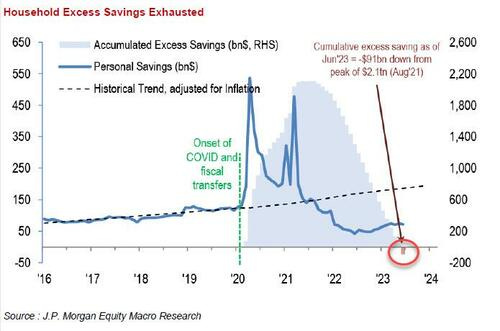

So, yields on the seven-year Treasury just priced through to the highest on record. Cost of the US debt is getting high. As the cost of debt rises for everyone because the rest of debt is pretty well pegged off of US debt, everything else is going down, including the strength of the US consumer. Savings from Covid stimulus are now gone!

Thus, the CEO of one fund-management firms says to expect the US to sink into “inevitable” recession “because that is how things work.” The Fed tightens; the economy goes down, and with so many troubles building up well before inflation is finished, it is going to go down hard.

The one thing you can always count on going down, though, are the revisions over time in Biden economic data.

Congress goes ‘round

In this perilous situation we’ll see below of numbers that are endlessly spiraling downward with every revision, the wise members of congress are, again, playing games of brinksmanship that may take the US credit rating down, too. Twice in past years, I have warned that their brinksmanship would almost certainly trigger a downgrade of US credit, even though I stated the US would never actually default on the its debt AND that members of congress know they will never let it default on the US debt evens they those use the good faith and credit of the US as a bargaining chip. Still, they play the game, threatening they will. In both cases, the US government got its credit downgraded. Another step down may easily be in store.

As they play the same game again over the budget, I’ll remind everyone of what I’ve said before: While members of congress may feel confident playing the game because they know they won’t default, they fail to recognize that the credit-rating agencies don’t know these goofballs won’t default, and those organizations are not going to give these clowns the benefit of the doubt. Of course, the only thing really at stake back in August and especially now is the ability to keep all departments of government open. This time, unlike August, it is not about the ability to issue endless debt. Otherwise, I would be predicting again that a credit-rating agency will downgrade US credit further before the Saturday deadline for shutdown arrives.

Even though the nation’s credit limit, itself, is not the issue this time, as it was in both of the previous mentioned incidents, I still wouldn’t be surprised to see a credit rating agency downgrade US credit over this issue even before D-Day arrives on Saturday just because it is clear the government cannot govern, and dysfunctional government doesn’t say “Stability is found here.” If they don’t make a deal by Saturday, expect some seriously bad fallout in the days ahead.

That is the kind of event it will take to trigger the next avalanche in US stocks. Either government shuts down, and that puts the mountainside in motion; or US credit gets downgraded again; or the upcoming inflation report shows inflation is clearly back to rising. It is not a question of whether the high cornice will break off the market, it is just a question of which trigger hits it first; but there are plenty of investors now starting to get worried as the supposedly new bull market crumbles back into dust in the bear cave as a number of likely triggers stack up. Stocks may be poking their nose up today, but wait until one of those major factors I’ve been describing makes itself boldly apparent.

Stock investors are endlessly delusional because of their extreme greed, but, like wack-a-mole, they keep getting their heads smacked back down. The next whacks are not far away. So, like I say, it just depends on which whack smacks down first!

In the meantime, the highest 7-year yield in Treasury history does not bode well for the overpriced stock market all by itself, no matter how much investors put on their denial glasses and try to ignore the day’s news by reading into it what they want to hear. Higher and higher yields as the Fed stays at the inflation battle, and bond traders wake up to recognize the fat lady in the Fed’s chorus ain’t singing anytime soon, will continue to pump out the pool of stock investors and feed it over into coupon-clipping bond investors pool

Also interesting in today’s news was the revision of US GDP data (put out by Biden Economic Analysis (a.k.a. the BEA, a.k.a. the Bureau of Economic Analysis), which shows GDP being whittled down a little, but more significantly revises that supposedly “strong consumer confidence,” which the Biden economic administration has been spewing, down to almost nothing.

Data go down

Zero Hedge calls out the data revisions by different Biden departments today just as I have in the past:

It has become a running joke: the “strong” Bidenomics economy comes with an expiration date, as it is only “strong” for about a month, at which point the initial “strength” is downgraded, and the data is revised sharply lower.

That has certainly been the case with US labor data, where as we first reported last month, every single monthly payrolls print in 2023 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

I’ve reported on how the Biden Admin. has been reporting grossly distorting labor data for some time, then revising it down after it is stale enough that no one cares to digest it anyway.

