by MegaZucc69

1: It’s never been this high ever, barring a financial crisis. Adjusting for inflation in the depths of the 2008 financial crisis, the highest amount of credit card debt held by the US population was 937m in 2009 (Adjusted to 1.3t in 2023 value), shortly after the kickoff of the financial crisis. (Currently the credit card debt rests at 1.03t)

2: Credit cards and the credit system underpin our entire financial system. Want a car, a house, a boat, any large purchase? It relies on your credit card. A record 40% of Americans now use credit cards as their first method of payment over debit cards and cash.

So how does this apply and why is this happening?

I believe that based on the current rate at which CC debt is accumulating, it soon will not be sustainable and delinquency will rise shockingly fast. This could set off a large bear run, and a possible recession.

My theory on how this happened is that some smaller banks loosened credit requirements after the recession in 2008 to lure customers and increase deposits. And, in 2018, Congress rolled back part of the Dodd-Frank Act which was designed to strengthen the banking system — further easing credit-requirement rules for smaller banks.

Why do I believe CC debt is unsustainable as of now?

Credit card limits are the highest they’ve ever been. According to the NY Fed, the total credit limit of those who hold credit accounts in the USA is 4.6 TRILLION. This means that EVEN WITH THE CURRENT BALANCE of 1t, the public can still accumulate trillions of dollars more worth of debt, to its extensive detriment.

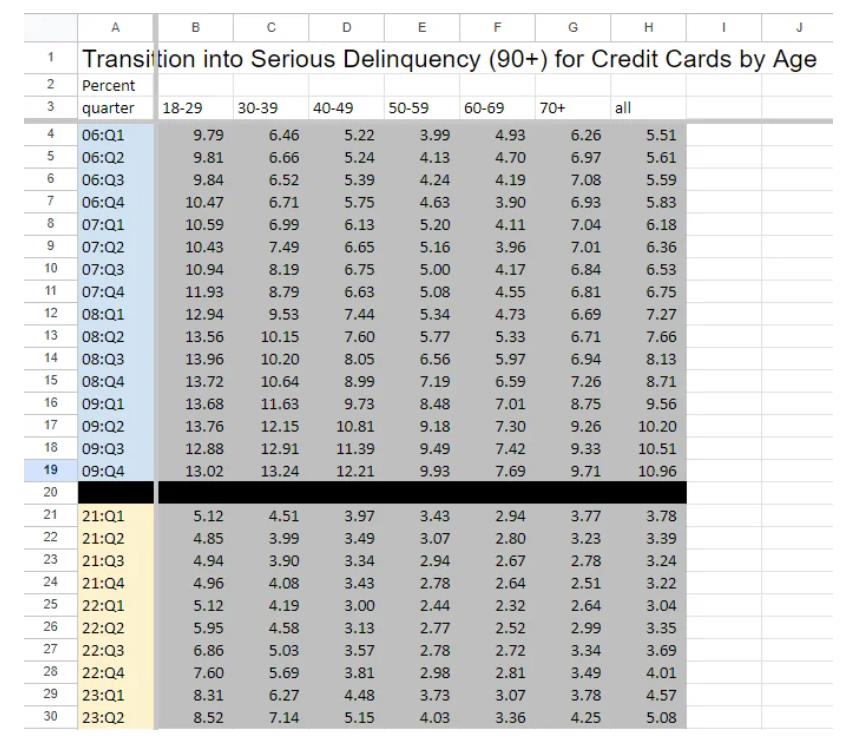

Delinquencies are on the rise. If you look at the table I sourced from the NY Fed, you can see that across all age groups, CC delinquency is rising quickly, and is approaching the levels it was just before the 2008 crisis, WITHOUT massive amounts of mortgage debt sucking away income.

