In a distressing revelation, the Federal Reserve anticipates three rate cuts next year, acknowledging the challenge posed by persistent inflation. The economic engine falters as demand plummets for homes, vehicles, and goods, painting a grim picture of financial distress among Americans.

Once deemed a lifeline, credit cards are now avoided, sinking below pre-pandemic levels. Soaring default rates further darken the economic landscape. Powell’s unexpected dovish shift marks a stark departure from his recent hawkish stance, signaling an alarming shift. The Fed’s surrender to inflation raises concerns, leaving a trail of confusion and uncertainty.

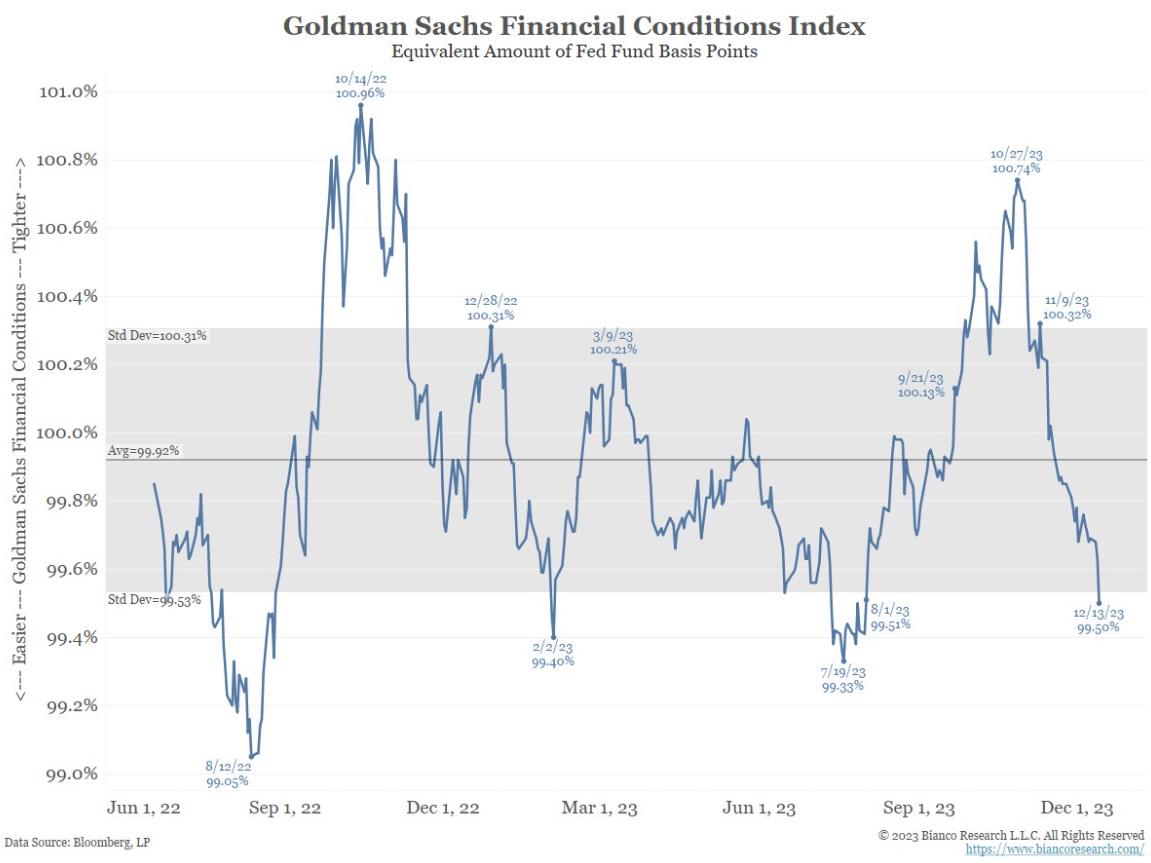

Powell’s abrupt change of heart, advocating for cuts despite prior dismissals, prompts an unsettling question: What prompted this shift? The FOMC’s conflicting rate-cut projections for 2024 reveal unprecedented uncertainty, hinting at unseen threats on the economic horizon. Bond yields plummet, and the Goldman Financial Conditions Index eases into troublesome territory, exposing a fragile economic foundation.

