From Peter Reagan at Birch Gold Group

Summary

- U.S. banks are in worse financial shape today than in March

- Fractional reserve banking is inherently unstable

- Data show it’s unlikely we’ve seen the last bank collapse of 2023

On top of the government robbing us blind to cover interest payments on its debt, the U.S. could be on the verge of yet another banking crisis.

That’s a prediction based on data. Let’s take a look at the numbers…

Earlier this year, weren’t surviving banks supposed to be safe?

Back in March of this year, the first banking crisis resulted in multiple relatively smaller bank failures, which resulted in billions of dollars in bank runs.

Naturally, that caused bank customers to start putting their money into “safer” big banks. That also meant the corporate media had to report on it:

Nervous bank customers have rushed to the safety of big banks in the wake of a pair of high-profile bank failures that have shaken confidence in the system.

As you’ll see in just a moment, the “safety” that the corporate media latched onto was rather illusory…

Back in March, customers pulled their money out of banks like SVB over fears that those “smaller” banks would collapse. As you just read, those banks did collapse.

Fast forward to now, and it appears the trend is beginning to reverse itself. According to one report, big banks like JP Morgan, Citigroup, and Wells Fargo are declining:

Breaking down the numbers, JPMorgan Chase’s deposits shrunk by $31 billion, while Wells Fargo’s deposits decreased by $7.1 billion. Citigroup faced the steepest decline, with a drop of $46.4 billion. Despite these challenges, JPMorgan Chase reported a net income of $13.2 billion for the quarter.

On a broader scale, data from the Federal Reserve Bank of St. Louis indicates a trend of declining deposits across all commercial banks, from a high of $18.203 trillion to currently $17.365 trillion.

So it appears like customers are not putting their money in the big banks, either. Could that be because the safety of those banks is in jeopardy too?

Here’s what FDIC Chairman Martin Gruenberg had to say in a recent speech, which might provide a clue about the safety of the bigger banks:

…the banking industry continues to face significant downside risks from the effects of inflation, rising market interest rates, and geopolitical uncertainty. These risks could cause credit quality and profitability to weaken, potentially resulting in a further tightening of loan underwriting, slower loan growth, higher provision expenses, and liquidity constraints… These issues, together with funding and earnings pressures, will continue to be matters of supervisory attention by the FDIC.

In other words, there are reasons to be concerned – but don’t worry! The “supervisory attention” of the FDIC is on the case!

The dire picture becomes a lot clearer once you see how much these banks have suffered:

via FDIC

That’s right – the banking sector is more undercapitalized right now than back in March, when we saw the first round of bank failures.

Currently, the FDIC admits to only 53 “problem banks” with some $50 billion in assets collectively. For banks, “assets” are not the same as deposits (your checking and savings accounts are a liability to banks, because they owe you money.)

It’s impossible to know exactly how many of our dollars are on deposit in these “problem banks,” though… Banks are required to own some liquid assets, called “reserves,” as a sort of collateral for customer deposits. That just makes sense, right?

The actual amount of collateral banks are required to maintain is more troubling. Before I tell you, take a wild guess – if you and every other customer of your bank tried to withdraw your cash at the same time, how much could the bank come up with?

Quick, grab a pen and jot down your answer.

…

…

…

Time’s up.

The answer? 8%. (Actually that’s a gross simplification, because bank reserve requirements will make your head spin – Tier 1, Tier 2, leverage ratios, minimum capital buffers… The 8% figure, though, is roughly correct.)

That’s why we call it “fractional reserve banking,” by the way… For every dollar in your checking account, the bank makes $12.50 in loans.

Working from that 8% number, those 53 “problem banks” have $625 billion in customer money on deposit.

While that’s worrisome, that’s just the way the system is supposed to work. Remember, the FDIC insures most bank deposits at participating institutions.

Not all of them, though. According to the FDIC, banks have reserves set aside for about 85% of non-insured deposits (below the pre-pandemic average). It’s these un-insured depositors who have the most to lose.

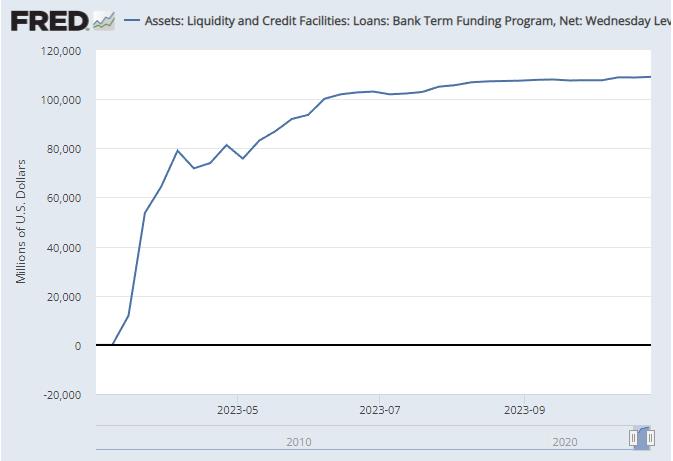

Fortunately, the Federal Reserve, also known as “the bank of last resort,” opened a new program back in March. The Bank Term Funding Program (BTFP) provides 1-year loans to banks – and, as you can see, banks need it:

Since the beginning of the program, week after week, banks are borrowing more and more money. And it’s not cheap!

So here’s the situation:

- Banks are undercapitalized (their liabilities outweigh their assets) by about $550 billion overall

- Banks have enough cash to pay out 84% of uninsured deposits

- If they’re desperate for cash, banks can borrow from the Federal Reserve

For context: Back in March, SVB was forced to recognize a $1.8 billion loss – which torpedoed the bank 48 hours later.

Now that the BTFP exists, a problem bank could probably borrow enough cash from the Fed to get them through a tight spot… Probably.

But they’d have to pay 5.46% on those loans! Now do you see why banks are so desperate to market their 5% APY savings accounts?

Because they need deposits!

They’re collectively sitting on $550 billion in losses, and they have to fill the hole somehow.

The entire U.S. banking system is skating on thin ice. We’ve heard a few cracks, we’ve seen a number banks vanish into the cold dark water – so far.

The rest of them are still skating, though. Still out on the ice. Some are at more risk than others – but all of them are at risk.

The ice-cold reality: No bank is truly safe

Big bank, small bank, or medium bank, it doesn’t matter where your money is sitting…

Between deposit flight and losses on reserves, banks are in worse shape than they were back in March. That’s when the #2, #3 and #4 biggest bank failures in U.S. history occurred, within one week.

The good news is FDIC insurance kicks in for many accounts. But there are limits: “$250,000 per depositor, per insured bank, for each account ownership category.” Uninsured accounts make up approximately 60% of the total dollar amount on deposit with U.S. banks (the minority of accounts, which have the vast majority of dollars).

Historically, tangible assets like physical precious metals are the preferred safe haven in times of economic uncertainty. Like the banker J.P. Morgan told Congress way back in 1912:

“Gold is money. Everything else is credit.”

Physical precious metals, especially gold and silver, have long track records as safe haven assets. Gold has historically outperformed inflation, and is more liquid than you might think (which can be helpful if banks start collapsing like a house of cards).

Furthermore, physical precious metals are just about the only financial assets that are tangible. You can hold them in your hands. They aren’t someone else’s liability – they’re your property. They’re the most certain assets you can own.

Whether or not you’re concerned by the perilous state of the U.S. banking system, the diversification benefits of physical precious metals work in your favor, as well.

Take a moment now to get all the information you need to evaluate whether precious metals are right for you in our free kit.