via Egon von Greyerz

Unsustainable deficits and galloping debt levels, combined with a crumbling military, are the perfect recipe for the end of an Empire.

And it is exactly the position that the US finds itself in.

But it also means a new golden era for real money, which is obviously GOLD! (more later…)

I have written before about the END OF THE US EMPIRE – ORWELL’S 1984 NEWSPEAK & DIRT CHEAP GOLD.

A prospering empire must have a very strong and functioning economy, a solid currency, and a controlled level of debt. Today, America does not possess any of these essential requirements.

The empire must also be supported by a strong military. Sadly, this is not the case any longer, as ex-defence Secretary Robert Gates explains in a recent (24 September 2024) article about the weakness of the US military in the Washington Post called “The Pentagon and Congress must change their ways”:

“We face unprecedented peril. The Pentagon and Congress must change their ways.

America cannot make the weapons it needs in the time it needs.“

– Washington Post, 24th September 2024.

That must change.

Yet our army is shrinking while the navy is decommissioning warships faster than new ones can be built, our Air Force has stagnated in size, and only a fraction of the force is available for combat on any given day. After decades of neglect, the defence industrial base cannot produce major weapon systems in the numbers we need in a timely way, nor – as we have seen in Ukraine – can it produce the vast quantity of munitions required for a great power conflict. Despite these realities, it is largely business as usual in Washington. Dramatic change is needed to convert rhetoric into ensuring and sustaining long-term “military superiority”.

Even the US administration now realises that the US and NATO are losing the war, and support for Ukraine is more reticent.

From the beginning of this conflict, I have been convinced that Russia is unlikely to lose a conventional war against the US or NATO. For example, out of 31 US tanks sent to Ukraine, 20 or 2/3 have been destroyed.

But the real tragedy is the unnecessary loss of many lives on both sides. There is no honour in winning or taking part in a war that only has losers.

But desperate leaders commit desperate acts. And since the US is in a futile fight to avoid its hegemony collapsing, no one can predict what will happen next.

If Kamala Harris wins, the risk of a significant conflict is much greater since she has not committed to ending the war, opposing Trump.

What leads to the greatness of an empire also leads to its destruction.

Is it only possible to become the biggest economy in the world by totally mismanaging its affairs? Well, that is the normal end to all empires.

Just print money and let debt grow exponentially.

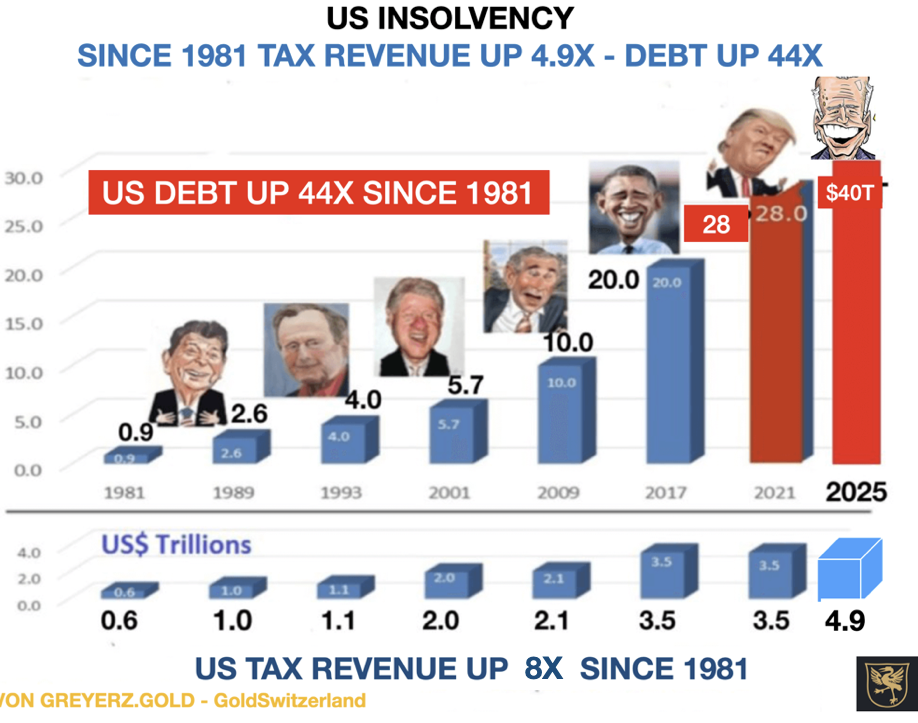

Reagan started with $900 billion in debt in 1981, which has today grown to $36 trillion, which is an average of 9% per annum.

