if this is not THE low, it’s a decent spot for a bounce as XLK rallies to $175 or so as it carves out a potential right shoulder in a Head and Shoulders pattern.

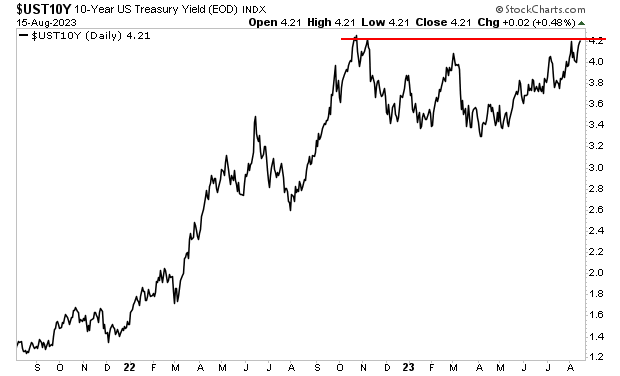

Moreover, the yield on the 10-Year U.S. Treasury is at major resistance.

Tech is a long-duration play, meaning it is heavily affected by the yield on longer-term Treasuries. The odds of the yield on the 10-Year U.S. Treasury breaking above its current levels right here and now are not high. This suggests the next move for this yield would be down, which would alleviate some of the pressure on tech stocks.

Given that the S&P 500 is heavily weighted towards tech (the sector accounts for 28% of the index’s weight) all of the above items suggest a bounce in tech and the broader market here. Again, this is just a short-term idea.