This is the second return of inflation since Covid.

The first return of inflation came last year and into January through March of this year when inflation started rising again after about a year of declining. Since then, I’ve made a big point all summer of saying inflation would rise for a second time this year—that what we and the Fed saw, most notably during the first three months of 2024 to where even the Fed finally had to finally admit it was happening, was not done with us yet. Right on schedule for the end-of-summer timeframe that I gave, inflation has, indeed, begun to rise again. Also right on time for the Fed to put in its first rate cut, as I said was likely how this would time out. Now it has.

At least, the turn appears to be happening. It is too early, of course, to declare this single move the start of another upward trend, but the first step back up has happened right where I expected the turn would show up; so, we’ll see where it goes from here.

While overall inflation has not turned up yet, which is all the mainstream financial press is crowing about, core PCE is the yardstick the Fed uses to measure its 2% target. This favorite inflation gauge of the Fed (annual core PCE) just headed upward for the first time since it stopped heading upward in April. Core services were particularly higher, and services are the larger part of the economy and tend to be stickier in pricing. Core services (excluding energy and shelter) went up rose to a 3.8% inflation rate. The overall Core PCE rate hit 2.7%.

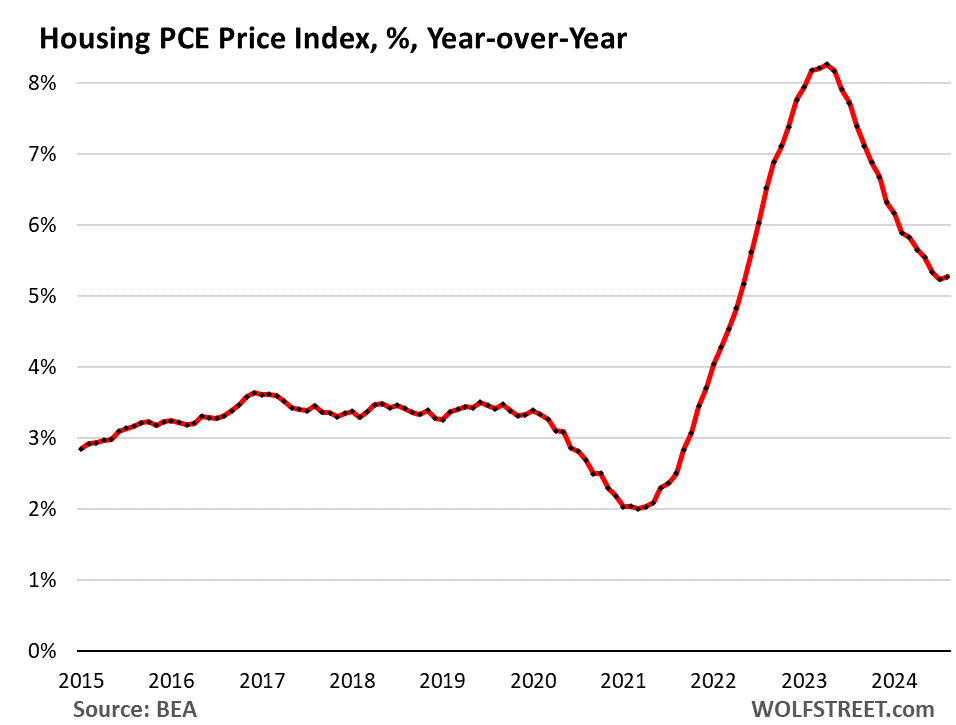

A particularly noteworthy leap within overall PCE came from housing, which you may recall I pointed out a few times could be readily counted on to raise its head at the end of summer because it is a lagging measure of inflation that started going back up over a year ago. On a monthly basis, this is the second month in a row of sharp reaccelerating in housing prices. On a YoY basis, however, this is just the first blip of an upturn:

However, because this measure of inflation has a year-long or greater lag between actual price changes and a move in PCE or CPI, we knew this turn was coming, and we know actual housing prices experienced a lot of upward movement for an entire year after they put in this turn more than a year back. So, we have every reason to expect a definitive upward trend in both PCE and CPI for housing.

I’ll get into the details of all of this in the rest of the Deeper Dive below for paying subscribers, as I talk about the forces that are still rebuilding inflation, including some that are unexpected, but the above is a snapshot picture.