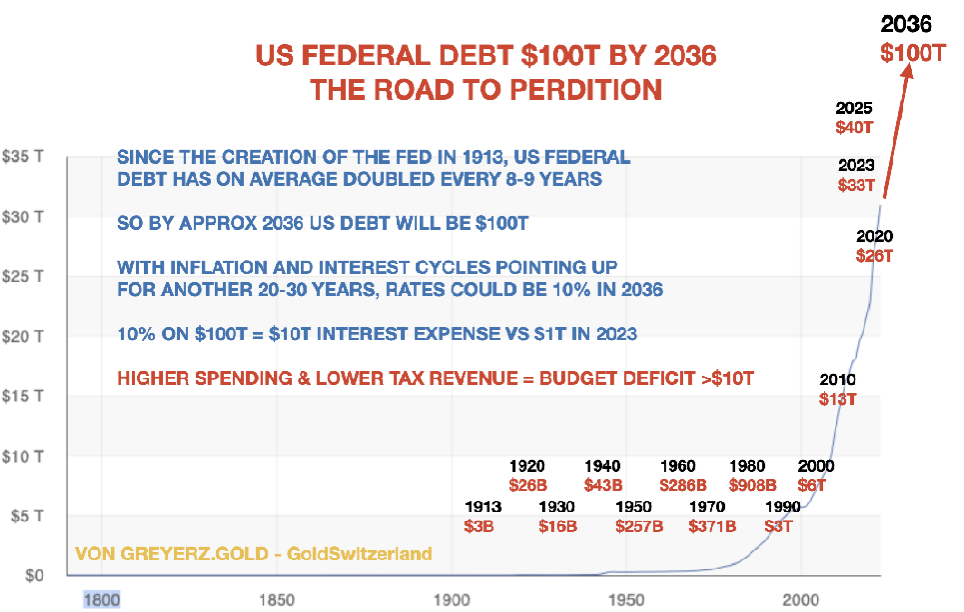

The rule of 72 tells us how long it takes for something to double. If you divide 72 by the annual growth of 9%, the answer is 8, which means that it takes 8 years for the debt to double if it grows by an annual average of 9%.

Thus, it has been very easy to extrapolate US debt using this method. This is how I reached $40 trillion in debt in 2025, which I forecasted in late 2016.

Buying votes is a very effective way of winning elections, and every president does it. Still, few observers foresaw or believed at the end of 2017 that the debt would approach $40 trillion eight years later.