Current CC delinquency is approaching the levels it was slightly before 2008

FURTHERMORE, large banks such as Capital One, Bank of America, and Wells Fargo have all increased the amount of profit set aside to address losses from credit card delinquency. According to an article by the Virginia business bureau, “Lenders are feeling the losses, including McLean-based Capital One Financial Corp. The credit card giant reported a 60% drop in profits to $960 million in the first quarter from the same period a year ago, largely due to customers defaulting on their credit cards and car loan debts ” Furthermore, BOA has increased its provision for credit card debt by 896 MILLION.

In Q2 2023, credit card delinquency rates reached a record high of 7.51% at smaller banks, up from 6.01% the previous year. Meanwhile, the top 100 banks reported a delinquency rate of 2.63% in Q2 2023, compared to 1.71% in the same period a year ago. The Federal Reserve defines large banks as those with assets of $300 million or more. Over 80% of U.S. consumers had credit cards in the previous year, with 48% carrying balances (Federal Reserve data). 48% of americans CANNOT afford to pay their credit card bill on time.

I think this is due to multiple reasons, chief among them the cost of living:wage increase ratio.

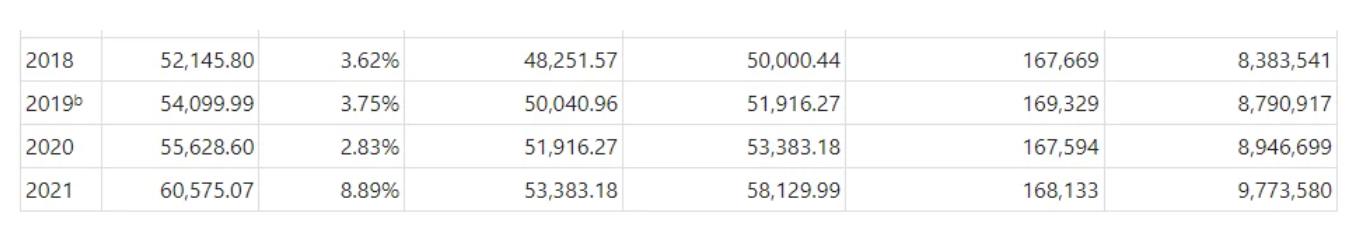

This is the increase in cost of living per year

Below is the amount wages increased on average, sourced from the SSA2022 wage growth is around 5.1% according to BLS.gov

As you can see, cost of living growth (20.3% in 2018-2022) is shockingly close to average wage growth (24.19% in 2018-2022). 2023 further adds to that, with Cost of living increasing by another 8.7%, with wages only increasing 4.1% (Bureau of Labor), putting cost of living at 29% growth, and wages at 28.29% growth. This is predicted to only widen, with cost of living being exacerbated by climate change, natural disasters (climate change related or otherwise), and inflation. (In 2024, the SSA predicts a 3.1% rise in cost of living, and a 3.8% rise in wages)

But if cost of living and wages are increasing to about the same amount, what’s the issue?

1: This is the average wage, so its disproportionately skewed by high income jobs such as managing directors, doctors, software engineers, etc. Minimum wage workers, according to a study conducted by congress, have a monthly cc balance of 500 dollars OR MORE.

2: Credit card debt is still increasing, purporting that the current ratio is somehow unsustainable, with consumers not having enough money to pay the bills on time.

Additionally, credit card interest is still increasing.

- The average credit card interest rate is 24.08%, according to Forbes Advisor’s credit card rate report as of mid-March 2023. In November 2022, the average credit card interest rate in the U.S. on accounts with balances that assessed interest was 19.07%

- According to a Forbes Advisor survey from February 2023, 47% of U.S. cardholders reported that they don’t know or are unsure about the interest rate on their card.

This means that as interest skyrockets at a record rate, consumers might not even know how deep their financial hole is going to get.

Evidence I couldn’t find a place for but is still important

- Student loan payments are currently paused. This is 1.7 trillion that borrowers don’t currently have to make payments on. Come Q4 (october) payments will no longer be paused, creating further instability as consumers will have to balance both credit card debt and student debt. Just out of college demographics are also currently most at risk for default even with no student loan payments which doesnt spell for good omens.

