-DXY breaking out towards 107

-10 yield is nibbling at 5%

-Futures red and accelerating lower as I type this.

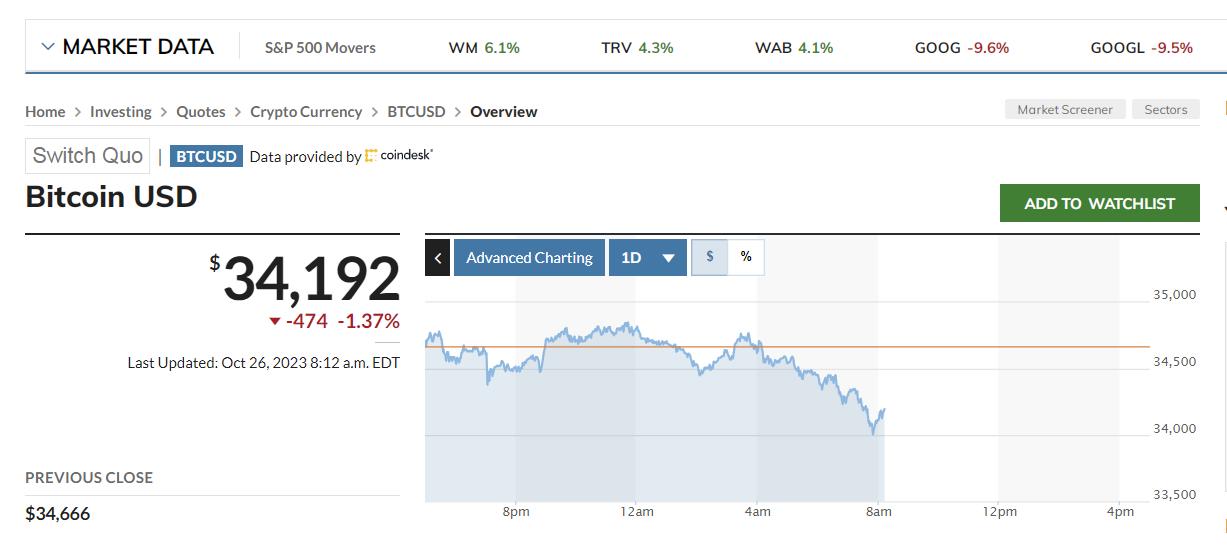

-Cypto suflee is crushing down.

Dollar Index DXY pic.twitter.com/SdGxqSuhcX

— The_Chartist 📈 (@_chartitude) October 26, 2023

Despite the ongoing debates, the current economic cycle has unfolded much more like the 1970s period than the World War II era up to this point.

To put this into perspective:

During the 1940s, the 10-year yield never surpassed 2.5%.

Today, we are essentially double that… pic.twitter.com/L6a74fO8iT

— Otavio (Tavi) Costa (@TaviCosta) October 25, 2023

Historic decoupling! pic.twitter.com/yuJJ3K90qU

— The Macro Guy (@SagarSinghSetia) October 26, 2023

Congrats bears 🐻.. for today$SPY $QQQ $IWM $DIA $VIX#Futures pic.twitter.com/gTK0oGx30w

— BlueMoonTrades (BMT) (@BlueMoonTrades) October 26, 2023

Carnage in small caps and Tbonds is coming for big caps next. https://t.co/gyl2hVfYWL

— Porter Stansberry (@porterstansb) October 26, 2023

JUST IN: The S&P 500 has officially erased $4 trillion in market value since its July 27th high.

In 3 months, the S&P 500 has dropped 430 points and stands less than 1% away from correction territory.

The exact top in the S&P 500 came on the same day that Fed removed a… pic.twitter.com/op7aYBExMS

— The Kobeissi Letter (@KobeissiLetter) October 26, 2023

#TheGreatDefault#LiquidityCrisis https://t.co/lobfHPNdoy

— DOQ (@doqholliday) October 25, 2023

Chinese equity markets fell to the lowest level since before the pandemic, as Beijing’s latest efforts to prop up the country’s stock market failed to stem a sell-off driven by slowing economic growth, a liquidity crisis in the property sector and geopolitical tensions — FT pic.twitter.com/SKGcE8a4c6

— Whole Mars Catalog (@WholeMarsBlog) October 23, 2023

#recession … #GFC2 US #CRE edition#commercialrealestate #CMBS #Blackstone $BX 📉 🥶 https://t.co/GcwbGYBZqz pic.twitter.com/nuaBmJJRJZ

— Invariant Perspective (@InvariantPersp1) October 26, 2023

Gold is your liquidity gauge indicator, risk on/off asset..always rips previous to bottoms.. 2009 low, 2016 crisis, 2020 covid lows, SVB crisis this year.. now it is ripping. doesn't necessary have to perfectly time the bottom but you know liquidity is there.

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) October 26, 2023

After Massive Bond Losses World’s Oldest Central Bank Seeking $7 Billion Bailout

Rising interest rates have led to substantial losses on global fixed income securities, totaling over $100 trillion. The Federal Reserve has incurred significant losses, with operating losses surpassing $111 billion. Despite these losses, the Fed remains financially unscathed due to its ability to print the world’s reserve currency. Other central banks aren’t as fortunate. The Bank of England required a bailout after suffering from the Quantitative Easing program. The Riksbank, Sweden’s central bank, revealed a loss of SEK 80 billion in 2022 and requires a capital injection to restore its equity. Other central banks may soon follow suit, facing financial challenges from rising interest rates.