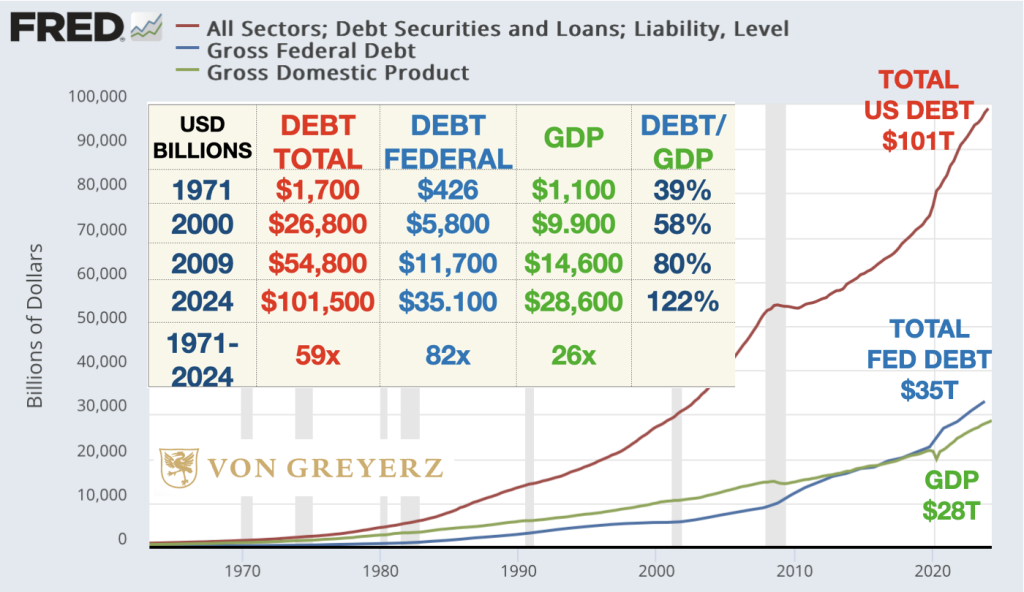

But look at the consequences in the table below. If we take the Federal Debt column, it has grown from $426 billion in 1971 to $36 trillion soon. Debt is up 82x this period, while GDP is up only 26x. The growing gap between debt and GDP means that more and more debt is required to create artificial growth. Thus, Debt to GDP has gone from 39% in 1971 to 122% today.

So, what does this have to do with gold?

Well, that is very straightforward. The table started in 1971 when Nixon closed the gold window. That was the start of the final phase of this monetary era.

We are at the beginning of a super-exponential period of growth in debt and inflation.

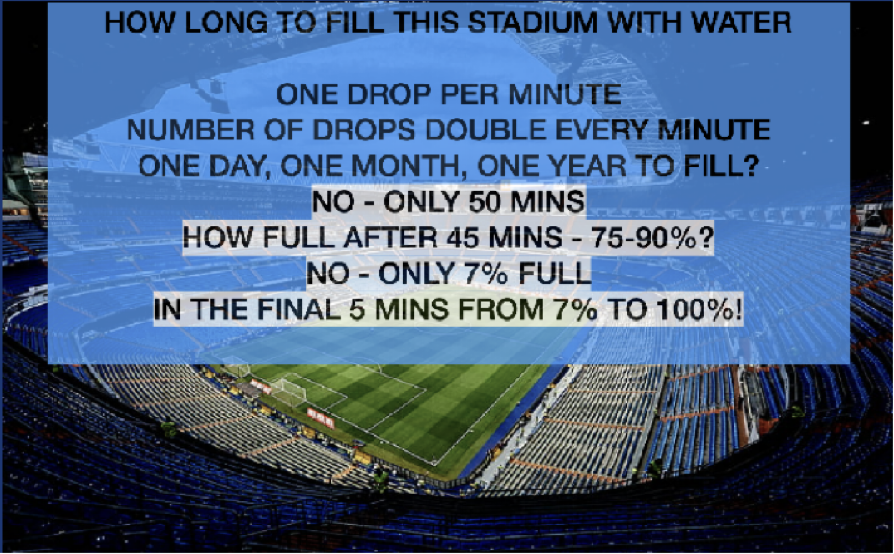

For anyone who doesn’t understand how exponential growth works, look at this brief explanation below.

Somebody commented that how long it takes depends on the size of the stadium. This obviously makes no material difference since the amount of water doubles every minute.

Nor does it matter if it is a real football (soccer) stadium or American football!

So, extrapolating the current debt explosion, which is exponential, will give the US a federal debt of $100 trillion in 2036; see the graph below.

MUCH HIGHER RATES

A $100 trillion debt means both high inflation and a high risk of default, leading to much higher rates. No one will hold risky debt with a mere 3-4% yield.

So, do not believe the Fed that the US is entering a continued rate-cutting cycle. It is hard to believe that lower interest rates are compatible with exploding debt.

Thus, sustained rate cutting is unlikely. The bond market doesn’t believe it either, with the 10-year treasury up 0.6% in the last three weeks. I repeat what I have stated many times: the 40-year rate cycle bottomed in 2020, and the long-term trend is now up. I would expect in excess of 10% rates for many years to come, just like in the 1970s. It is likely to start already in 2025.

That obviously doesn’t stop more minor corrections and possibly another rate cut.

But what is certain is that high rates and, thus, inflation will be with the world for many years.

MUCH HIGHER GOLD AND SILVER PRICE

Inflation and money printing mean weaker dollar and weaker currencies in general.

Gold will continue to benefit. So will silver, possibly in an explosive way.

So, the world is facing a crisis bigger than anything we have seen in history.

Of course, the economic/financial crisis is insignificant compared to the geopolitical one, especially if it turns into a nuclear war.

For everyone who is waiting to buy gold at considerably lower prices, let me tell you that you risk missing a major part, and maybe all, of the biggest gold moves in this century.

Yes, it will be a long and big move. But if you miss the start, the big risk is that you will get out of sync with the move and never dare to enter because you wait for a major correction that never comes.

Gold is going to multiples of the current price, but sadly, most investors will miss it totally.

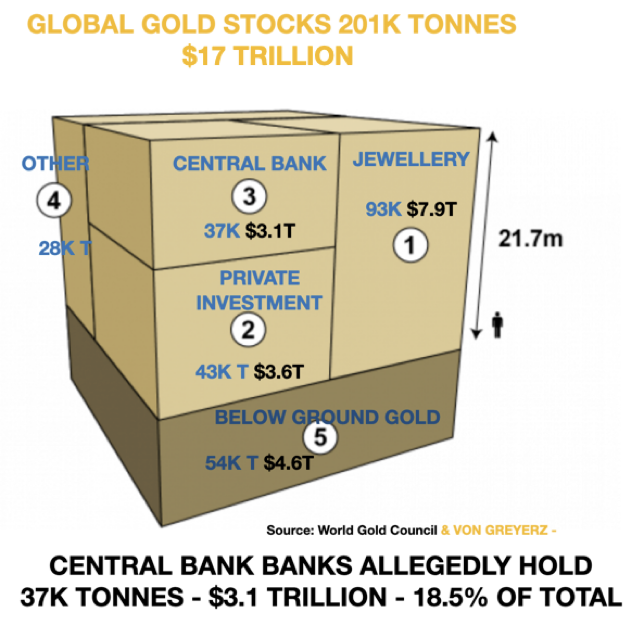

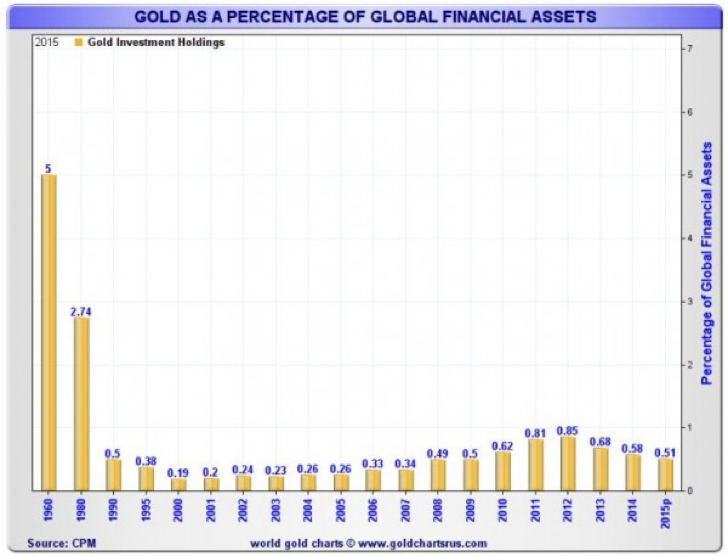

With only 0.5% of global financial assets invested in gold today, any significant increase in demand cannot be satisfied by physical gold, at anywhere near current prices.

The mines produce around 3,000 tonnes of gold annually. That amount of gold is absorbed annually, and there are no surplus stocks.

MAJOR SHORTAGES OF GOLD

There are, in fact, major shortages of physical gold. If paper gold buyers one day ask for delivery on a bigger scale, the whole Futures and LBMA markets will collapse. They cannot deliver physical gold against the massive amounts of worthless gold paper that they have issued.

If we take the Bullion Banks, they lease gold from Central Banks and then sell it to gold buyers in the East, like China and India.

So, all a Central Bank then holds is an IOU issued by a Bullion Bank. If the Central Bank wants its gold back, it will never receive it because this gold is in China or India, where the buyer has bought it outright with no obligation to hand it back.

This makes the whole paper gold market into a Ponzi scheme, which will eventually fail, just like all Ponzi schemes. But we will, of course, never find a central banker or BIS (Bank of International Settlement) executive who would ever admit to this.

Only 0.5% of global financial assets are invested in gold – only $3.6 trillion – which represents 43 thousand tonnes. If gold investments increased to the 1980 level of 2.7% (see table below) of financial assets (at today’s gold price), that would involve a requirement for 230,000 tonnes of gold. That is roughly equal to the total amount of gold that has ever been produced in history.

GOLD UP BY MULTIPLES

So, an increase in gold demand, which is inevitable, can only be satisfied by a substantially higher gold price.

Substantial, in this case, means that gold will go up by multiples.

Higher debt/debts and inflation lead to falling currencies and a higher gold price.

In addition, there is a substantial increase in demand from central banks as they swap their dollar reserves for gold.

This is how gold went from 0.5% of global financial assets to 2.7%, like in 1980, or even 5%, like in 1960.

CURRENTLY NO GOLD BUYING IN THE WEST

Gold is up 26% in 2024, both in US dollars and Euros.

Since the $1,060 correction low in 2016, gold is up 150%

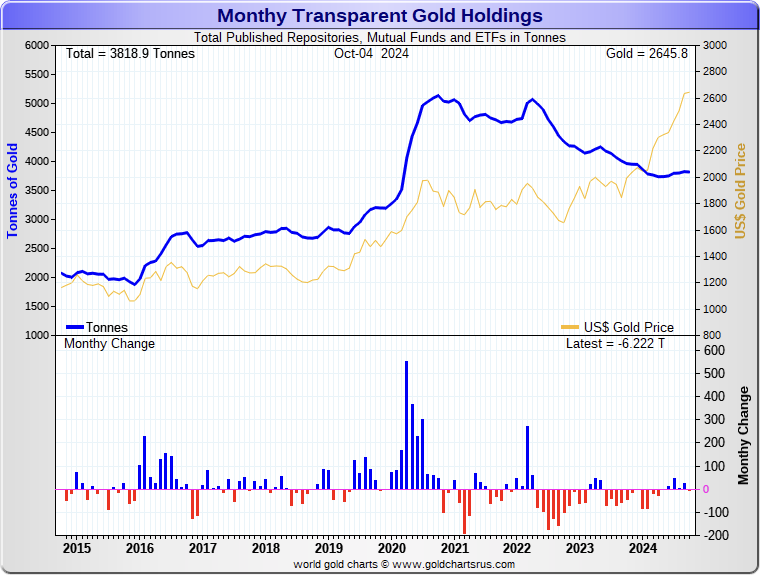

Still, gold buying in the West is shining in its absence, and nobody buys gold currently.

Total gold holdings by Funds and ETFs peaked in late 2020 at just over 5,000 tonnes.

Gold was then $1,900.

Today, these funds and ETFs hold just over 3,800 tonnes of gold – 25% less than in 2020 – and the gold price has gone from $1,900 to $2,600, which is up 37%!

So how is this possible?

Clearly, Western investors still don’t understand what is happening and thus stay away from gold.

This gives the BRICS countries, as well as other astute gold buyers, the opportunity to pick up gold at bargain prices.

But gold should never be bought as a speculative investment at an opportunistic price.

Investors who understand the real long term value of an investment never try to buy it on the cheap.

Initially in his investment career, Warren Buffett did not follow the above axiom. He preferred initially to buy a fair company at a cheap price. His returns were therefore mediocre and patchy. Then Charlie Munger convinced him of buying a good company at a fair price. This simple advice had a major influence on Buffett’s investment style.

As Charlie Munger said, “bet big when you have the odds”.

This is what we did for ourselves, and our investors, in early 2002 when gold in dollars was $300 and in pounds £200 (the pound was an important reference currency for us).

Since then, gold is up 9x in dollars and 10x in pounds.

It was an easy decision in 2002 for us, so we followed Munger’s advice to “bet big”.

But our primary purpose was not to make a high return on our investment, but to preserve our wealth and protect it against the risks we saw in the financial system.

We also forecast that the destruction of paper money will continue or even accelerate.

As throughout history, gold has been an excellent hedge against the debasement of currencies.

Looking at the fundamentals for gold in 2024, the reasons to “bet big” are much greater today than they were back in 2002.

In the 53 years since 1971, the dollar and all major currencies have, in real terms, lost 99% of their value.

YES. YOU READ THAT CORRECTLY, THE DOLLAR HAS LOST 99% OF ITS PURCHASING POWER IN JUST OVER HALF A CENTURY.

But that’s just the beginning.

All the dominos are now in place for this trend to accelerate.

So there we have it.

Nobody can of course predict the exact timing of the end of a monetary era. Especially since it is normally not an event but a process.

It is a slow and painful death of the currencies. But as Hemingway answered when asked how you go bankrupt – “first slowly and then suddenly.”

We have had the slower part, but the acceleration or “suddenly” has now started, and that is likely to be the painful part.

Some observers might accuse us of selling fear and misery.

But that is far from the purpose of our predictions.

Cassandras are always disliked. Nobody wants to hear forecasts of doom and gloom.

Our purpose and passion is to assist investors in insuring and protecting wealth in the form of physical gold and not to frighten them.

BRICS BUYING GOLD

As dedollarisation continues, BRICS nations will trade in their own currencies with net settlement in gold. This will lead to an increase both in the demand for gold and in gold holdings by the BRICS.

Trade barriers in the West will lead to a weaker dollar and euro and more inflation.

It’s also good for gold.

With the continued issuance of sovereign debt in the West, we are likely to see a sovereign debt crisis with higher rates and lower dollar and euro prices.

Gold will benefit.

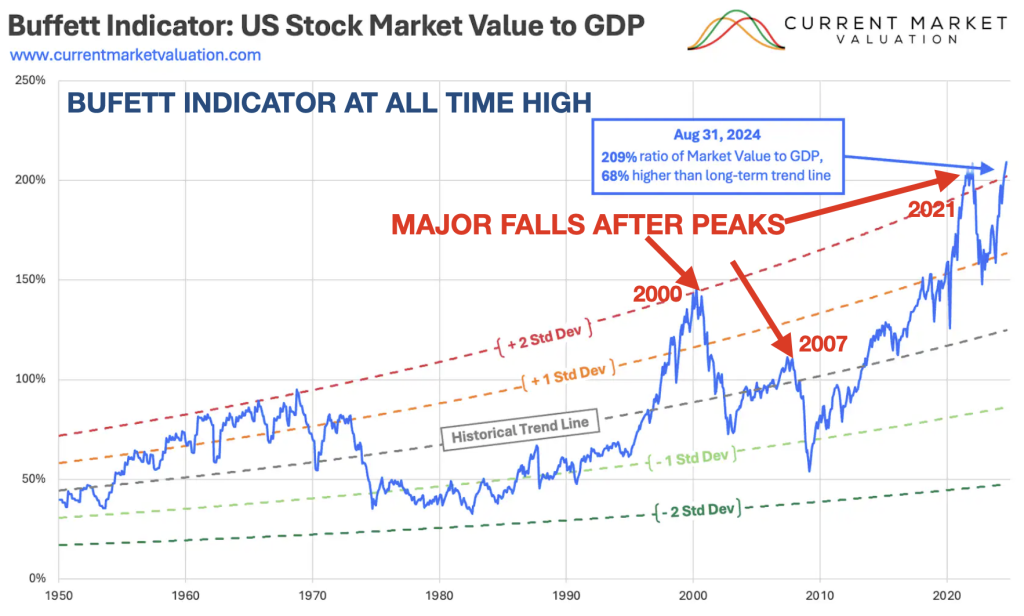

Just look at Buffett’s favourite indicator below, Stocks to GDP.

This is now at an all time high of 197%. The previous peak in 2021 was 193% and that led to a 40% fall.

The 2000 peak in 2000 was 138%. Nobody needs to be reminded that the Nasdaq subsequently fell by 80% and that tech stocks are also in a bubble in 2024.

Don’t forget that an 80% fall can be very painful, especially since many over-leveraged companies went under with ZERO value.

SUMMARY: STOCKS HIGH RISK – BONDS HIGH RISK – GOLD VERY LOW RISK

So if we summarise, reduce exposure to stocks, sell bonds and load up the truck with gold and some silver.

And as I often point out, family and friends are our most important assets.

It is absolutely critical to look after and help your loved ones.

They will need you, and you will need them in coming years.