- This one might be a huge reach, but I think it should be said nonetheless, especially with all the angst surrounding insider buying/selling in Congress. Larry Fink, Mr Blackrock, has sold 2.1 million blackrock shares recently, totaling up to 95 million dollars. While I would like to believe he’s just buying a yacht, I somehow don’t think so. As blackrock is an everything company, with investments in almost everything, what motivation would he have to sell. He’s not cash poor, being paid 25 million per year.

- Unemployment. Unemployment is currently at a record low. 3.4%. This means that most people who want a job, have one. Yet debt still increases, consumer spending still increases, and the wages aren’t making up for it.

- Commercial Real Estate. Large commercial real estate companies are defaulting on their loans, purporting a massive shakeup in cities and further economic uncertainty.

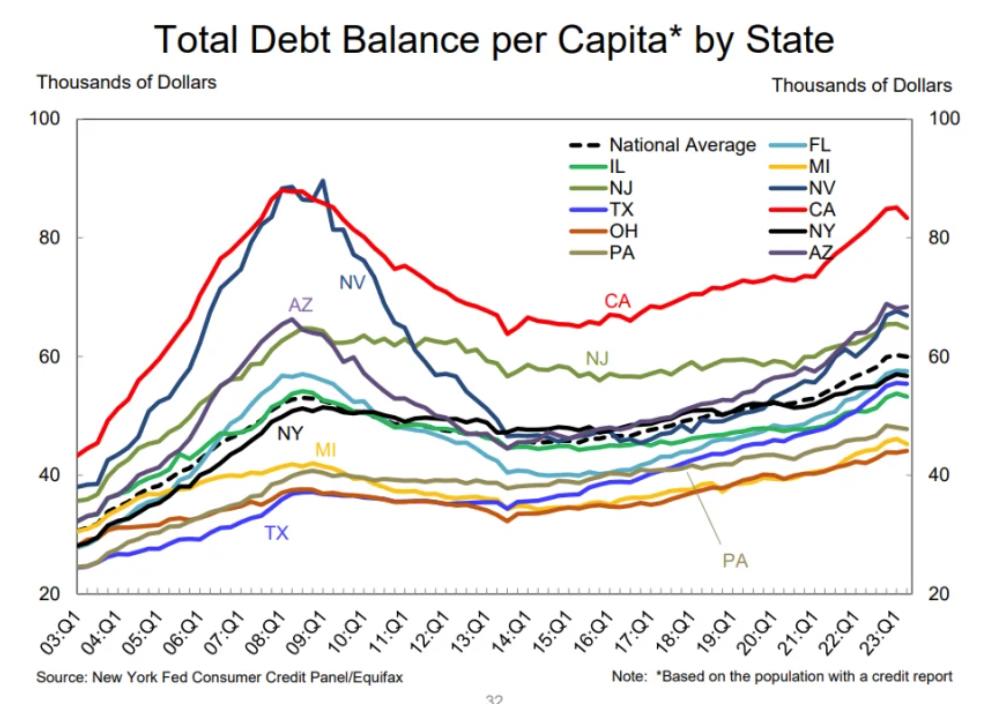

- Debt Per Capita. Just look at the graph below. Look at 2008/9 and where we are now. Should speak for itself.

EDIT: (goes under circumstantial evidence for such a crisis) Cramer claims he doesn’t see a recession on the horizon. ” Jim Cramer doesn’t see a recession on the horizon — and doubts the ‘so-called experts’ calling for a downturn. ”

So what might happen?

Small banks are going to have issues very soon. Consumers will begin defaulting at high rates, and we might have a SVB type repeat. Bigger banks will be bailed out by #biggovernment. A recession might be triggered. I’m not sure, which is why I would like opinions.

If this post gets traction I’ll write a followup with help from replies with higher clarification on vague areas.

TDLR; Credit balances are too high, people soon won’t be able to pay, small banks might go under, currently unsure as to the consequences.

100 views