by absoluteunitVolcker

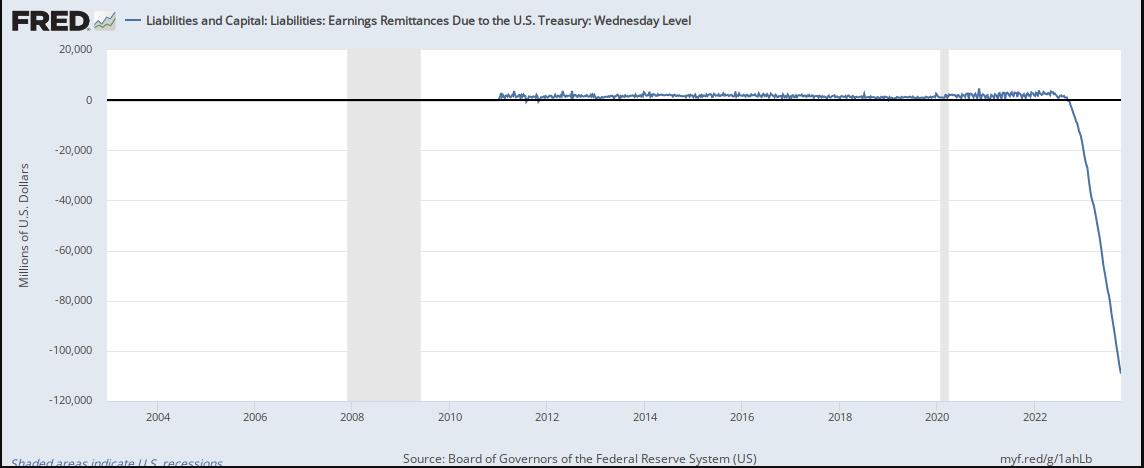

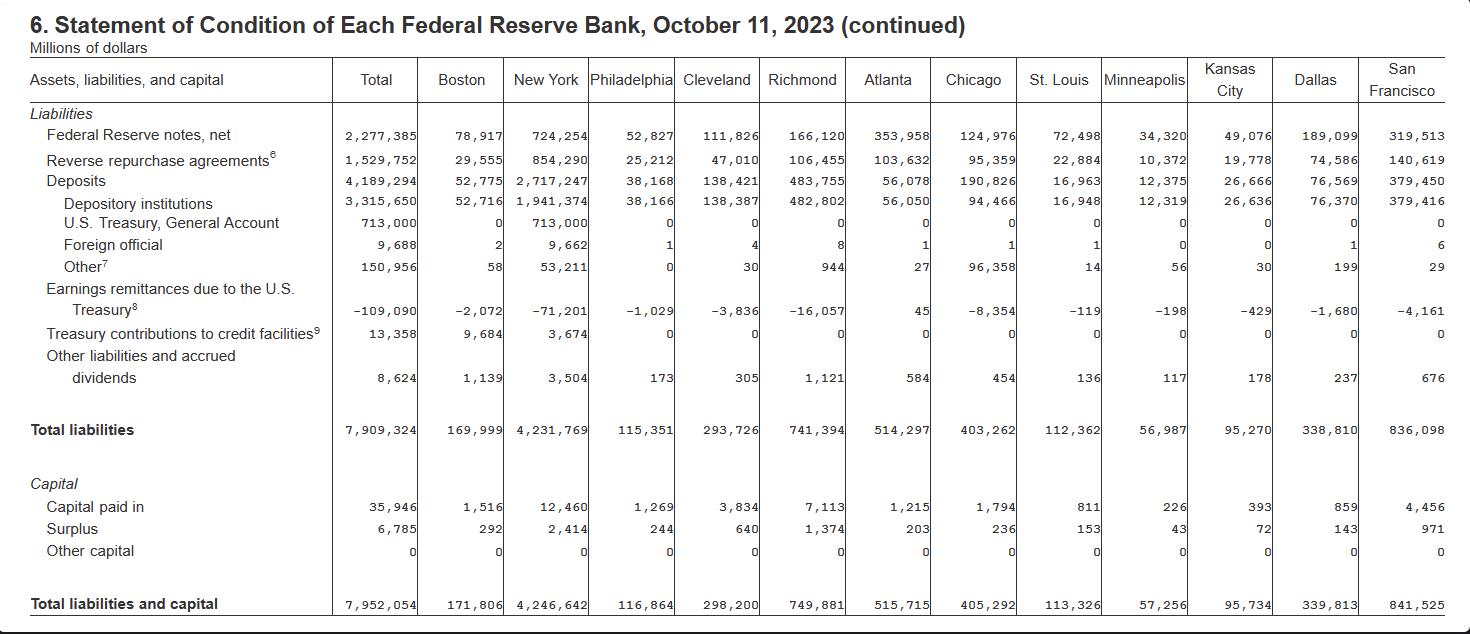

For basically all of its history, the Fed is self-funded, turns a profit and sends it to the Treasury (the taxpayer). Now the Fed is rapidly losing money, underwater on its investments and its liabilities will soon exceed its assets:

Technically since the Fed can fabricate money infinitely, it can’t actually go bankrupt. But it will signal to the world the extent to which Fed is losing control of the dollar’s value.

Additionally, with QT around $1.1T a year and massive deficits projected to be $2.0T a year for the next decade, the bond market will be flooded with an insurmountable supply ($3.1T/yr) of Treasuries. Who will buy all these bonds when we are struggling to absorb even today’s supply? More printing and QE is the only way out.

What to buy then? Stonks, gold, internet money, or signed Taylor Swift memorabilia??? Your guess is as good as mine.

Edit: I simplified a few things for the average reader but no QT “rolling off debt” is not any better than selling bonds. Don’t be gaslit by this pseudo intelligent sounding verbal diarrhea, it’s the exact same thing functionally and Treasury must still rollover existing debt + issue more each year. Fed is still printing money currently with the floor system through lush interest payments via RRP and IORB. Moreover they will have to print even more to absorb absolutely massive incoming supply of Treasuries. At the current trajectory our version of YCC is not out of the question.

275 views