As highlighted by Goldman Sachs, hedge funds swiftly retreat from US financials, reaching exposure levels unseen since March ’20. The financial system appears rattled, and the Fed’s desperate attempts to combat inflation unveil the vulnerabilities within our economic structure.

In this foreboding scenario, with the economic engine stuttering and the Fed taking drastic measures, we find ourselves on the brink of a potential crisis. The signals are flashing red, and the unsettling question lingers: What awaits us in the dark abyss of economic uncertainty?

A Recession Is Right Around the Corner – The Economy Is Running on Fumes: Professor Steve Hanke

The Federal Reserve’s disregard for the quantity theory of money, which connects monetary supply with economic outcomes, seems flawed. The rapid increase in the money supply (M2) since 2020 led to high inflation, and its current sharp decline suggests an impending recession and possible deflation by 2025. This situation highlights concerns about the Fed’s current monetary strategy and the risk of economic downturns.

I did not see Powell coming out this dovish. Make no mistake, he has been hawkish up until this…regardless of what talking heads say. This was a total about face, and the first time he talked cuts above 2% Core PCE.

Which begs the question: what spooked him?

— RJR Capital (@RJRCapital) December 13, 2023

Powell two weeks ago: Too early to consider cuts

FOMC today: Time to consider cuts pic.twitter.com/MfstLrnARD

— Markets & Mayhem (@Mayhem4Markets) December 13, 2023

Fed credibility. Gone in 6 seconds. https://t.co/SZ7Sw6quZD

— Sven Henrich (@NorthmanTrader) December 14, 2023

This is remarkable: one FOMC member sees 6 rate cuts in 2024 (four see 4 cuts; six see 3 cuts, five see 2 cuts; one sees 1 cut, and two see 0 cuts)

This is the most confused "year ahead" FOMC we have seen in years pic.twitter.com/b5fkL3p0Il

— zerohedge (@zerohedge) December 13, 2023

The Fed just capitulated on inflation.

Bond yields plummeting

What are they seeing to make them change their minds?

Something bad me thinks.

— QE Infinity (@StealthQE4) December 13, 2023

Now that the #Fed is claiming victory over #inflation, the dollar should tank and commodity prices should spike. That will reverse the decline in the #CPI, put downward pressure on employment and GDP growth and upward pressure on long-term interest rates. Inflation is the winner!

— Peter Schiff (@PeterSchiff) December 13, 2023

Consumers will go as far their credit cards will take them.

— floridanow1 (@floridanow1) December 13, 2023

5.8 rate cuts in 2024 now. this is epic

— zerohedge (@zerohedge) December 13, 2023

The Fed went from saying more hikes are on the table to discussing when cuts will begin.

Fed Chair Powell effectively said rates have peaked.

Just about everything the market wanted to hear was said.

Yet, core inflation is still at 4%.

Did the Fed just declare victory?

— The Kobeissi Letter (@KobeissiLetter) December 13, 2023

Yields on 10-year Treasuries have dropped by more than a percentage point in less than a month, to below 4%. pic.twitter.com/l1XFSlIBA0

— Lisa Abramowicz (@lisaabramowicz1) December 14, 2023

Goldman Financial Conditions Index just updated.

Below the shaded area … back into the "easy" territory again. https://t.co/FMPLHDzhKa pic.twitter.com/RcGLvt59av

— Jim Bianco (@biancoresearch) December 14, 2023

Recession Watch: Forget About That Soft Landing

Demand is cratering for houses, trucks, toys, you name it

Jim Grant, editor of “Grant’s Interest Rate Observer,” expects Federal Reserve Chair Jerome Powell to remain cautious due to persistent high inflation. Grant criticizes the Fed’s previous underestimation of inflation and predicts gradual rate cuts, later than the market anticipates. The Fed, which misjudged inflation as “transitory” in 2021, raised rates 11 times since March 2022. Banks like ING and UBS forecast varying timelines for rate cuts, while the Fed plans a modest reduction in 2024.

Inflation Here to Stay, Eroding Purchasing Power Indefinitely: Jim Grant

Recession confirmed …

Inverse Cramer 😥 pic.twitter.com/O3CqooabD0

— Wall Street Silver (@WallStreetSilv) December 14, 2023

426 views