But the BLS is not done: as we reported last week, besides the now traditional one-month lookback revisions, the ridiculously high monthly payrolls prints accumulated over the past year will also be slowly but surely revised gradually lower at annual benchmark revisions for years to come. As Morgan Stanley chief US economist Ellen Zentner explained….

“Payrolls get revised too, and we expect a downward revision.”

Those kinds of attempts to keep the true data on the day-old bread shelf are things I’ve pointed out in previous articles. Regardless of revisions downward in new hires, unemployment remains very low in today’s headlines. In fact, initial jobless claims just fell back to a 12-month low.

We wonder just what is going on with the claims data when The Conference Board survey is signaling the labor market is worsening significantly and financial conditions are tightening aggressively.

ZH notes the same kinds of revisions are happening with GDP and especially consumer confidence reports:

But while downward payroll revisions under Bidenomics are as certain as death and taxes, what we wanted to discuss here are the just as striking downward revisions to US consumption which hit this morning alongside the comprehensive once every-five-years historical revisions to GDP….

We already noted the disaster that was Q2 Personal Consumption: instead of the 1.7% unchanged print from the second estimate of Q2 GDP, the final number was a dire 0.8%, a 9-sigma miss to estimates… Personal consumption in every single quarter since the start of 2022 – when the Fed aggressively started tightening and hiked rates by the most since Volcker – has been revised lower, and in some cases dramatically so….

With personal consumption being revised much worse than was reported by the Biden crew all along the way, one has to wonder how Gross Domestic Production is holding up as reported, even as Gross Domestic Income has been in recession for two full quarters! Unless all of that product is being sold overseas, you can’t keep production up for long when consumption is falling away.

Bloomberg also picks up on the GDP revision and looking at revisions to the historical data, writes that “the pandemic contraction is seen as being a bit less severe than previously thought: GDP is now reckoned to have dropped at a 28% annual clip in the second quarter of 2020, instead by 29.9% … But the recovery since then has been somewhat slower, according to the update. Growth last year was revised to 1.9% from 2.1%.” And of all GDP components, consumption was the weakest.

One has to wonder why the Biden Admin. numbers always start on the high side then drift downward in the revisions that almost no one pays any attention to anyway.

Consumers not sound

Amidst the numbers of these reports, here is where ZH says all those excess savings that made for a “strong” and “resilient” consumer are as of today:

Consumer financial strength has fallen below the trend or even any past point along the trend in terms of the consumer inflation-adjusted savings rate with the accumulated surplus in savings just breaking zero when adjusted for inflation. So, the savings are gone! No more resilient consumer.

Which means no more fake GDP, or, as ZH put it …

… which means that if Q3 GDP was bad and consumption was “revised” sharply lower (odd how economic data is never revised higher under Joe BIden), Q4 – when savings are virtually non-existant – and where we also get the i) return of student loan payments; ii) the UAW strike; iii) the government shutdown and iv) oil at almost $100 and gasoline at one year highs, [GDP] is about to fall off a cliff.

Which means, as I laid out awhile back in one of my “Deeper Dives,” GDP is about to plunge to match negative GDI, since the two usually track with each other. It will not be a case of GDI rising to match positive GDP. Matching down to negative GDI equals a recession.

All of the above revisions, forewarned of all along the way here, are one more reason I say The Daily Doom is where you get the news before it happens. In this case, it is news that has happened, but it never got reported, except in editorials and “Deeper Dives” here that analyzed what was really happening. In other cases, I try to lay out trends that tell us what will be happening soon, regardless of what all the other flummoxed gurus are saying.

Or, as ZH puts it in the form of a question:

When will this [reported] data be ‘free’ to reflect reality?

I try to bring reality into the picture of what is being parroted by the press from the Biden Admin. and the Fed and other central bankers and market-makers on Wall Street.

“We are going to have a recession, because that’s the way the world works,” Katie Koch, CEO of the firm with $210 billion under management, said Thursday at CNBC’s “Delivering Alpha” conference. “We haven’t had a real one for over a decade and a half….”

The U.S. economy has stayed afloat due largely to a resilient consumer flush with cash and a labor market that has remained powerful. However, Koch said the Federal Reserve’s interest rate hikes targeted at slowing the economy and bringing down inflation will start to bite. Higher rates have long been thought to work with lag effects, the timing of which is uncertain and dependent on a variety of factors.

“I do think it pays to be patient and wait to see higher rates work their way through the system,” Koch said. “We haven’t seen the pain of higher rates, but it’s coming.”

Meanwhile, US oil prices just edged higher toward that $100/bbl I’ve been saying we are likely to see. Brent crude overnight tapped $97/bbl on the shoulder. Just a little higher reach, and we’re there. That’s close enough for horseshoes, hand grenades and dancing, but not quite close enough for me to say we hit my projection … yet.