The joke's on the BNPL companies, because one of the benefits to the consumers is it doesn't go on their credit report. So, there is no real incentive to pay it back other than being honest.

— Mr Omnicent (@MrOmnicent) January 21, 2024

Consumer Sentiment 19-Year Record 🏆 :

U.S. Consumer Sentiment had its biggest monthly increase since 2005 pic.twitter.com/M8GBIyiTut— Win Smart, CFA (@WinfieldSmart) January 21, 2024

S&P 500 stocks above their 50-day MA has hit the overbought region

This has systematically marked local tops in the market since 2022 pic.twitter.com/m6M5sYGouU

— Game of Trades (@GameofTrades_) January 21, 2024

"The middle class in the United States isn't dying; it's already dead"

"Inflation is way worse than everyone thinks"

"In 1950, the median household income was $3,000; the cost of a new home back then was $7,354"

"Back then, if you wanted to buy a brand new house and a brand… pic.twitter.com/eLAldGFAR9

— Wall Street Silver (@WallStreetSilv) January 21, 2024

8 out of 10 FMS investors expect either a "soft" or "no" landing while 41% believe the US will avoid a recession in 2024.

via BofA FMS pic.twitter.com/qiJrQrIHj8

— Daily Chartbook (@dailychartbook) January 20, 2024

“Largest US banks set to log sharp rise in bad loans.”

— Win Smart, CFA (@WinfieldSmart) January 9, 2024

U.S. Banks are facing unrealized losses of roughly $685 billion https://t.co/E2WQ4MlssA pic.twitter.com/p12S4eDBDj

— Win Smart, CFA (@WinfieldSmart) January 16, 2024

Even financial media’s golden child is finally referring to housing as,

“A complete mess” pic.twitter.com/yew8ks6mRS

— Amy Nixon (@texasrunnerDFW) January 21, 2024

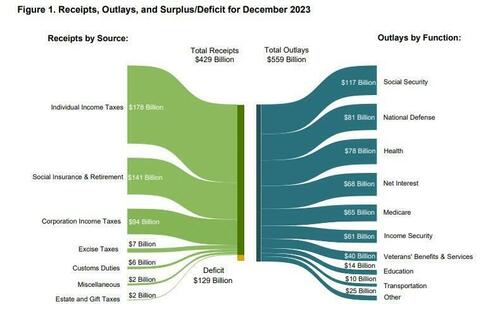

Massive Deficit Spending Keeping The Economy Out Of Recession (For Now)

Economic growth continues to defy expectations of a slowdown and recession due to continued increases in deficit spending. In fact, the U.S. Treasury recently reported the December budget deficit, which shows the U.S. collected $429 billion through various taxes while total outlays hit $559 billion.

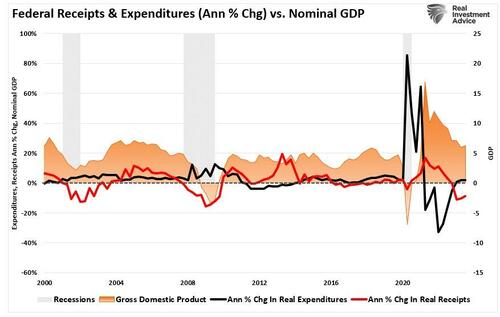

As noted, the problem remains on how the economy has avoided a recession despite the Fed’s aggressive rate hiking campaign. Numerous indicators, from the leading economic index to the yield curve, suggest a high probability of an economic recession, but one has yet to occur. One explanation for this has been the surge in Federal expenditures since the end of 2022 stemming from the Inflation Reduction and CHIPs Acts. The second reason is that GDP was so grossly elevated from the $5 Trillion in previous fiscal policies that the lag effect is taking longer than historical norms to resolve.