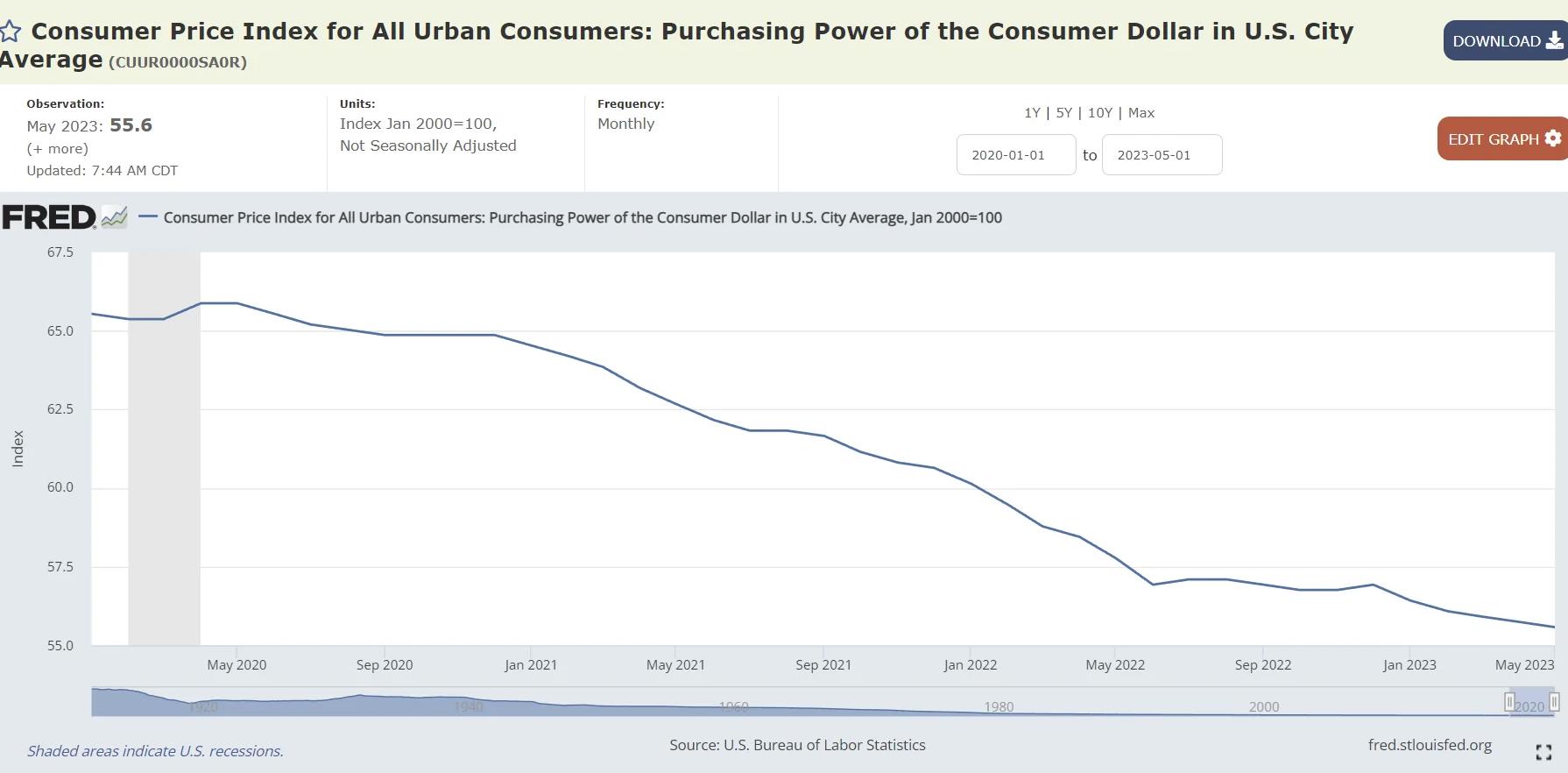

Source: https://fred.stlouisfed.org/series/CUUR0000SA0R

Let’s zoom in on this since 2020:

CPI tracks the loss of the purchasing power of your dollars, and thereby the purchasing power of your hard earned labor:

- May 2022 purchasing power: 57.8 (down -3.80% in purchasing power in the last year!)

- May 2021 purchasing power: 62.7 (down -11.32%% in purchasing power in two years!)

- May 2020 purchasing power: 65.9 (down -15.63% in purchasing power in three years!)

TLDRS:

- The Consumer Price Index (CPI) is a measure that helps us understand how the average price of a basket of goods and services has changed over time.

- May 2023 of $100 in January 2000 purchasing power: 55.6

- May 2022 of $100 in January 2000 purchasing power: 57.8 (down -3.80% in purchasing power in the last year!)

- May 2021 of $100 in January 2000 purchasing power: 62.7 (down -11.32%% in purchasing power in two years!)

- May 2020 of $100 in January 2000 purchasing power: 65.9 (down -15.63% in purchasing power in three years!)

- In other words, it’s an indicator of inflation, or the increase in prices over time.

- When I say that the purchasing power of your dollars has decreased, I’m talking about how much less you can buy with the same amount of money due to rising prices.

- The purchasing power of your hard-earned labor is eroded by inflation!

- For example, imagine you have $100 today, and you decide to save this money in cash instead of investing it.

- Fast forward a year, and the CPI indicates that there’s been a 6.9%% increase in the average price of goods and services.

- This means that the things you could buy with your $100 last year would now cost $106.9.

- The value of your dollars has decreased, and your purchasing power has dropped.

- To avoid this loss in purchasing power, many investors choose to put their money into assets that are expected to appreciate over time.

- These investments aim to counteract the effects of inflation and help maintain or increase the purchasing power of your money.

- GameStop’s leadership team is buying its stock–Ryan Cohen bought 443,842 shares, Larry Cheng 5,000 shares, and Attal Alin bought 10,000 shares–that we know of, so far…

Remember: